WIC Infant Formula: Single-Supplier Competitive Contracts Reduce Program Costs and Modestly Increase Retail Prices

Fast Facts

Over half the country's infant formula is bought through the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). States must contract with the formula manufacturer that offers the lowest price after a rebate to be their sole supplier for WIC.

Two formula manufacturers hold most of the contracts. In 2022, the U.S. had a formula shortage because one of them halted production after a recall.

While sole supplier contracts make states vulnerable to supply disruptions, the rebates saved states about $1.6 billion in FY 2023. These savings offset other WIC food costs, allowing the program to serve more eligible participants.

Highlights

What GAO Found

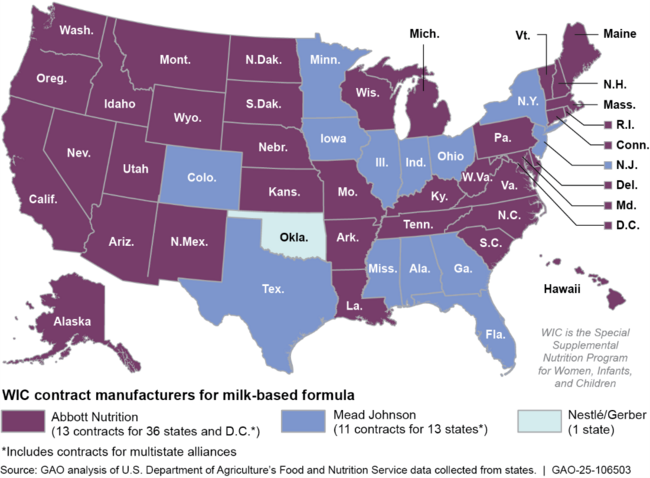

Over half of the country's infant formula is purchased by state agencies through the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC). Since 1989, federal law has generally required WIC state agencies to use a single-supplier competitive system for infant formula. States solicit bids from formula manufacturers for the lowest net price after accounting for a rebate amount given to the state. The manufacturer with the winning bid is awarded a multi-year contract to provide formula for WIC participants in a state or in a group of states that are part of a contracting alliance. As of August 2024, two manufacturers held almost all of WIC contracts in the United States (see figure).

WIC Contract Manufacturers for Milk-Based Infant Formula by State, August 2024

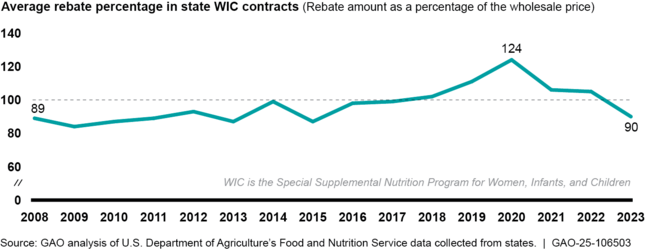

From 2013 to 2023, U.S. infant formula prices were generally stable or decreased, according to GAO's analysis of retail sales data adjusted for inflation. For instance, the average price of milk-based powder formula—the most commonly purchased formula type—was relatively stable from 2013 to 2020 then fell by 11 percent from 2020 to 2023. During this same period (2020 to 2023), the size of rebates from formula manufacturers to states in newly awarded contracts fell by 27 percent after years of increases, according to GAO's analysis of U.S. Department of Agriculture (USDA) data (see figure). A number of trends were present in the infant formula market at this time, including a decline in the number of formula-fed infants and the temporary removal of tariffs on foreign formula. However, GAO's analysis was not designed to evaluate the role of these factors in determining national price or rebate trends over time.

Rebates on Milk-Based Powder Infant Formula in Newly Awarded WIC Contracts, 2008–2023

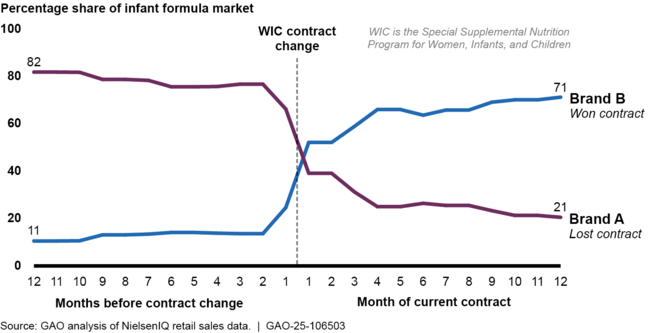

The WIC single-supplier competitive system modestly increased prices for infant formula products of the winning brand, according to GAO's regression analysis of 2018-2023 infant formula sales data. Winning a WIC contract caused an average price increase of 1.7 percent for the formula products specified in WIC contracts—about 30 cents for a typical 12-ounce container of powder formula. It also caused a 0.3 percent price increase for other formula products of the same brand. Winning a contract also greatly increased the winning brand's overall market share in a state (see figure).

Estimated Average Infant Formula Brands' Market Share of Selected Products Before and After a New State WIC Infant Formula Contract Was Initiated, 2018–2023

The key advantage of the current system is that rebate savings allow states to serve more eligible participants. About one-fifth of WIC participants were served monthly with $1.6 billion in rebate savings in 2023, according to USDA estimates. Disadvantages include limited choice for WIC participants and increased retail prices, which adversely affect non-WIC consumers. The reliance on a single-supplier can also leave states vulnerable to supply chain disruptions, which Congress and USDA took steps to mitigate. For example, USDA implemented provisions of the Access to Baby Formula Act of 2022 that require WIC state agencies to prepare plans in case of any future supply chain disruptions.

Alternative approaches identified in research and stakeholder interviews could address some disadvantages of the current system but would be unlikely to result in the same level of cost savings compared to the current system. For example, states could contract with more than one manufacturer to provide WIC participants additional choices and mitigate potential supply disruptions. However, state agencies could face additional administrative burdens in managing multiple contracts, and manufacturers would likely reduce the size of their rebates to states without the guarantee of an exclusive contract.

Why GAO Did This Study

WIC provided food assistance to more than 6 million low-income pregnant and postpartum women, infants, and young children each month in fiscal year 2023. WIC is administered by USDA and state agencies. For infant formula, state agencies use a competitive bidding system. The manufacturer offering the lowest net price after a rebate to the state becomes that state's single-supplier of formula for WIC participants. In 2022, a national infant formula shortage raised questions about how this system for WIC affects the infant formula market.

This report examines (1) trends in the price of infant formula and the rebates states receive from manufacturers, (2) how the WIC single-supplier competitive system affects infant formula prices and the formula market, (3) advantages and disadvantages of the current system for WIC and (4) alternatives to the current system.

GAO reviewed 31 studies determined to be methodologically sound and analyzed 2013–2023 retail sales data on infant formula (the most current at the time of analysis). GAO also reviewed 2013–2024 USDA data on states' WIC contracts. GAO conducted an econometric analysis to assess the effect of winning a WIC contract on retail formula prices, sales, and market share within a state. GAO interviewed federal agency officials and various stakeholders, including researchers; representatives of associations, retailers, and formula manufacturers; and officials from eight states that serve large numbers of WIC infants or that had provided formula to WIC participants outside the retail market.

For more information, contact Kathryn A. Larin at (202) 512-7215 or larink@gao.gov or Michael Hoffman at (202) 512-2700 or hoffmanme@gao.gov.