Helping Government Help Small Businesses

National Small Business Week recognizes the contributions of American small business owners and entrepreneurs. On the WatchBlog, it’s a time to look at the Small Business Administration—the federal agency that is charged with providing many small businesses with resources and tools to help them succeed.

Today, we’re exploring some of the many management problems at SBA that can limit how much help SBA can give to small businesses.

Old and lingering problems

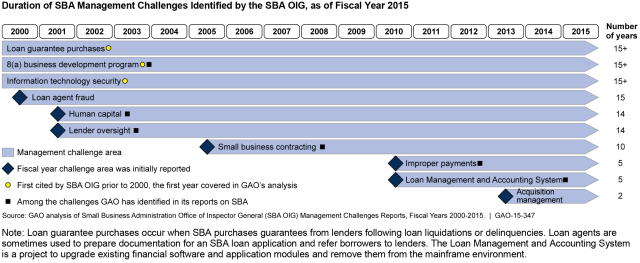

SBA’s Office of Inspector General has found problems in several areas of SBA’s management—many of which have persisted for years.

(Excerpted from GAO-15-347)

(Excerpted from GAO-15-347)

We have found many of the same problems and have made multiple recommendations—60 of which are still unaddressed.

For example, one of the most persistent problems is SBA’s management of loan guarantee purchases. SBA has provided billions of dollars in loans and guarantees to small businesses that might not otherwise be eligible for credit. Yet the SBA Inspector General found that SBA didn’t catch when its lenders failed to follow SBA rules and prudent lending practices, resulting in payments that shouldn’t have been made.

Another persistent problem at SBA—for more than 15 years—is its management of the 8(a) business development program. This program is supposed to help small businesses owned by socially and economically disadvantaged people. But we and the SBA Inspector General found multiple problems. For example, SBA didn’t make sure that only eligible businesses received funding.

Planning for the future

SBA needs a sustained leadership commitment to address its management challenges so that it can help small businesses.

Yet SBA’s own analyses show that it doesn’t have the workforce it needs. For example, SBA district offices used to process loans. Now those offices have shifted to helping develop businesses. But those offices are staffed with the same employees, so people trained in loan processing and finance are now doing the work of marketing and outreach.

Compounding these problems is that SBA didn’t assess the skills of its workforce before offering early retirement to employees. We recommended, among other things, that SBA develop a workforce plan to address its skill imbalances and better manage its workforce to find and keep people with the skills SBA needs.

These are just a few of the problems we found. Check out the entire report for the full details on these and other issues, read what we told Congress about these problems in our congressional testimony, and listen to Bill Shear, a Director in our Financial Markets and Community Investment team, briefly explain the role of SBA and some of the key problems his team found:

- Questions on the content of this post? Contact Bill Shear at shearw@gao.gov.

- Comments on GAO’s WatchBlog? Contact blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.