COVID-19 Relief: Consequences of Fraud and Lessons for Prevention

Fast Facts

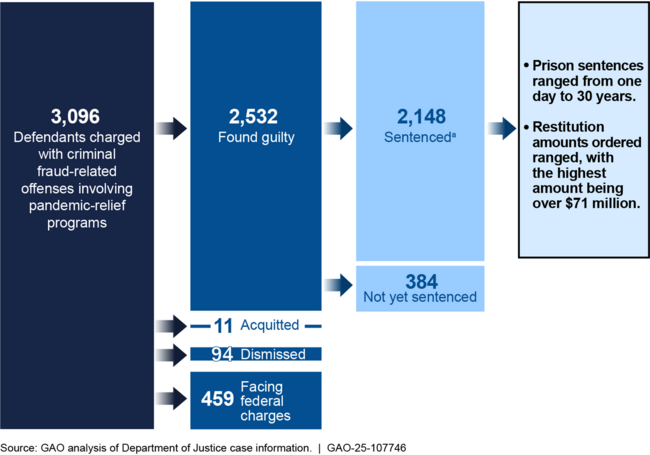

Hundreds of billions of dollars were likely lost to fraud during the pandemic. As of December 2024, the Department of Justice has charged more than 3,000 people, companies, and other entities with fraud-related crimes.

Defendants were typically sentenced to prison, usually 1–5 years. Most were also ordered to pay restitution in varying amounts, with the highest over $71 million.

It’s crucial for agencies to learn from these events to help them fight fraud during normal operations and future emergencies.

This Q&A offers ways for agencies to enhance their antifraud strategies. We also discuss examples of pandemic-relief fraud and consequences.

Highlights

What GAO Found

The full extent of fraud within the pandemic-relief programs will never be known with certainty. The scope of the pandemic-relief response; the inherently deceptive nature of fraudulent activities; and the resources needed for detection, investigation, and prosecution of fraud make it difficult to measure. However, estimates indicate hundreds of billions of dollars in potentially fraudulent payments were disbursed.

As of December 31, 2024, the Department of Justice (DOJ) has publicly announced criminal fraud-related charges involving pandemic-relief programs against at least 3,096 defendants—which can be individuals or entities.

Number of Defendants Charged with Criminal Fraud-Related Offenses Involving Pandemic-Relief Programs and Case Status, as of December 31, 2024

Why GAO Did This Study

Pandemic-relief programs were critical for assuring public health and economic stability. However, they also created unprecedented opportunities for fraud due to the dollars involved and other risk factors.

Considering what was likely lost to fraud during the pandemic, assessing what lessons and insights can be taken to better prepare for both normal operations and future emergencies is critical for agencies. Beyond financial impacts, fraud erodes public trust in government and hinders agencies’ efforts to execute their missions and program objectives effectively and efficiently. Therefore, it is important to take steps to prevent fraud from occurring in the first place.

While the disbursement of pandemic-relief funds is largely over, the work of investigating, prosecuting, and recovering fraudulently disbursed funds is still ongoing. DOJ and its law enforcement partners continue to prioritize the investigation and prosecution of defendants that committed these offenses.

GAO performed this work under the CARES Act that includes a provision for GAO to report on its ongoing monitoring and oversight efforts related to the COVID-19 pandemic. This report provides information on the status of pandemic-relief program cases involving fraud-related charges brought by DOJ and how agencies can enhance fraud prevention.

For more information, contact Rebecca Shea at shear@gao.gov.