Small Business Administration: Leadership Attention Needed to Overcome Management Challenges

Highlights

GAO has a related report that discusses SBA’s organizational structure with a focus on its regional offices. See Small Business Administration: Views on the Operational Effects of Closing Regional Offices, GAO-15-369 (Washington, D.C.: Sept. 22, 2015).

What GAO Found

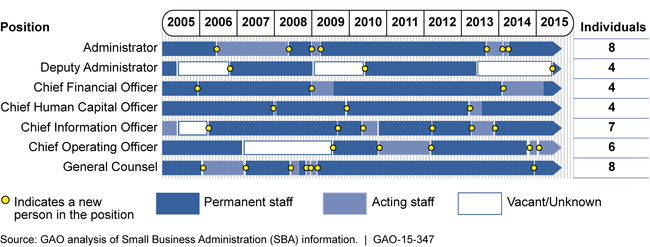

The Small Business Administration (SBA) has not resolved many of its long-standing management challenges due to a lack of sustained priority attention over time. Frequent turnover of political leadership in the federal government, including at SBA, has often made sustaining attention to needed changes difficult (see figure below). Senior SBA leaders have not prioritized long-term organizational transformation in areas such as human capital and information technology (IT). For example, at a 2013 hearing on SBA's budget, the committee Chairman stated that SBA's proposed budget focused on the agency's priorities but ignored some long-standing management deficits. This raises questions about SBA's sustained commitment to addressing management challenges that could keep it from effectively assisting small businesses.

