More Fraud Has Been Found in Federal COVID Funding—How Much Was Lost Under Unemployment Insurance Programs

Criminal charges against individuals in alleged COVID-19 funding fraud are growing. Last month, the Department of Justice announced over 700 new enforcement actions—including criminal charges—against 371 defendants for more than $836 million in alleged fraud. While many COVID-19 relief programs were vulnerable to fraud, unemployment insurance has proven to be particularly susceptible.

Today’s WatchBlog post takes a look at our new work estimating the amount of fraud in Unemployment Insurance (UI) programs, and federal efforts to combat fraud and recover taxpayer dollars.

Why were Unemployment Insurance programs so vulnerable to fraud?

The UI system faces long-standing challenges detecting and preventing fraud. These issues worsened during the pandemic when four new emergency UI programs were created to support large amounts of workers impacted by COVID-19. The unprecedented demand for unemployment benefits, paired with the need to respond quickly, heightened the risk of fraud in these programs even further.

The Department of Labor (DOL) has taken steps to estimate fraud across the UI system as a part of its effort to better understand the scale of payment errors. In 2022, DOL reported that about $2.2 billion in payment errors it identified were likely fraudulent. However, this amount did not include payments made through the four emergency UI programs.

In our new report, we estimated that the total amount of fraud across all UI programs (including the new emergency programs) during the COVID-19 pandemic was likely between $100 billion and $135 billion—or 11% to 15% of the total UI benefits paid out during the pandemic.

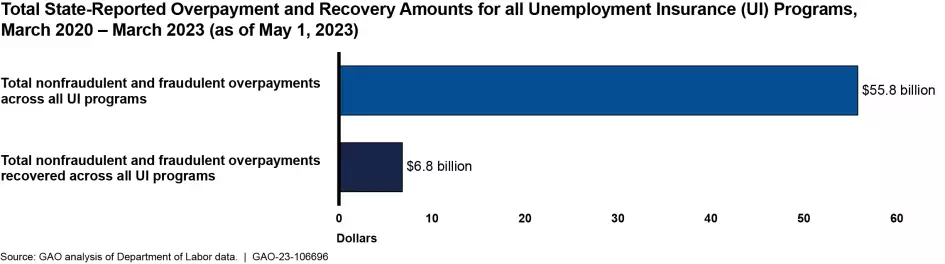

While DOL and federal law enforcement (like the Department of Justice) are taking action to recover these funds, we also found that recovery rates for both fraudulent and nonfraudulent overpayments occurring during the pandemic remain low. The below chart shows the total estimated fraudulent and nonfraudulent overpayments that occurred between March 2020 and March 2023 vs. how many payment errors have been recovered during this time period.

Image

What is being done to combat fraud in Unemployment Insurance programs?

Since 2018, we have made eight recommendations to DOL that would help it better identify and respond to fraud risks in the UI system. Of these recommendations, DOL has implemented four. The other four remain either partially addressed or not addressed. These remaining recommendations would help DOL identify, assess the impact of, and prioritize fraud risks facing the UI program.

Without consistent commitment to these efforts, DOL cannot ensure that it is prioritizing and addressing UI fraud risks effectively.

In February, the U.S. Comptroller General and head of GAO testified before Congress on the factors that contributed to fraud in pandemic UI programs, and our remaining recommendations for DOL on how to combat fraud. You can watch a clip of the Comptroller’s testimony here.

How can you help combat fraud?

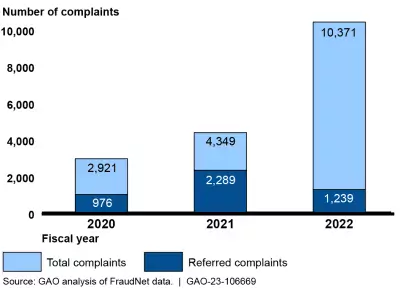

GAO manages the FraudNet hotline that allows the public to submit complaints or concerns about fraud, waste, and abuse completely anonymously. Complaints or concerns can be submitted electronically here, by clicking on “report fraud.” When applicable, the FraudNet team refers allegations to the relevant external agency for consideration of further action.

In FY 2022, the team processed over 10,000 of these complaints. A heavy volume of complaints (over 3,000) were received in March 2020 through January 2022—of which over half involved COVID-19 relief programs, such as UI.

Image

If you are concerned about fraud or want to learn more about how fraud affects federal programs and operations, our interactive Antifraud Resource lets you look up common fraud schemes by agency, type of funding, type of fraud, and more.

Anyone can report suspected fraud, waste, abuse, or mismanagement of federal funds by using our electronic tool or by calling (800) 424-5454.

Learn more about our work on fraud in unemployment insurance programs by checking out our new report.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.