Private Health Insurance: Premium Subsidy during COVID-19 Was Implemented under Tight Timeline

Fast Facts

Workers who lost jobs during the COVID-19 pandemic were eligible for a 100% subsidy to continue health care coverage for up to 6 months via former employers. Employers offering coverage could receive tax credits to offset costs.

The Department of Labor and the IRS expedited their pre-pandemic processes to make this happen. Under tight deadlines, the agencies created guidance—like Q&A notices and updated forms—for employers and the public.

Over 30,000 employers reported to the IRS that their former employees used about $1.2 billion in subsidies during the pandemic. The IRS is auditing some employer tax returns to ensure tax credit compliance.

Example of Department of Labor Advertisement for the Subsidy Marketing Campaign During the COVID-19 Pandemic

Highlights

What GAO Found

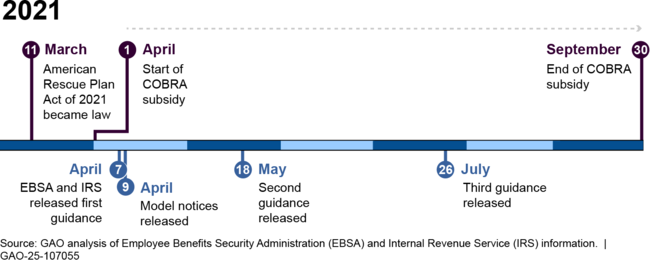

The American Rescue Plan Act of 2021 (ARPA) was enacted on March 11, 2021, and included a temporary 100 percent subsidy toward continued health care coverage for individuals who lost their jobs during the COVID-19 pandemic. Employers were to offer continued coverage, free of charge, to individuals after certain qualifying events and could receive tax credits to offset the costs. To implement the subsidy, the Department of Labor's Employee Benefits Security Administration (EBSA) and the Department of the Treasury's Internal Revenue Service (IRS) used existing processes in an expedited fashion to facilitate the offer of subsidized health insurance through the Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA). As part of their efforts, both agencies developed guidance for individuals and employers, educated the public, and updated internal systems under a tight timeline. The agencies released six of the eight pieces of guidance within 30 days of enactment of ARPA.

Timeline of Selected EBSA and IRS Guidance on COVID-19-related COBRA Subsidy (March 11, 2021–September 30, 2021)

The tight timeline for implementing the COBRA subsidy resulted in challenges for employers and administrators, according to seven of eight selected employer groups and administrators GAO interviewed, with some noting challenges early in the implementation process. These challenges related to the requirement that employers and administrators send COBRA notices to eligible individuals and included uncertainty about the interpretation of the eligibility requirements and shortened timelines for sending the required COBRA notices.

More than 30,000 employers reported to IRS that their former employees utilized approximately $1.2 billion in COBRA subsidies during the pandemic. The number of individuals who received the subsidy is unknown, according to employment tax returns IRS processed as of February 2024 and agency officials. However, IRS is conducting selected audits of employment tax returns for compliance with tax credits including the COBRA subsidy. GAO's literature review did not find any studies that examined the effects of the COBRA subsidy during the pandemic. However, two of three selected employee groups GAO interviewed said the subsidy benefited those in industries that were disproportionately affected by job loss during the pandemic, such as the entertainment industry.

Why GAO Did This Study

Millions of workers lost their jobs during the COVID-19 pandemic. While COBRA generally provides certain individuals with the right to maintain their employer-sponsored health coverage after certain qualifying events, not all individuals enroll due to its high cost.

GAO was asked to review the responsible federal agencies' implementation of the COBRA subsidy. In this report, GAO describes (1) EBSA's and IRS's implementation of the COBRA subsidy and related challenges identified by selected stakeholders and (2) information on the utilization and effects of the COBRA subsidy.

GAO reviewed agency documents and interviewed officials on how the agencies developed guidance, disseminated information, updated systems, and ensured adherence to ARPA's requirements. GAO reviewed aggregate data from IRS on the number and type of employers that claimed the COBRA tax credit and the amount of credits claimed. GAO conducted a literature search for studies that examined the effects of the subsidy on enrollment. GAO also interviewed external stakeholders representing employers, administrators, and employees on their experiences with the COBRA subsidy.

For more information, contact John Dicken at (202) 512-7114 or dickenj@gao.gov.