Turnover in Senior-Level Positions at SBA, 2005 through 2015

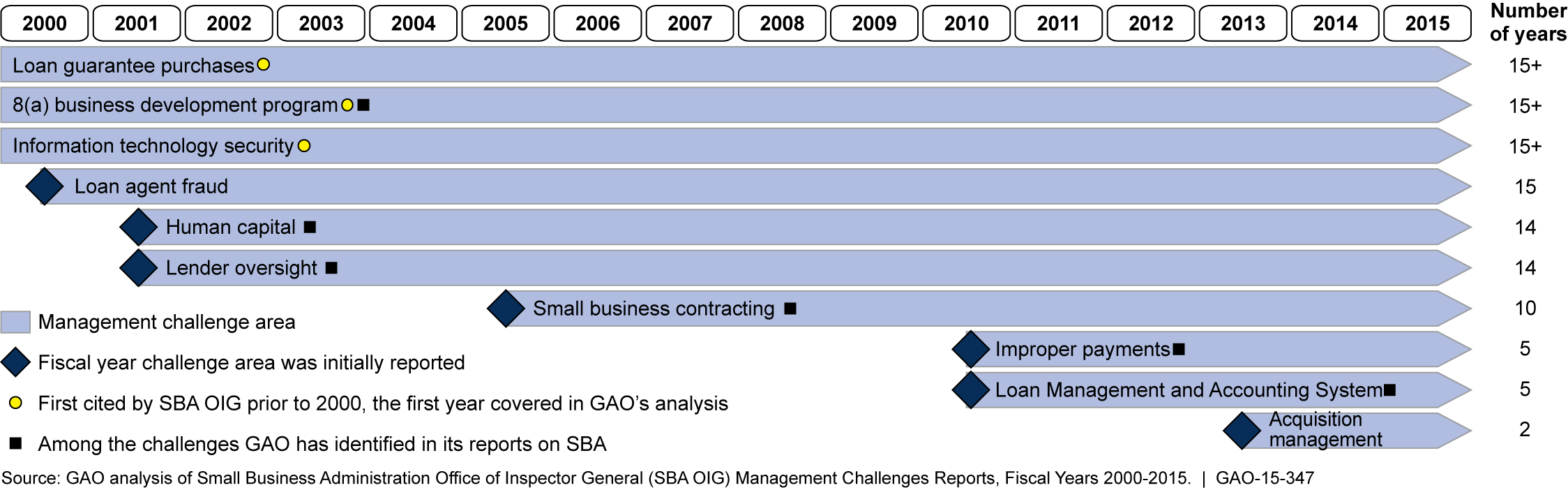

Many of the management challenges that GAO and the SBA Office of Inspector General (OIG) have identified over the years remain, including some related to program implementation and oversight, contracting, human capital, and IT (see figure below). SBA has generally agreed with prior GAO recommendations that were designed to address these issues and other challenges related to the lack of program evaluations. The agency has made limited progress in addressing most of these recommendations but has recently begun taking some steps. A senior SBA official told us that improving human capital management, IT, and the 8(a) program (a business development program) were priorities for the new administrator. For example, he stated that SBA was exploring creative ways to recruit staff and plans to expand SBA One—a database currently used to process loan applications—to include the 8(a) program. Also, SBA has begun addressing some internal control weaknesses that GAO and the SBA OIG identified as contributing to the agency's management challenges. SBA officials noted that the agency had begun to update its standard operating procedure (SOP) on internal controls and planned more revisions after the Office of Management and Budget (OMB) updated its Circular A-123, which is expected to include guidance on implementing GAO's 2014 revisions to federal internal control standards. OMB issued a draft of the revised circular in June 2015 and is reviewing comments it received.

Duration of SBA Management Challenges Identified by the SBA OIG, as of Fiscal Year 2015

Note: Loan guarantee purchases occur when SBA purchases guarantees from lenders following loan liquidations or delinquencies. Loan agents are sometimes used to prepare documentation for an SBA loan application and refer borrowers to lenders. The Loan Management and Accounting System is a project to upgrade existing financial software and application modules and remove them from the mainframe environment.

|

GAO identified management areas in which SBA had not incorporated key principles or made other improvements. |

|

|

|

Why GAO Did This Study

SBA has provided billions of dollars in loans and guarantees to small businesses. As of March 31, 2015, SBA’s total loan portfolio was about $116.9 billion, including $110.3 billion in direct and guaranteed loans and $6.6 billion in disaster loans. GAO has previously reported on management challenges at SBA. GAO was asked to review SBA management, including whether those challenges were ongoing. This report discusses SBA’s efforts to address management challenges related to specific programs and internal controls. It also looks at challenges in strategic planning, human capital, organizational structure, enterprise risk, procedural guidance, and IT. To do this work, GAO reviewed SBA policies and compared them with federal requirements, key principles for human capital management, and internal control standards. GAO also interviewed officials at SBA headquarters, all 10 regional offices, and 10 of 68 district offices selected on the basis of location and size.

Recommendations

GAO makes eight new recommendations designed to improve SBA's program evaluations, strategic and workforce planning, training, organizational structure, ERM, procedural guidance, and oversight of IT investments. SBA generally agreed with these recommendations and provided additional context. In response, GAO clarified one of its recommendations. GAO also maintains that 69 recommendations it made in prior work have merit and should be fully implemented.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Small Business Administration | To improve management of the Small Business Administration and to ensure that SBA assesses the effectiveness of its programs, the SBA Administrator should prioritize resources to conduct additional program evaluations. |

SBA has taken several steps to prioritize resources to conduct additional program evaluations. First, in August 2016, the agency hired a lead program evaluator to develop a long-term evaluation agenda and technical guidance and manage SBA's Impact Evaluation working group. Specifically, the position description for this lead evaluator states that his/her duties include planning, coordinating, and overseeing SBA's program evaluation framework and agendas; serving as an expert advisor on program evaluation methods and design; and coordinating complex, multi-year program evaluation contracts, projects, and studies for the agency. Second, in August 2017, SBA finalized a program evaluation framework that outlines the structure of the agency's program evaluation function, defines roles and responsibilities, and establishes guiding principles. Finally, SBA's fiscal year 2019 Congressional Budget Justification shows that SBA increased funds for evidence/evaluation from $500,000 in fiscal year 2017 to $1.713 million in fiscal year 2018, with a request of $1.725 for fiscal year 2019. The fiscal year 2019 Congressional Budget Justification also notes that SBA selected four evaluations to complete in fiscal year 2018 and through fiscal year 2019, SBA will continue to develop and refine its program evaluation and evidence framework, initiate and coordinate more evaluations, and build evaluation capacity through its Performance and Evaluation Community of Practice, which shares best practices and methods across program offices. Further, the document noted SBA plans to initiate new evaluations, which will continue to build a suite of evidence from which to better inform decisions. Conducting more program evaluations should help SBA assess program effectiveness and learn how to improve program performance.

|

| Small Business Administration |

Priority Rec.

