Shipbuilding and Repair: Navy Needs a Strategic Approach for Private Sector Industrial Base Investments

Fast Facts

The Navy relies on contracts with private companies—the "industrial base"—to build and, in many cases, repair ships. These companies are critical to the Navy's plans to increase its fleet size and improve the fleet's readiness for missions. But ships are often ready much later than expected and at a much higher cost.

DOD has invested billions to support the shipbuilding industrial base—with plans for investments in ship repair. A strategy and coordinated leadership around its industrial base efforts could ensure the Navy is getting what it needs from these investments.

Our recommendations address this and more.

Nuclear-powered submarine on a dry dock at Newport News shipyard in Virginia

Highlights

What GAO Found

The private companies that the Navy contracts with to build vessels and repair surface ships are key components of the Navy's ship industrial base. These private companies augment the repair work conducted at the Navy's public shipyards.

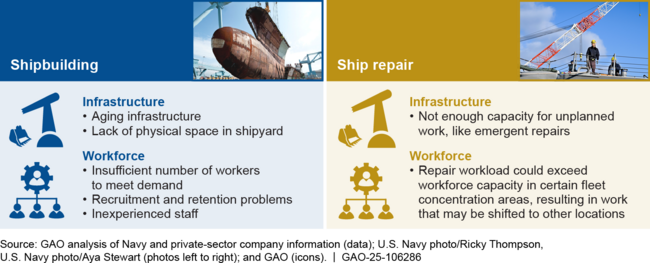

Ship Industrial Base Struggles to Meet the Navy's Goals

- Shipbuilding. The shipbuilding industrial base has not met the Navy's goals in recent history. The Navy's shipbuilding plans have consistently reflected a larger increase in the fleet than the industrial base has achieved. Yet, the Navy continues to base its goals on an assumption that the industrial base will perform better on cost and schedule than it has historically. The shipbuilders have infrastructure and workforce challenges that have made the Navy's goals difficult to accomplish.

- Ship repair. The Navy has not historically met ship repair goals, but it has improved since 2019. The industrial base has grown since then, and representatives from some companies that GAO spoke with stated they often had more capacity than the Navy used. But companies may not be able to take on unplanned work due to infrastructure or workforce limitations. For example, a dry dock of the right size may not be empty when needed.

Key Infrastructure and Workforce Challenges Facing the Ship Industrial Base

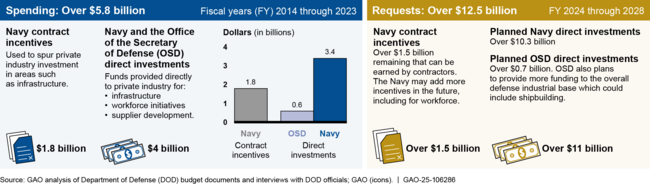

DOD Invests Billions to Support the Shipbuilding Industrial Base

The Department of Defense (DOD)—specifically the Navy and Office of the Secretary of Defense (OSD)—spent billions to support the shipbuilding industrial base. This included funding for infrastructure and workforce improvements for shipbuilders and their suppliers. But it has yet to fully determine the effectiveness of that support (i.e., its return on investment), though it has taken steps to do so. More specifically, DOD spent over $5.8 billion on the shipbuilding industrial base from fiscal years 2014 through 2023. It plans to spend an additional $12.6 billion through fiscal year 2028. DOD spent this funding on contract incentives and direct investments.

DOD Investments and Budget Requests for the Shipbuilding Industrial Base, Fiscal Years 2014–2028

However, the Navy and OSD are not fully coordinating their shipbuilding investments to prevent duplication or overlap in spending. For example, the Navy and OSD do not coordinate across all investment efforts—such as between submarines and surface ships—though they both make related investments in workforce and infrastructure for these ship categories. Further, the Navy has yet to fully establish performance metrics, such as measurable targets that link to the agency's goals that would enable it to consistently evaluate the effectiveness of its investments in building a larger fleet or achieving other intended outcomes. Without better visibility across investments and established performance metrics, the Navy and OSD cannot ensure their investments in the shipbuilding industrial base are an effective use of federal funds to help build a larger fleet.

