Financial Audit: FY 2024 and FY 2023 Consolidated Financial Statements of the U.S. Government

Fast Facts

The Financial Report of the U.S. Government provides a comprehensive view of government finances, including revenues, costs, assets, liabilities, and long-term sustainability.

We audit the financial statements in that report each year, but we haven't yet been able to determine if they are fairly presented. This year, it was primarily due to:

Serious financial management problems at the Department of Defense

Problems in accounting for transactions between federal agencies

Weaknesses in the process for preparing the statements

Inadequate support for the cost of Small Business Administration and Department of Education loan programs

Highlights

What GAO Found

To operate as effectively and efficiently as possible, Congress, the administration, and federal managers must have ready access to reliable and complete financial and performance information—both for individual federal entities and for the federal government as a whole. GAO’s report on the U.S. government’s consolidated financial statements for fiscal years 2024 and 2023 discusses progress that has been made, but also underscores that much work remains to improve federal financial management and that the federal government continues to face an unsustainable long-term fiscal path.

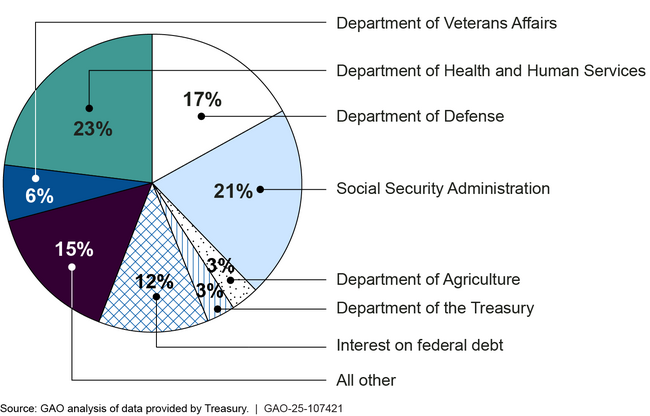

The federal government’s net costs were about $7.4 trillion in fiscal year 2024.

Fiscal Year 2024 Net Costs of U.S. Government Operations ($7.4 Trillion)

Why GAO Did This Study

The Secretary of the Treasury, in coordination with the Director of OMB, is required to annually submit audited financial statements for the U.S. government to the President and Congress. GAO is required to audit these statements. The Government Management Reform Act of 1994 has required such reporting, covering the executive branch of government, beginning with financial statements prepared for fiscal year 1997. The consolidated financial statements include the legislative and judicial branches.

For more information, contact Dawn Simpson at (202) 512-3406 or simpsondb@gao.gov or Robert F. Dacey at (202) 512-3406 or daceyr@gao.gov.