Federal Government Made an Estimated $162 billion in Improper Payments Last Fiscal Year

Note: This blog post was updated to include a video showing GAO's Kristen Kociolek testifying before Congress on March 11 about improper payments and fraud risk.

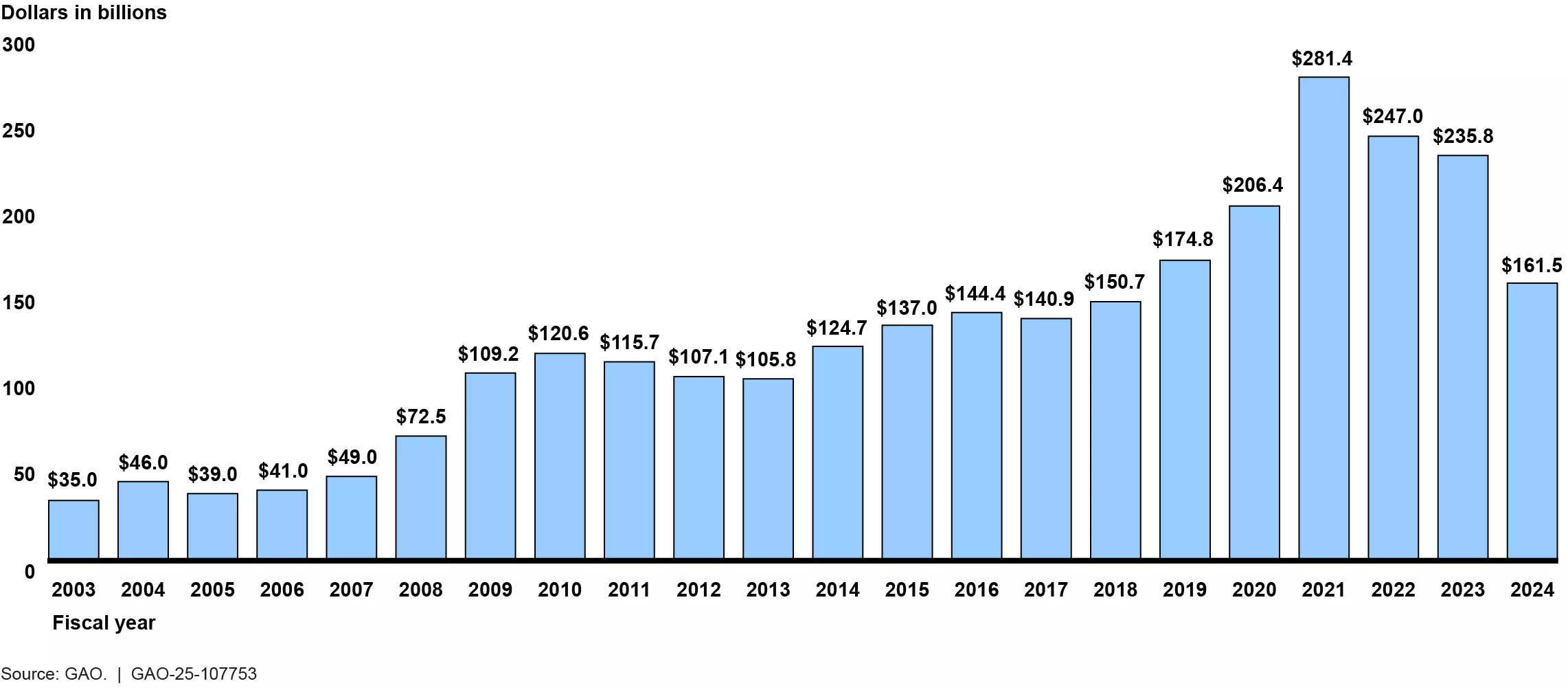

The federal government reported an estimated $162 billion in payment errors—or “improper payments”—during fiscal year 2024. This marks a steep decline from the prior year—$236 billion in FY 2023. This decline was largely due to the termination of or winding down of certain pandemic-related programs.

Even so, improper payments are a long-standing issue for the federal government. Since FY 2003, the federal government has made an estimated $2.8 trillion in such payments. Improper payments are essentially errors that can be the result of many things—including overpayments, inaccurate recordkeeping, or even fraud.

Which programs saw the most improper payments and what can be done to prevent them? Today’s WatchBlog post looks at our new report, issued today. GAO's Kristen Kociolek testified on March 11 before Congress about improper payments and fraud risks. Watch her opening statement below.

What were the payment errors in FY 2024?

The $162 billion in improper payments were reported by 16 agencies across 68 programs. The vast majority were due to overpayments.

- More than $135 billion (84%) of errors were overpayments—for example, payments to deceased individuals or those no longer eligible for government programs

- $7.9 billion were underpayments

- $12.6 billion were unknown payments—meaning it is unclear whether a payment was an error or not

- $5.9 billion were cases where a recipient was entitled to a payment, but the payment failed to follow proper statutes or regulations

Some good news. Improper payments have decreased since last fiscal year by about $74 billion. As stated above, this steep drop has been largely attributed to the end or winding down of certain COVID-19 programs. Eight program areas saw substantial declines in improper payments this past year. For example, payment errors under the Department of Labor’s Pandemic Unemployment Assistance program fell by $44 billion, which was due to the program’s termination.

