Another Warning About the Nation’s Fiscal Health and Financial Record Keeping

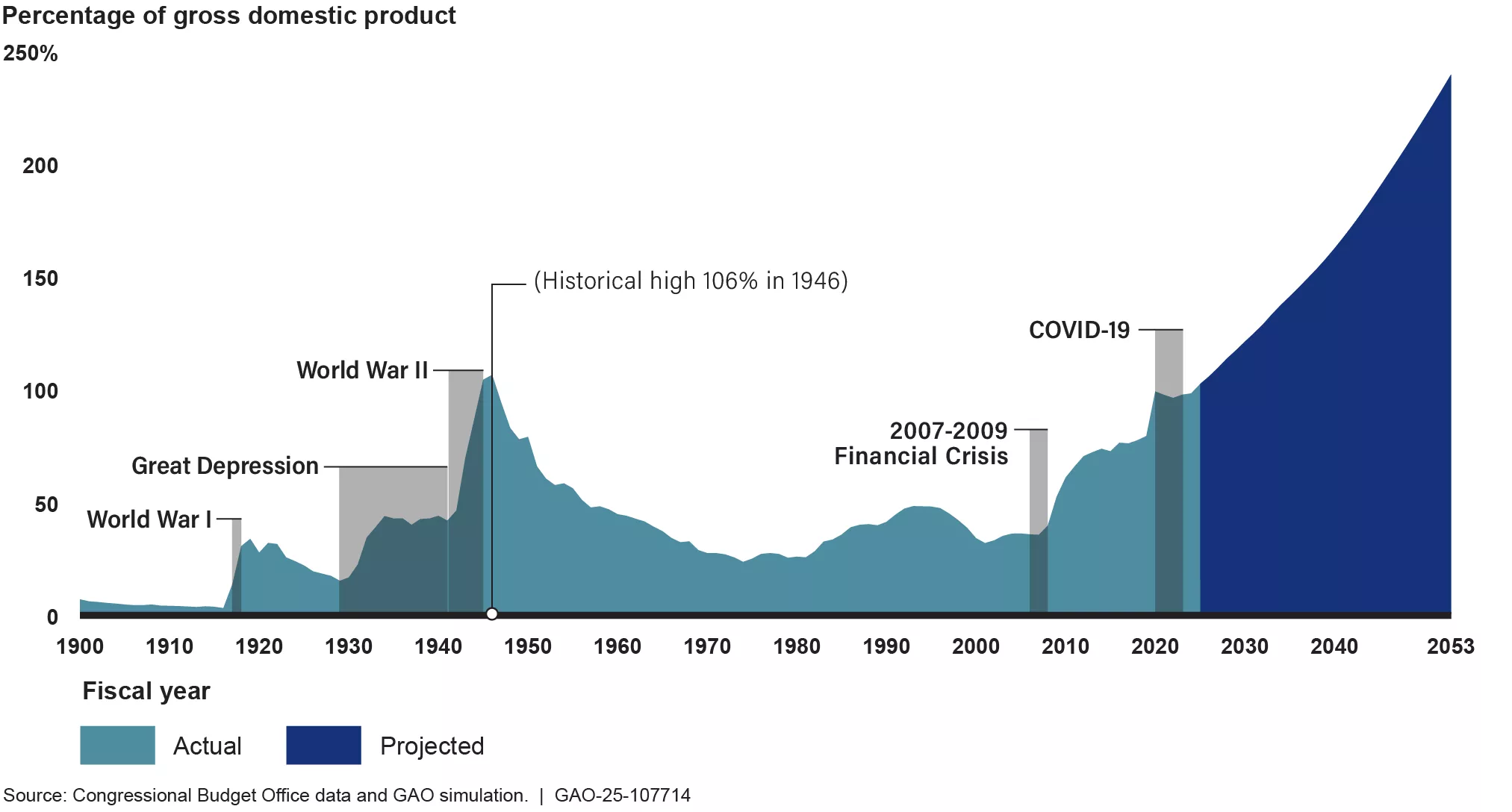

Fiscal year 2024 marked the fifth year in a row that the U.S. saw a budget deficit above $1 trillion. If no action is taken, we project that growing deficits will result in federal debt held by the public (federal debt) reaching its historical high of 106% of the U.S economy by 2027—1 year earlier than we projected last year.

To improve the nation’s fiscal outlook, Congress and the administration will need to make difficult budgetary and policy decisions to address the key drivers of federal debt. The longer they wait, the more significant changes will need to be. Having access to reliable federal financial statements will help inform these important decisions. But when we audited the latest financial statements for the U.S. government, we again found weaknesses that undermine their reliability.

Today’s WatchBlog post looks at our latest reports on the Nation’s fiscal health and ongoing issues with the government’s financial statements.

Debt Held by the Public as a Share of the U.S. Economy (GDP)

Image

Why our fiscal health matters and how it could affect you

The deficit is the difference between what the government spends and what it brings in with taxes and other revenues. In FY 2024, the government spent $1.8 trillion more than it took in. When spending exceeds revenues, that creates the need for debt. And like the deficit, federal debt is growing fast. As of September 30, 2024, federal debt was $28.2 trillion—$2 trillion higher than the prior year and almost 98% of our gross domestic product (GDP).

We project that federal debt will grow faster than the economy each year if current revenue and spending policies are not changed. This fiscal outlook is unsustainable and could lead to serious economic, security, and social challenges if not addressed.

