Federal Rulemaking: Trends at the End of Presidents' Terms Remained Generally Consistent across Administrations

Fast Facts

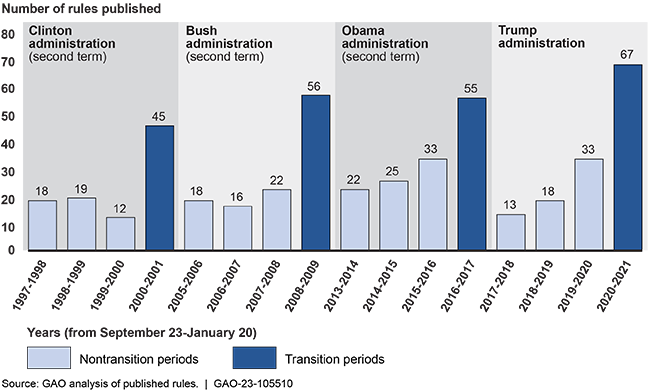

Federal agencies issue more regulations shortly before a president leaves office. This is often called "midnight rulemaking."

We compared agency rulemaking in the last 120 days of the Trump administration to rulemaking in nontransition periods. In the Trump transition period, agencies published about 3 times more rules. During the 3 prior administrations' transition periods, agencies published about 2.5 times more rules.

The Congressional Review Act requires agencies to submit rules to Congress and GAO with 60 days for review. Average noncompliance with this requirement during the Trump administration was comparable to prior administrations.

Comparison of Transition and Nontransition Rulemaking Across 4 Presidential Administrations, 1997-2021

Highlights

What GAO Found

During the transition period at the end of the Trump administration, agencies published an average of roughly 3 times more economically significant rules than during its nontransition periods. After removing the 11 rules specifically related to the federal government's COVID-19 response, agencies published on average 2.6 times more economically significant rules during the Trump administration transition period. This is similar to the Clinton, Bush, and Obama administrations, when agencies published on average roughly 2.5 times more such rules in transition periods.

The Congressional Review Act (CRA) requires agencies to submit rules to Congress and to GAO, as well as to delay the effective date of certain rules to provide Congress an opportunity to review and possibly disapprove of rules before they become effective. Twenty-eight percent of the final economically significant rules issued during the Trump Administration (37 of 131) did not meet at least one timing requirement of the CRA or were not submitted to GAO or to Congress.

Economically Significant Rules Determined to Be Noncompliant with the Congressional Review Act during the Past Four Administrations' Transition Periods

While there was a decrease in noncompliance over the 4 years of the Trump administration, the average percent of noncompliance was almost 30 percent across those 4 years of the Trump administration. This number is comparable with the Clinton, Bush, and Obama administrations. To address noncompliance with the CRA, GAO previously recommended that the Office of Management and Budget (OMB) identify rules that appear at potential risk of not complying with the CRA's delay requirements, and then work with the agencies to ensure compliance with these requirements. In 2019, OMB issued a memorandum that emphasizes the 60-day delay requirement for such rules. While GAO observed a decrease in noncompliance over the Trump administration, opportunities remain for agencies to improve levels of CRA compliance.

Why GAO Did This Study

Federal agencies typically issue a larger number of rules during the transition from one presidential administration to the next, according to GAO's 2018 report on late-term rulemaking. Congress and individuals outside of the government have expressed concerns that these rules may be rushed through analytical and procedural rulemaking requirements. The CRA requires agencies to submit rules to Congress so it can review and possibly disapprove of rules before they become effective.

GAO was asked to compare final economically significant rules issued during the transition and nontransition periods of the Trump, Obama, Bush, and Clinton administrations. Among its objectives, this report assesses (1) the number of economically significant rules, their scope, and other indicators; and (2) agencies' reported compliance with procedural requirements for promulgating the rules.

GAO compared the results to data from prior administrations. To address these objectives, GAO reviewed the text of economically significant rules published in the Federal Register for the universe of all 131 economically significant final rules (generally those with a likely annual effect of $100 million or more) published during transition and nontransition periods. It also compared Trump administration rules to the prior three administrations.

For more information, contact Yvonne D. Jones, (202) 512-6806, jonesy@gao.gov.