Improper Payments: Information on Agencies' Fiscal Year 2024 Estimates

Fast Facts

Improper payments—those that shouldn't have been made or were made in the incorrect amount—have been a government-wide issue for more than 20 years. In FY 2024, 16 federal agencies reported a total estimate of about $162 billion in improper payments across 68 programs. Of these, approximately 84% were a result of overpayments.

This Q&A shows that the agencies' estimates represent a small subset of federal programs. The estimates do not include certain programs that are susceptible to significant improper payments.

Federal improper payments since FY 2003 are estimated at about $2.8 trillion.

Highlights

What GAO Found

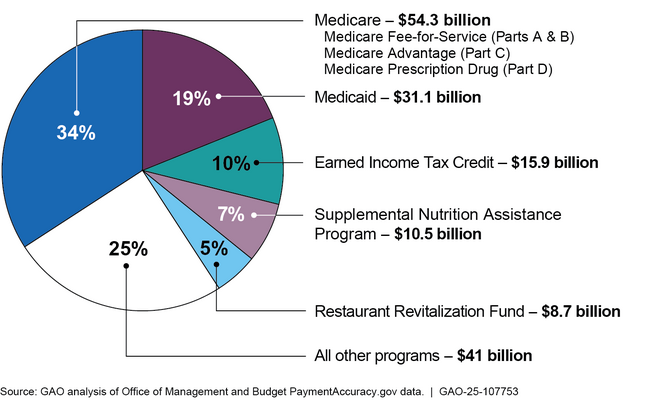

For fiscal year 2024, 16 agencies reported a total estimated $162 billion in improper payments across 68 programs. Agencies reported that about $135 billion (approximately 84 percent) of this total was the result of overpayments. About $121 billion (approximately 75 percent) was concentrated in five program areas. Eighteen federal programs reported improper payment rate estimates of at least 10 percent, including six programs whose rates ranged from over 25 percent to about 45 percent.

However, the improper payment estimates do not represent the full extent of government-wide improper payments. For instance, the $162 billion total represents a small subset of all federal programs and does not include certain programs that agencies have determined are susceptible to significant improper payments. These include the Department of Health and Human Services’ Temporary Assistance for Needy Families, the Department of Housing and Urban Development’s Office of Public and Indian Housing’s Tenant-Based Rental Assistance, and the Small Business Administration’s Shuttered Venue Operators Grant program.

Programs Reporting the Largest Percentage of Government-Wide Improper Payments Estimates for Fiscal Year 2024

Agencies reported about $74 billion less in improper payment estimates in fiscal year 2024 than they did in the prior fiscal year. Agencies that reported substantial decreases attributed the declines to factors such as terminating or winding down certain programs. These include programs specific to the COVID-19 pandemic and programs for which agencies had temporary review flexibilities during the public health emergency (e.g., Medicaid).

The Payment Integrity Information Act of 2019 (PIIA) and Office of Management and Budget (OMB) established criteria and guidance that executive branch agencies must comply with in assessing risk and estimating and reporting improper payments. PIIA also requires the inspector general (IG) at each executive branch agency to issue an annual report on the agency’s compliance with applicable PIIA criteria. In fiscal year 2023, 13 of the 24 Chief Financial Officers Act agencies fully complied with PIIA criteria and related OMB requirements, according to their IG. This was a decrease from fiscal year 2022, when IGs reported 14 agencies were fully compliant.

Eleven agencies were noncompliant with at least one criterion in fiscal year 2023, as reported by their IGs. The IGs identified a variety of causes for agencies’ noncompliance with these criteria, such as inadequate risk assessments and unreliable estimates (see table).

Chief Financial Officers Act of 1990 Agencies Noncompliant with Payment Integrity Information Act of 2019 and Office of Management and Budget Criteria for Fiscal Year 2023, as Reported by Their Inspectors General

|

Agency |

Criteria that agency did not comply with |

|---|---|

|

Department of Agriculture |

Publish corrective action plans Publish reduction target Report improper payments and unknown payment estimates of less than 10% |

|

Department of Defense |

Publish improper payment estimates |

|

Department of Health and Human Services |

Publish improper payment estimates Demonstrate improvements to payment integrity Develop a plan to meet the reduction target Report improper payments and unknown payment estimates of less than 10% |

|

Department of Homeland Security |

Publish improper payment estimates |

|

Department of Housing and Urban Development |

Publish improper payment estimates |

|

Department of Labor |

Publish payment integrity information within the agency financial report (AFR) Publish reduction target Develop a plan to meet the reduction target Report improper payments and unknown payment estimates of less than 10% |

|

Department of the Treasury |

Adequately conclude improper payment likelihood from risk assessment Report improper payments and unknown payment estimates of less than 10% |

|

Department of Veterans Affairs |

Report improper payments and unknown payment estimates of less than 10% |

|

Office of Personnel Management |

Publish improper payment estimates Publish corrective action plans Demonstrate improvements to payment integrity Report improper payments and unknown payment estimates of less than 10% |

|

Small Business Administration |

Publish payment integrity information within the AFR Post AFR on agency website Publish improper payment estimates Publish corrective action plans Publish reduction target Demonstrate improvements to payment integrity Develop a plan to meet the reduction target Report improper payments and unknown payment estimates of less than 10% |

|

Social Security Administration |

Demonstrate improvements to payment integrity |

Source: GAO analysis of inspectors general compliance reports. | GAO-25-107753

Why GAO Did This Study

Improper payments—those that should not have been made or were made in the incorrect amount—have consistently been a government-wide issue. Since fiscal year 2003, cumulative improper payment estimates by executive branch agencies have totaled about $2.8 trillion, and the actual amount of improper payments may be significantly higher. Reducing improper payments is critical to safeguarding federal funds.

GAO has reported on improper payments in its audit reports on the U.S. government’s consolidated financial statements since fiscal year 1997, finding that these payments represent a material deficiency or weakness in internal controls. Specifically, GAO has noted that the federal government is unable to determine the full extent of its improper payments or to reasonably assure that agencies take appropriate actions to reduce them.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, includes a provision for GAO to provide quarterly reports on improper payments. This is GAO’s ninth such report, and it provides an overview of federal agencies’ reported improper payment estimates for fiscal year 2024. This report also discusses agencies’ compliance with requirements for reporting and managing improper payments.

Recommendations

GAO has made numerous recommendations to Congress and agencies to help reduce improper payments government-wide. In March 2022, GAO recommended 10 matters for congressional consideration to enhance transparency and accountability of federal spending. These matters included designating all new federal programs making more than $100 million in payments in any one fiscal year as susceptible to improper payments and establishing a permanent data analytics center of excellence to aid the oversight community in identifying improper payments and fraud. In April 2022, GAO recommended that Congress consider providing the Department of Health and Human Services the authority to require states to report the data the agency needs to estimate and report on improper payments for Temporary Assistance for Needy Families. As of January 2025, these matters remain open.