But there was also some bad news. Four programs saw substantial increases in improper payments. For two of the programs, the increases were due to the agencies not reporting improper payment estimates last fiscal year. For example, the Small Business Administration’s Restaurant Revitalization Fund saw a $9 billion increase in payment errors.

Reported Improper Payments Each Year Since FY 2003

Image

Which programs had the most payment errors?

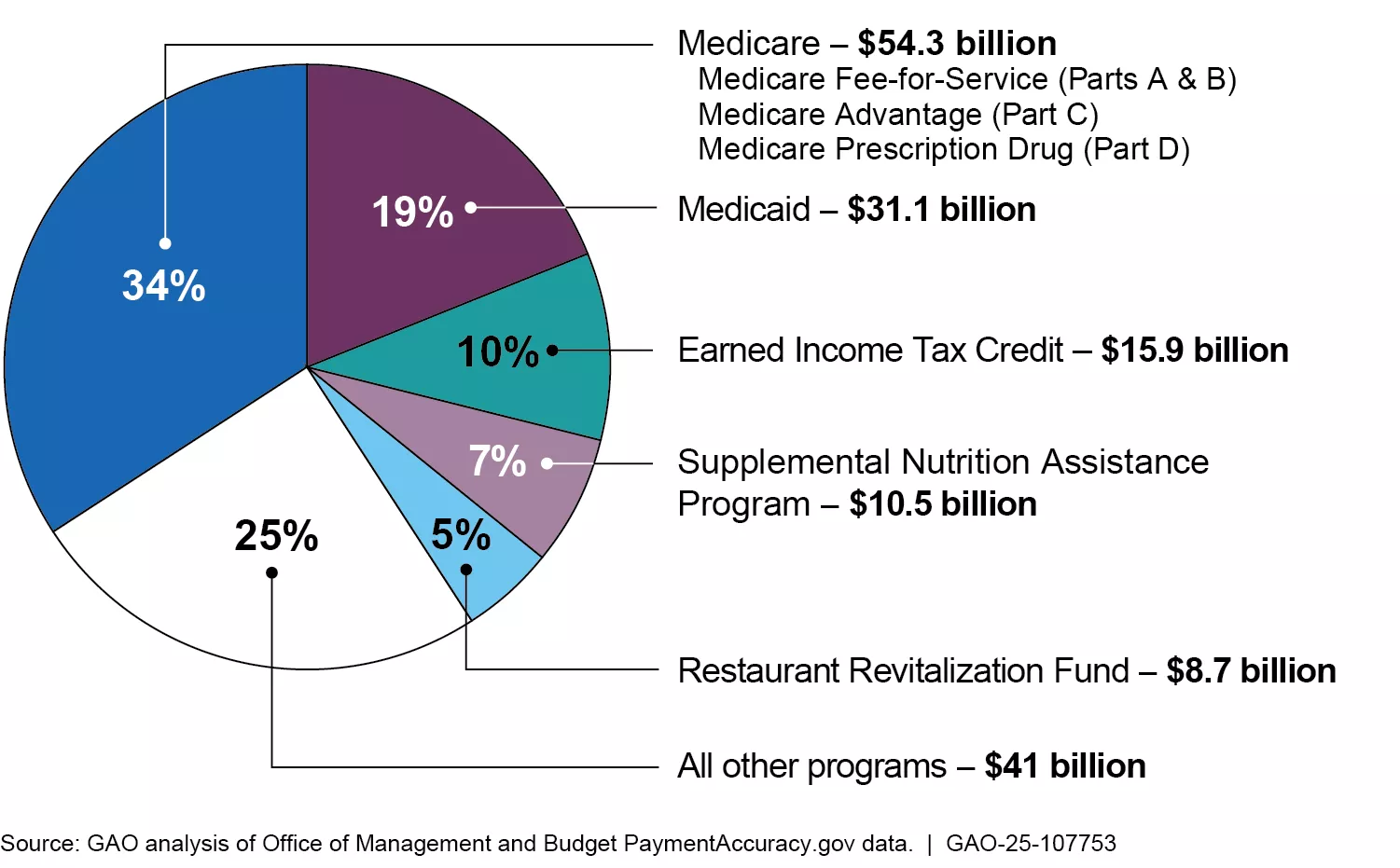

About $121 billion (75%) of improper payments were concentrated in five program areas: Medicare, Medicaid, the Earned Income Tax Credit, Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps), and the Restaurant Revitalization Fund.

Some of these program areas have consistently been among those with the highest payment errors—including Medicaid, Medicare, and the Earned Income Tax Credit. These are also federal program areas that issue the most payments and, as a result, may be more vulnerable to such errors.

Programs Reporting the Largest Percentage of Improper Payments in FY 2024

Image

How can we reduce payment errors across the federal government?

We have made numerous recommendations to agencies and provided suggestions to Congress on ways to help reduce improper payments. Our recommendations for federal agencies include those that would call for better monitoring of federal programs and planning that would help identify risks.

For Congress, we think agencies could use help identifying susceptible programs, developing reliable methods for estimating errors, and implementing effective corrective action.

Learn more about our work on federal payment errors by checking out our latest report on improper payments.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a comment, question? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.