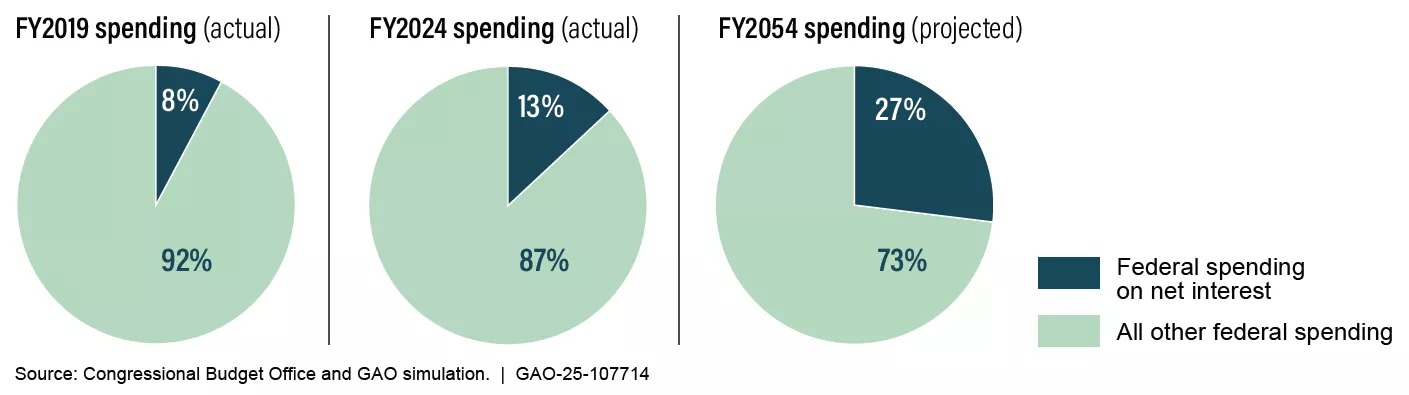

How does federal debt impact the government? Like other borrowers, the government must pay interest on its federal debt. The interest the federal government pays to service its federal debt continues to increase, and accounts for an increasing share of federal spending. The government’s annual spending on net interest has more than tripled since 2017. In FY 2024, the government spent more on net interest than either national defense or Medicare.

Federal Spending on Interest Relative to Other Spending

Image

The rising debt burden and associated interest costs may reduce policymakers’ flexibility to respond to future economic downturns and other unexpected events, including natural disasters or public health emergencies.

How does federal debt impact you? Rising federal debt could also adversely impact many Americans who may experience higher borrowing costs, stagnant wages, and more expensive goods and services.

Find out more with our new resource: How Could the Federal Debt Affect You?

Image

What needs to be done? The sooner the federal government takes action to address these dire financial issues, the less drastic its efforts will need to be. Since 2017, we have suggested that Congress develop a plan to place the government on a sustainable fiscal path—where government spending and revenue result in a stable or declining ratio of debt held by the public to GDP over the long term. Elements of this plan could include:

- Establishing fiscal rules and targets to address spending and revenue imbalances.

- Addressing financing gaps for Social Security and Medicare.

- Reducing improper payments and improve fraud risk management.

- Replacing the debt limit with an approach linking debt decisions to spending and revenue decisions. Statutory changes are needed to avert the risk of government default and its potentially severe consequences.

Our new report reiterates the need for action, while providing an update on our nation’s financial health. Learn more by reading our full report.

What’s wrong with the government’s bookkeeping, and why does that matter to fiscal health?

Each year, we audit the federal government’s financial statements—including the assets the government owns, the liabilities it owes (including federal debt), the revenues it takes in, and the costs it incurs. We recently completed our audit of the FY 2024 and 2023 statements and found the same serious financial management weaknesses seen in previous years.

These weaknesses hinder the federal government’s ability to have reliable, useful, and timely financial information to help it operate effectively and efficiently. It also makes it more difficult to address the nation’s long-term fiscal health.

What were some of the weaknesses in financial reporting? Several weaknesses prevented us from providing an opinion on the federal government’s financial statements.

- Serious financial management problems persist at the Department of Defense, which accounts for 17% of the federal government’s costs.

- The Small Business Administration and the Department of Education are unable to support the cost of their loan programs.

- Reporting of transactions between federal agencies remains inadequate for tracking funds.

- Weaknesses in the federal government’s process for preparing the consolidated financial statements continue.

- Payment errors (also known as improper payments) are a persistent challenge. In FY 2024, $162 billion in payment errors were reported by several agencies.

We outline these and other weaknesses in federal financial statements in our full report. Without high-quality financial information, our country’s leaders are not best positioned to make decisions, including those needed on our nation’s fiscal health.

- GAO’s fact-based, nonpartisan information helps Congress and federal agencies improve government. The WatchBlog lets us contextualize GAO’s work a little more for the public. Check out more of our posts at GAO.gov/blog.

- Got a comment, question? Email us at blog@gao.gov.

GAO Contacts

Related Products

GAO's mission is to provide Congress with fact-based, nonpartisan information that can help improve federal government performance and ensure accountability for the benefit of the American people. GAO launched its WatchBlog in January, 2014, as part of its continuing effort to reach its audiences—Congress and the American people—where they are currently looking for information.

The blog format allows GAO to provide a little more context about its work than it can offer on its other social media platforms. Posts will tie GAO work to current events and the news; show how GAO’s work is affecting agencies or legislation; highlight reports, testimonies, and issue areas where GAO does work; and provide information about GAO itself, among other things.

Please send any feedback on GAO's WatchBlog to blog@gao.gov.