To improve management of the Small Business Administration and to ensure that SBA fully meets GPRAMA requirements, the SBA Administrator should use the results of additional evaluations it conducts in its strategic planning process and ensure the agency's next strategic plan includes required information on program evaluations, including a schedule of future evaluations. |

In February 2018, SBA released its strategic plan for fiscal years 2018-2022. In response to our recommendation, SBA incorporated the results of evaluations in its strategic planning process and included a schedule of future evaluations in the plan. The plan states that SBA annually assesses its strategic objectives through a review that summarizes the key successes, opportunities, challenges, and risks using evidence and evaluations. SBA included citations to evidence and evaluations in each of the strategic goal and objective sections. In addition, the plan includes an enterprise learning agenda that is a 5-year plan that identifies priorities based on SBA's four strategic goals where evaluations could provide insights about program effectiveness, progress toward outcomes, or test pilot initiatives or program adjustments. The agenda provides, for each strategic objective, a sample of prior research and future research and evaluation questions. Relying on program evaluations to help set strategic objectives should better enable SBA to assess the appropriateness and reasonableness of its goals and objectives and the effectiveness of the strategies used to meet them.

|

| Small Business Administration |

Priority Rec.

To improve management of the Small Business Administration and to improve SBA's human capital management, the SBA Administrator should complete a workforce plan that includes key principles such as a competency and skill gap assessment and longterm strategies to address its skill imbalances. |

In response to this recommendation, SBA completed a strategic workforce plan for fiscal years 2017-2020 that complies with key principles. The plan, which was finalized in December 2016, explains SBA's workforce planning model, documents its workforce analysis, includes strategies it will employ to address workforce skill gaps, and describes plans to monitor progress. According to the plan, SBA initiated a skills assessment to identify and close any gaps in core and leadership competencies as part of the agency's workforce planning effort. This assessment was completed in fiscal year 2016 and identified competency gaps for five mission critical occupations. The plan also includes recruitment and retention strategies to address these gaps. Some of the recruitment strategies mentioned include short-term staffing options such as term appointments and details within the agency and alternative staffing options such as hiring interns and veterans. Some of the retention strategies cited include talent development (training and education related to an employee's official duties, executive development plans, individual development plans, and mentoring), employee engagement (selecting the right leaders, coaching leaders and holding them accountable for their employees' engagement, and developing a broad and diverse employee recognition program), and work/life policies (phased retirement, beginning employment with a comprehensive orientation/on boarding process, and developing metrics to track separation losses). The final section of the plan describes SBA's plans to monitor progress against workforce plan milestones and objectives, such as using metrics from Office of Personnel Management guidance and employee survey results. Taking these steps should help SBA manage its workforce planning efforts.

|

| Small Business Administration | To improve management of the Small Business Administration and to improve SBA's human capital management, the SBA Administrator should incorporate into its next training plan key principles such as goals and measures for its training programs and input on employee development goals. |

In December 2016, SBA issued a talent development plan for fiscal years 2016-2017. The plan outlines the agency's three-part strategy for improving the management of the agency's talent development. SBA completed the first part, a talent development needs assessment, in fiscal year 2016. Based on input from managers and staff, this assessment identified gaps in core and leadership competencies for mission critical occupations and was used to inform the talent development plan itself, which is the second part of SBA's three-part strategy. The talent development plan outlines training that will be offered in fiscal years 2016-2017 to meet the goals of furthering executive and senior leader development, leader development, supervisory and managerial development, and technical and core skills development. The third and final part of SBA's strategy for talent development is an annual talent development summary. The talent development plan (1) states that this performance measurement tool is to compare planned versus actual training performance and (2) includes a template for such a summary. Further, SBA officials told us that additional measures associated with the systematic evaluation of learning will be gathered through the training evaluation process. They cited measures of learner satisfaction and changes in learning/organizational impact. Developing a more strategic approach to training should help SBA establish priorities in its training initiatives or address skill gaps to help ensure that employees can effectively deliver programs and meet SBA's strategic objectives.

