Farm Loans: Status of USDA Debt Assistance for Distressed Borrowers

Fast Facts

Federal farm loan programs provide credit when farmers and ranchers can't secure a commercial loan. Disruptions from the COVID-19 pandemic and climate-related weather events put some at risk of falling behind on loan payments and potentially losing their farms and ranches.

We reviewed USDA's distribution of $3.1 billion appropriated for debt assistance in 2022 (as of April 2024).

USDA had distributed $2.3 billion to delinquent borrowers

About half of borrowers received less than $25,000

USDA is tracking and plans to report on how the program affected foreclosures, bankruptcies, and more.

We will continue to track distribution of these funds.

Highlights

What GAO Found

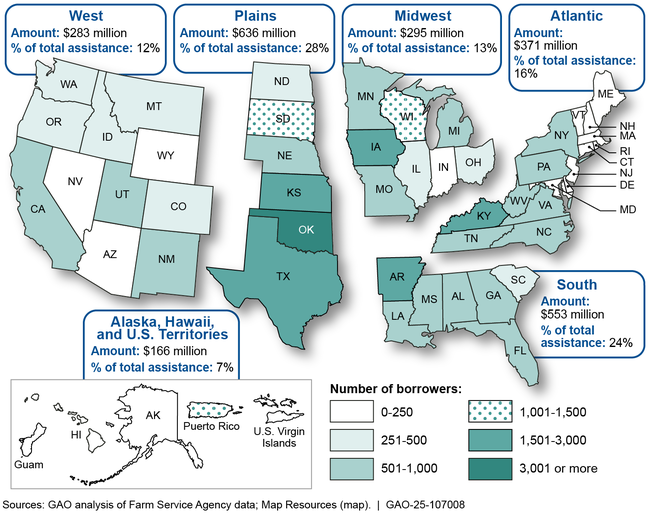

The U.S. Department of Agriculture's (USDA) Farm Service Agency (FSA) is responsible for distributing $3.1 billion in loan debt assistance appropriated under the Inflation Reduction Act of 2022 (IRA) to distressed borrowers with qualifying farm loans. As of April 2024, GAO found that FSA had distributed approximately $2.3 billion to borrowers who were delinquent on their FSA or other qualifying loan. According to FSA officials, about 44 percent of FSA delinquent loans received assistance. Approximately half of the borrowers (52 percent) received $25,000 or less. About half of all assistance distributed went to borrowers in the Plains and South regions—areas where delinquent farm loan amounts were highest. In October 2024, FSA officials said they are using $250 million of the remaining funds to assist about 4,600 borrowers. GAO will continue to track the distribution and use of the funds.

Inflation Reduction Act Section 22006 Assistance Recipients by Region, as of April 29, 2024

According to agency officials, FSA is taking steps to measure the impact of IRA loan debt assistance. For example, FSA is tracking whether such assistance has resulted in improvements in borrowers' delinquency rates, the number of loan accounts in bankruptcy, and foreclosure rates. FSA expects to complete its performance monitoring and report results later this year.

Why GAO Did This Study

Federal farm loan programs serve as a safety net for agricultural producers. The programs provide an important source of credit when farmers and ranchers are otherwise unable to secure a commercial loan. Disruptions from the COVID-19 pandemic and climate-related weather events put agricultural producers at risk of falling behind on loan payments and potentially losing their farms and ranches.

Congress appropriated $3.1 billion to the Secretary of Agriculture for loan debt assistance under section 22006 of IRA. FSA's financial assistance pays off delinquent loan amounts and covers the next payment with no additional debt incurred by the borrower.

The IRA also provides that GAO support oversight of the distribution and use of funds appropriated under the act. This report describes the status of FSA's distribution of loan debt assistance to qualifying borrowers under IRA Section 22006 from October 2022 through April 2024.

GAO analyzed FSA data as of April 29, 2024 (the most recent data available), including borrowers’ loan status, amounts of financial assistance, and the location of their farm or ranch, or where their loans were serviced. GAO reviewed federal laws, program eligibility requirements, and FSA handbooks on farm loans. GAO also interviewed FSA officials to discuss actions the agency is taking to implement IRA Section 22006.

For more information, contact Steve Morris at (202) 512-3841 or Morriss@gao.gov.