The Navy plans to make direct investments in the ship repair industrial base as it has for shipbuilding. However, the Navy has yet to fully assess how much infrastructure, such as dry docks, it needs to meet its ship repair goals when considering other than peacetime needs. Without understanding its needs, the Navy risks funding more infrastructure than necessary, which could interrupt the competitive environment.

The Navy Has Not Developed a Strategy for Managing the Ship Industrial Base

The lack of an overall strategy to guide management of the ship industrial base hinders Navy efforts to address several challenges, such as:

- Changing plans for future work. The Navy has struggled to provide industry with a stable workload projection. The Navy's plans for building and repairing ships vary from year to year, hindering efforts to encourage the industry to invest in needed infrastructure.

- Competing priorities. The Navy seeks to increase opportunities for competition in shipbuilding and repair, while simultaneously seeking to protect existing companies. These priorities can be at odds. A more competitive environment could help expand the industrial base, but some companies could struggle to remain viable if they do not win contracts.

Developing a ship industrial base strategy would help the Navy better address these challenges to improve the likelihood of achieving its shipbuilding and ship repair goals. GAO's prior work has shown that a consolidated and comprehensive strategy enables decision-makers to better guide program efforts and assess results. GAO also previously identified desirable characteristics that a national strategy should include. DOD issued its national industrial strategy in November 2023. However, Navy officials told GAO that it established a new program office in September 2024 that will be positioned to develop a strategy for the ship industrial base. Officials said they plan to have additional details available in early 2025. Until the Navy implements a ship industrial base strategy, it will not be able to effectively align or assess its actions to manage the industrial base for shipbuilding and repair.

Why GAO Did This Study

The Navy plans for a larger, more capable fleet of ships to counter evolving threats. But the Navy has struggled to increase the size of the fleet for the past 2 decades. Its performance in shipbuilding and ship repair is critical to achieving the desired future fleet.

Senate Report 116-236 includes a provision for GAO to examine the ship industrial base. GAO's report examines the extent to which (1) the industrial base can support Navy shipbuilding and repair; (2) DOD supports the ship industrial base and assesses its support; and (3) the Navy has a strategic approach to the industrial base.

GAO analyzed DOD and Navy data and documentation; interviewed agency officials and all companies conducting complex repairs for surface ships and major shipbuilding; and conducted site visits.

Recommendations

GAO is making six recommendations to DOD, including that it improves visibility across investments; and that the Navy establish metrics for its investments; assess its repair needs; and create a ship industrial base strategy. DOD did not provide formal comments on this report, but the Navy noted in draft comments that it generally concurred with the substance of the recommendations. The Navy stated that one of the six recommendations should include additional parties within the Navy. GAO agreed and adjusted the recommendation accordingly.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Navy | The Secretary of the Navy should ensure that the Commander of Naval Sea Systems Command (NAVSEA) updates and implements its policies to require its Contracts Directorate to centrally collect data for shipyard investment incentives from contracting officers and its Program Management Offices' contracting officer's representatives to track and monitor its incentive efforts on an ongoing basis. (Recommendation 1) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. In its June 2025 Corrective Action Plan, DOD stated that NAVSEA will disseminate policy to its directorates and program management offices requiring tracking and monitoring incentive efforts on an ongoing basis. It also stated that the NAVSEA Contracts Directorate will establish a repository to centrally collect data for shipyard investment incentives from contracting officers and its Program Management Offices. DOD estimated this action would be completed by the end of Fiscal Year 2025. GAO will continue to monitor the Navy's efforts to address this recommendation.

|

| Department of the Navy | The Secretary of the Navy should develop performance metrics to assess the programmatic and aggregate effect of the Navy's ship industrial base investments. (Recommendation 2) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. DOD stated in its June 2025 Corrective Action Plan that the Navy's Direct Reporting Program Manager for Maritime Industrial Base (DRPM-MIB) will continue to identify, monitor, and assess performance metrics for individual direct Navy investments and the aggregate effect of Navy's direct shipbuilding industrial base investments to inform health and capacity of the industrial base and support decision-making. DOD estimated that this action would be completed by the end of Fiscal Year 2025. GAO will continue to monitor the Navy's progress in implementing this recommendation.

