IRS Workforce: Actions Needed to Address Barriers to Diversity, Equity, Inclusion, and Accessibility

Fast Facts

The IRS seeks an inclusive workforce that reflects the nation's diversity. With about 90,000 employees, IRS is more diverse than the national civilian labor force in representing women, employees from historically disadvantaged racial or ethnic groups, people with disabilities, and veterans.

But diversity is largely concentrated in lower ranks and jobs without senior-level advancement potential. And these employees often face lower chances for promotions, lower salaries, and greater likelihoods of separation from the agency.

IRS is working to identify and address DEIA workforce barriers but can do more. Our 8 recommendations would help.

Highlights

What GAO Found

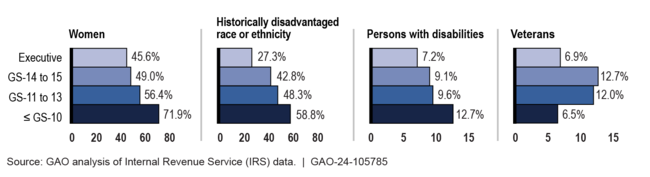

From 2013 to 2022, the Internal Revenue Service's (IRS) workforce diversity increased. However, disparities persisted in the representation of women, employees from historically disadvantaged racial or ethnic groups, and persons with disabilities across ranks, occupations, and divisions. For example, in 2022, 71.9 percent of IRS employees in General Schedule (GS) grades 10 and below were women, compared to 45.6 percent of employees at the executive level.

IRS Workforce Representation by Demographic Group and Rank in the General Schedule (GS) Pay Plan and Executive Positions, Fiscal Year 2022

Note: See appendix I of GAO-24-105785 for information on demographic group definitions.

These same groups also frequently faced lower likelihoods of promotion, lower salaries, and—for historically disadvantaged racial or ethnic groups—greater likelihoods of separation compared to their counterparts during this period. For example, when controlling for other factors such as occupation, employees from historically disadvantaged racial or ethnic groups were 9 to 34 percent less likely than White employees to be promoted across most GS grades. This analysis, taken alone, does not prove or disprove the presence of discrimination, completely explain reasons for different career outcomes, or establish causality but can provide important insight.

From 2013 to 2022, IRS reported eight trends, disparities, or anomalies—referred to as triggers—related to workforce diversity, equity, inclusion, and accessibility (DEIA). However, IRS faced challenges identifying and addressing barriers—policies, procedures, practices, or conditions—underlying the triggers. IRS overly relied on workforce data to identify triggers, conducted limited stakeholder consultation, and did not complete some barrier analysis steps or took them out of order. In January 2024, IRS issued draft policies and procedures that, once implemented, should help address the last of these issues. However, without actions to use many information sources and improve stakeholder consultation, IRS will be limited in its ability to fully identify and address DEIA barriers.

Furthermore, IRS has established multiple DEIA goals in separate strategic plans, creating a lack of clarity about the agency's DEIA efforts. In addition, GAO found that associated performance measures were incomplete. Without a unified strategy for DEIA goals and fully developed performance measures, IRS cannot effectively set priorities, allocate resources, assess progress, and restructure efforts as needed to address DEIA barriers affecting its workforce.

Why GAO Did This Study

With approximately 90,000 employees, IRS's workforce is one of the largest among federal agencies. This workforce provides critical services affecting millions of Americans. IRS has long emphasized the importance of ensuring its workforce reflects the diversity of the nation it serves. However, recent analysis shows disparities and challenges for many demographic groups within IRS.

GAO was asked to examine workforce diversity at IRS. This report examines (1) the demographic composition of IRS's workforce over the last 10 years; (2) the extent to which promotion, salary, and separation outcomes differed by demographic group in IRS's workforce during that time; and (3) the extent to which IRS has identified and taken steps to address barriers to DEIA in its workforce.

GAO reviewed relevant federal laws and guidance and IRS documents; analyzed employee personnel data, survey data, and complaints data; and interviewed officials from IRS, the Equal Employment Opportunity Commission, and representatives from IRS union and employee groups.

Recommendations

GAO is making eight recommendations to IRS, including that IRS consult many information sources and regularly consult stakeholders to identify triggers and address barriers, and establish a unified DEIA strategic plan with associated performance measures. IRS concurred with all eight recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion updates its barrier analysis policies and procedures to incorporate the regular use of many information sources for trigger identification. (Recommendation 1) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in legal authorities which remain in effect. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion uses relevant results from our analyses of its workforce composition and of outcomes related to employee promotion, salary, and separation to inform its next annual barrier analysis effort. (Recommendation 2) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in legal authorities which remain in effect. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion updates its barrier analysis policies and procedures to ensure regular consultation and collaboration with stakeholders, including employee groups and equal employment opportunity program staff, throughout the barrier analysis process. (Recommendation 3) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in legal authorities which remain in effect. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion conducts a comprehensive assessment of and develops recommendations to address staffing issues hampering its ability to perform barrier analyses. (Recommendation 4) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in legal authorities which remain in effect. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion uses the results of its comprehensive staffing assessment to take actions to address staffing issues hampering IRS's barrier analyses. (Recommendation 5) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in legal authorities which remain in effect. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion establishes a unified DEIA strategic plan to determine goals for and guide the development and implementation of agencywide DEIA initiatives. (Recommendation 6) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in GAO's work on leading practices for workforce management and internal controls, which remains valid. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion establishes performance measures for the goals in its unified DEIA strategic plan. (Recommendation 7) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in GAO's work on leading practices for workforce management and evidence-based policymaking, which remains valid. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Office of Equity, Diversity, and Inclusion uses the data collected for its established performance measures to assess progress toward its DEIA goals and to inform decisions about further efforts. (Recommendation 8) |

In August 2024, IRS stated that it agreed with this recommendation and would take steps to implement it. However, in March 2025, IRS stated that, in light of Executive Orders 14151 and 14173 issued in January 2025, the agency had ended its DEIA programs and would not take action to address the recommendation. The criteria upon which this recommendation is based is grounded in GAO's work on leading practices for workforce management and evidence-based policymaking, which remains valid. GAO will continue monitoring developments related to this recommendation, including any additional Executive Orders, guidance, and court decisions.

|