|

| Small Business Administration | To improve management of the Small Business Administration and to ensure that SBA's organizational structure helps the agency meet its mission, the SBA Administrator should document the assessment of the agency's organizational structure, including any necessary changes to, for example, better ensure areas of authority, responsibility, and lines of reporting are clear and defined. |

In response, SBA conducted another examination of its organizational structure and documented the resulting changes. Specifically, in January 2017 SBA established five subcommittees on resources, capital access, entrepreneurial development, government contracting, and disasters. Each subcommittee was responsible for recommending improvements to the agency that would enhance lines of authority and make the agency more efficient, effective, and accountable. The subcommittees presented their recommendations to then Administrator Linda McMahon. The Administrator then reviewed all the recommendations, created an Agency Reform Plan, and implemented the plan with three separate reorganizations. The first reorganization, which was approved in April 2017, brought SBA into compliance with federal laws and initiatives related to information technology and made changes to the Office of the Chief Information Officer (OCIO), including establishing cross-functional steering committees and a Business Technology Council to engage non-OCIO stakeholders across SBA in information technology transformation. The second reorganization, which was approved in June 2018, realigned, streamlined, renamed, and simplified reporting responsibilities across the offices that currently fall under the Office of the Chief Operating Officer. The third reorganization, which was approved in April 2019, created a new reporting structure under the Office of the Administrator for SBA's 20 major program offices. Examining its organizational structure and documenting the resulting changes should help SBA ensure that its structure contributes effectively to its mission objectives.

|

| Small Business Administration |

Priority Rec.

To improve management of the Small Business Administration and to ensure that SBA can effectively identify, assess, and manage risks, the SBA Administrator should develop its enterprise risk management consistent with GAO's risk management framework and document the specific steps that the agency plans to take to implement its enterprise risk management process. |

In response to this recommendation, SBA developed additional guidance on its enterprise risk management process. This guidance, dated June 2016, outlines a 6-phase process that is consistent with GAO's risk management framework. For instance, SBA added a new first phase ("Strategic Goals and Objectives") that is similar to the first phase of GAO's framework. The guidance also describes actions to be taken during each phase of the process, something that SBA did not provide for our September 2015 report. In addition, SBA provided other documentation showing that it had implemented additional phases of its process. Specifically, SBA provided the template that offices use to assess their risks, the template used to strategize responses to risks, and the risk scoring criteria used to determine risk severity. According to the June 2016 guidance, SBA's Enterprise Risk Management Board is to review each office's draft risk profile before the office implements any planned actions. Taking these steps should help SBA ensure that its efforts effectively identify, assess, and manage risks before they adversely affect SBA's ability to achieve its mission.

|

| Small Business Administration | To improve management of the Small Business Administration and to improve SBA's program and management guidance, the SBA Administrator should set time frames for periodically reviewing and updating its SOPs as appropriate. |

In response to this recommendation, SBA updated its policy on managing standard operating procedures (SOP) to require an annual certification and completed the certification process for 2 years. Specifically, in August 2016, SBA updated its SOP on managing directives, including SOPs. The updated SOP calls for an annual certification of SOPs. It states that the head of each program office is required to certify in writing as to the status of SOPs that have previously been issued by his/her office. It also notes that if the SOP is currently being revised, or being canceled, the office head must provide a date when this process is expected to be completed. In February 2019, SBA provided spreadsheets reflecting the results of its annual certification processes for 2017 and 2018. Both spreadsheets identified SOPs that needed to be revised and generally included projected completion dates for the revisions. Taking these steps should help SBA hold managers accountable for completing needed revisions to SOPs and help ensure that agency staff have updated guidance on program delivery.

|

| Small Business Administration | To improve management of the Small Business Administration and to help ensure that SBA's IT operations and maintenance investments are continuing to meet business and customer needs and the agency's strategic goals, the SBA Administrator should direct the appropriate officials to perform an annual operational analysis on all SBA investments in accordance with OMB guidance. |

In fiscal year 2018, SBA completed operational analyses for its ongoing major IT investments. Using these analyses and those completed in fiscal year 2017, SBA now has a strong basis to evaluate the ongoing effectiveness of its major operational IT systems.

|