Program Integrity: Agencies and Congress Can Take Actions to Better Manage Improper Payments and Fraud Risks

Fast Facts

Reducing fraud and improper payments is critical to safeguarding federal funds. Improper payments are payments that shouldn't have been made or were made in an incorrect amount.

For FY 2024, the federal government reported about $162 billion in improper payments. Since FY 2003, such payments have totaled nearly $2.8 trillion.

We testified about steps agencies can take to better manage improper payments and fraud risks, such as better planning and sharing data between agencies. We also identified actions Congress can take to hold agencies accountable.

Highlights

What GAO Found

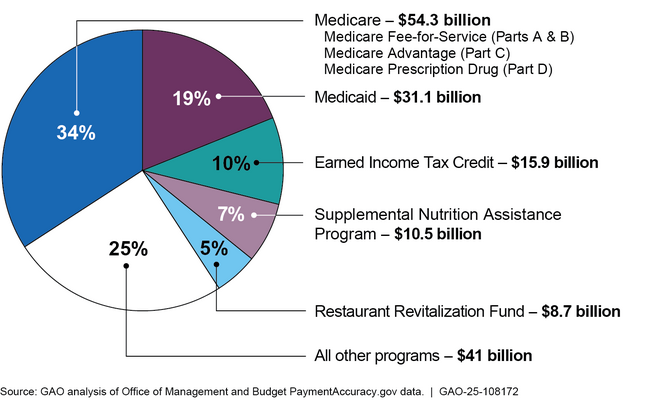

Improper payments and fraud are long-standing and significant problems in the federal government. Since fiscal year 2003, cumulative improper payment estimates by executive branch agencies have totaled about $2.8 trillion. In fiscal year 2024, federal agencies estimated $162 billion in improper payments, representing 68 programs, a small subset of all federal programs. The fiscal year 2024 estimate is a decrease of about $74 billion from the prior year. The reduction in estimated improper payments is largely attributable to the completion or winding down of certain COVID-19 programs. About 75 percent ($121 billion) of the government-wide total of estimated improper payments that agencies reported for fiscal year 2024 is concentrated in five program areas (see figure).

Programs Reporting the Largest Percentage of Government-Wide Improper Payment Estimates for Fiscal Year 2024

In April 2024, GAO estimated total direct annual financial losses to the government from fraud to be between $233 billion and $521 billion, based on fiscal year 2018 through 2022 data. GAO's fraud estimate includes all federal programs and represents 3–7 percent of average annual obligations in this period. The range reflects the different risk environments during this period, which include normal operations, as well as emergency pandemic-relief programs and spending. The upper end of the range is associated with higher risk environments. The amount of estimated fraud loss underscores the importance of prevention and need for strategic fraud risks management.

GAO's prior work has highlighted actions to help federal agencies better manage improper payment and fraud risks, including (1) focusing on prevention, (2) conducting regular risk assessment and root cause analysis, (3) establishing accountability, (4) sharing data and using technology, and (5) preparing for the next emergency. GAO also made recommendations to Congress to increase agencies' accountability over improper payments and fraud.

Why GAO Did This Study

Reducing improper payments—payments that should not have been made or that were made in an incorrect amount—and fraud—obtaining something of value through willful misrepresentation—is critical to safeguarding federal funds. Such actions would help achieve cost savings and improve the government's fiscal position. These payment integrity issues also erode public trust in government and hinder agencies' efforts to execute their missions and program objectives effectively and efficiently.

This testimony covers (1) estimates of government-wide improper payments and fraud and (2) steps federal agencies and Congress can take to manage improper payment and fraud risks.

This testimony is primarily based on GAO's large body of work on improper payments and fraud. GAO reviewed additional information to summarize improper payment root cause data reported by agencies for fiscal year 2024. More detailed information on the scope and methodology of GAO's prior work can be found within each specific report cited in this statement.

Recommendations

GAO has made numerous recommendations to Congress and agencies to help reduce improper payments and fraud. In March 2022, GAO identified 10 actions that Congress could take to strengthen internal controls and financial and fraud risk management practices across the government. As of February 2025, these matters remain open.