Recommendations for Congress: Action Can Produce Billions of Dollars in Financial and Other Benefits

Fast Facts

In this Q&A, we reported on our recommendations to Congress—our "matters for congressional consideration." Since 2000, we've recommended that Congress consider over 1,000 of these matters to save money and improve federal programs. Congress has acted on 80% of them.

As of March 2024, 242 matters remained open. For example, in 2018, we recommended requiring electronically prepared tax returns that are filed on paper to include a scannable code. This could help the IRS process returns faster, which could reduce staff hours and save money.

Since 2021, legislation has been proposed to partially or fully address 103 of these open matters.

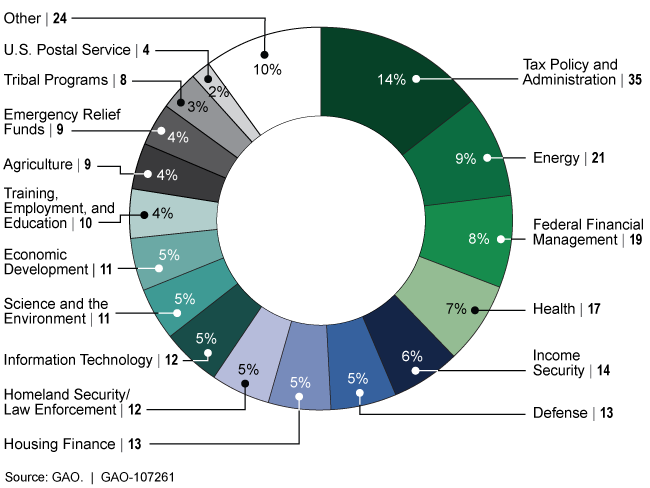

Open Recommendations for Congressional Consideration by Topic, as of March 2024

Highlights

What GAO Found

Matters for congressional consideration are recommendations that GAO makes to Congress to address findings from GAO's work. Since 2000, GAO has recommended that Congress consider more than 1,100 matters and Congress has acted on nearly 80 percent of them. As of March 2024, 242 matters remained open. Action by Congress to address certain open matters can produce billions of dollars in financial savings. Action by Congress on other matters can improve the effectiveness of federal agencies and programs and help position the nation to address future challenges. GAO identified 30 open matters that could result in measurable financial benefits, with 12 of these each having the potential to provide at least a billion dollars of financial benefits. For example,

- Reauthorizing the First Responder Network Authority by 2027 could ensure the continuity of the public-safety broadband network and collect $15 billion in fee revenue over the next 15 years.

- Requiring the Department of Health and Human Services to improve the Medicaid demonstration review process, such as clarifying review criteria and the basis for approved limits, could save tens of billions of dollars or more.

- Requiring the Social Security Administration to offset Disability Insurance benefits for any Unemployment Insurance benefits received in the same period could result in over $2 billion in savings.

- Clarifying the Department of Energy's (DOE) authority to make decisions about what is high-level radioactive waste at its Hanford site could help DOE save billions of dollars as part of a larger effort to address the waste by pursuing less expensive treatment and disposal options.

- Enhancing the Internal Revenue Service's (IRS) enforcement and service capabilities can reduce the gap between taxes owed and paid and protect billions of dollars in revenue. This could include expanding third-party information reporting and granting IRS explicit authority to establish professional requirements for paid tax preparers.

The remaining open matters have the potential to provide numerous other important benefits, such as improving government effectiveness and efficiency. For example, establishing an independent commission to recommend reforms to the federal government's approach to disaster recovery could provide Congress and federal agencies with specific actions to improve the effectiveness and speed of federal disaster recovery services.

Many of these matters could be addressed by legislation Congress is considering. As of March 2024, bills introduced in the 117th and 118th Congress would have fully or partially addressed 103 of the 242 open matters (about 43 percent). Of these, GAO identified legislation related to 18 matters that, if enacted, could result in financial benefits to the government. This includes $141 billion from proposed changes to Medicare payment structures (according to the Congressional Budget Office) and a billion or more each year from establishing a permanent analytics center to aid the oversight community in identifying improper payments and fraud (according to GAO analysis).

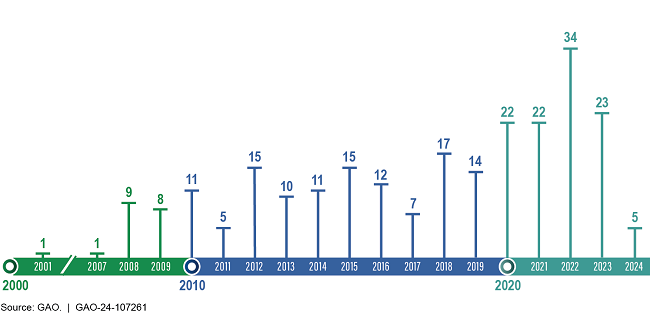

To assist Congress, GAO cataloged the open matters, which span a wide range of topics and involve many parts of the federal government. Topic areas include energy, information technology, tax policy and administration, science and the environment, health, defense, and economic development, among others. Eighty-four of the 242 matters, or 35 percent, have been open for less than 4 years. The oldest open matter is more than 20 years old and remains highly relevant to addressing one of the issues on GAO's High-Risk List—Improving Oversight of Food Safety.

Open Recommendations for Congress Reported by Calendar Year (as of March 2024)

Congressional action in response to matters has been critical to addressing significant challenges facing the nation. Among these challenges are those on GAO's High-Risk List and in GAO's annual Duplication and Cost Savings Report.

Why GAO Did This Study

GAO issued this report in response to a provision contained in the James M. Inhofe National Defense Authorization Act of 2023. In producing this report, GAO used information from its internal system for tracking recommendations and matters for congressional consideration.

For more information, contact Jessica Lucas-Judy at 202-512-6806 or LucasJudyJ@gao.gov.