|

| Department of Defense | The Secretary of Defense should ensure that the Office of the Under Secretary of Defense for Acquisition and Sustainment and the Secretary of the Navy regularly coordinate on industrial base support investments, to include collecting and sharing relevant data. (Recommendation 3) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. In its June 2025 corrective action plan, DOD stated that it concurred with the recommendation and that the Navy's Direct Reporting Program Manager for Maritime Industrial Base (DRPM-MIB) and the Office of Deputy Assistant Secretary of Defense for Industrial Base Policy, Industrial Base Analysis and Sustainment (IBAS) have a standing meeting to coordinate on industrial base investments and sharing of data. In August 2025, the Navy provided lists of its submarine industrial base investments to date across key lines of effort, such as supplier development and workforce, as well as a list of selected investments across the government that are relevant to the ship industrial base. Officials told GAO that this type of information is shared with some stakeholders today and could provide a mechanism in the future for sharing data across a broader range of offices responsible for ship industrial base investments. GAO will continue to monitor DOD's efforts to ensure that data on ship industrial base investments is consistently shared across relevant offices.

|

| Department of the Navy | The Secretary of the Navy should ensure that grant funding or other support efforts the Navy provides for the ship repair industrial base are informed by analysis that identifies the required infrastructure capacity needed for surface ship repair. (Recommendation 4) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. In its June 2025 Corrective Action Plan, DOD stated that if funding is appropriated to support development of the ship repair industrial base, the Navy will ensure investment decisions are informed by analysis that identifies the required infrastructure capacity needed for surface ship repair. It added that as part of a Congressionally directed analysis of potential funding needed to support the surface ship industrial base, the Navy has initiated engagements with the ship repair industrial base to understand infrastructure needs and challenges. DOD estimated this action would be completed by the end of the first quarter of Fiscal Year 2026. GAO will continue to monitor the Navy's efforts to address this recommendation.

|

| Department of the Navy |

Priority Rec.

The Secretary of the Navy should develop a ship industrial base strategy that aligns with the National Defense Industrial Strategy and adheres to the desirable characteristics of a national strategy. (Recommendation 5) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. In its June 2025 Corrective Action Plan, DOD stated that the Navy is supporting the Administration's whole of government approach on revitalizing America's Shipbuilding Industrial Base. It added that as part of this approach, the President issued an Executive Order that directs the Senior Advisor to the President for Maritime and Industrial Capacity and Director of the Office and Management and Budget to lead efforts across the federal government to develop a comprehensive "Maritime Action Plan" (MAP) that addresses strategies to enhance U.S. shipbuilding capabilities. Further, it stated that although the Navy is not the lead organization, the Navy will be integral in the development of the MAP. DOD estimated this action would be completed by the end of the third quarter of Fiscal Year 2026. GAO will continue to monitor the Navy's efforts to address this recommendation.

|

| Department of the Navy | The Secretary of the Navy should evaluate how to ensure ASN (RD&A) has the line of authority it needs to carry out its responsibilities for acquisition and sustainment, including repair, for example, by reorganizing NAVSEA's Director for Surface Ship Maintenance, Modernization and Sustainment to fall under PEO Ships' authority, and act on the results of this evaluation, as appropriate. (Recommendation 6) |

DOD did not provide official comments on this report. The Navy provided draft comments indicating that it generally concurred with the substance of the recommendations. In June 2025, the Navy stated that it had determined that the current structure of having PEO Ships and NAVSEA separated was effective and provided documentation that under Navy policy, the commander of NAVSEA reports directly to the ASN (RD&A) for all matters pertaining to sustainment, among other matters. Further, in March 2025, the Navy assigned dedicated leadership at the flag officer level for the NAVSEA's Directorate for Surface Ship Maintenance, Modernization and Sustainment. Previously, the same officer oversaw that directorate and the Navy Regional Maintenance Center (CNRMC). In its June 2025 Corrective Action Plan, DOD stated this decision was made as part of a continuing evaluation to ensure maximum focus on surface force readiness. This change meets the intent of our recommendation by better positioning the Navy to ensure focused leadership attention for effective oversight of surface ship repair.

|