Third-Party Litigation Financing: Market Characteristics, Data, and Trends

Fast Facts

Third-party litigation financing is an arrangement in which a funder who is not a party to the lawsuit agrees to help fund it. Funders may get a pay off on their investment if the suit is successful. Funders are typically private firms that obtain funds from investors.

We looked at trends, pros and cons, data limitations, and regulation of this practice. For example, federal law doesn't specifically regulate this industry, but some states do—with limits on fees or interest rates that funders can charge, and other regulations. Some courts have required disclosures when a lawsuit has third-party financing, but there's no national requirement.

Highlights

What GAO Found

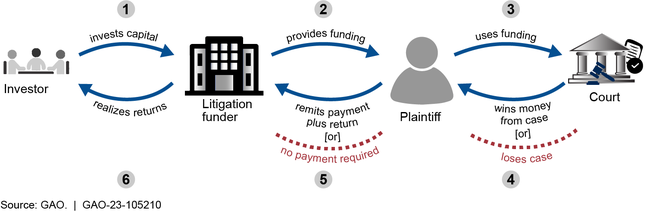

Third-party litigation financing is an arrangement where a funder that is not a party to a lawsuit agrees to provide funding to a litigant (typically a plaintiff) or law firm in exchange for an interest in the potential recovery in a lawsuit (see figure). Plaintiffs do not have to repay the funding if their lawsuit is not successful. This funding generally falls into two categories: commercial and consumer funding. Commercial arrangements are between funders and corporate litigants or law firms. For example, a funder agrees to provide funding for legal or business expenses in exchange for a portion of the court award if the plaintiff wins. The funding is typically in the millions of dollars. Consumer arrangements are between a funder and an individual, such as the plaintiff in a personal injury case. The funder provides a relatively small amount (typically under $10,000) to the plaintiff, who uses it for living expenses. Trends identified by funders GAO interviewed included increased acceptance or familiarity with commercial and consumer funding arrangements and growth in the commercial market.

Example of Third-Party Litigation Financing for Plaintiffs

Experts GAO spoke with identified gaps in the availability of market data on third-party litigation financing, such as funders' rates of return and the total amount of funding provided. They identified policy options to address the gaps and challenges posed by them. For example, state or federal courts could collect data, but the data may be incomplete or could create more burden for the courts.

Funders and stakeholders GAO interviewed identified several advantages and disadvantages of third-party litigation financing for users and investors. For example, this funding can help underfunded plaintiffs litigate their cases. However, it is expensive and may deter plaintiffs from accepting a settlement offer because they may want to make up the amount they will repay the funder. Third-party litigation financing can offer investors potentially high returns. But, the investor risks losing the investment if the plaintiff loses the case.

The third-party litigation financing industry is not specifically regulated under U.S. federal law. However, some states regulate consumer funding by, for example, limiting the fees funders can charge. There also is no nationwide requirement to disclose litigation funding agreements to courts or opposing parties in federal litigation, although courts have required disclosures of funding arrangements in some instances.

Why GAO Did This Study

Litigation funders are typically private firms that obtain investment capital from a variety of investors, such as endowments and pensions. While third-party litigation financing has been well established for decades in some countries, such as Australia and England, it gained a foothold in the U.S. around 2010, according to literature GAO reviewed. However, publicly available data on the market are limited. Some policymakers have raised concerns about the transparency of funding arrangements and other issues.

GAO was asked to review issues related to third-party litigation financing. This report describes (1) characteristics of and trends in the commercial and consumer markets, (2) data gaps in the markets, and policy options to address them, (3) potential advantages and disadvantages of third-party litigation financing for users and investors, and (4) its regulation and disclosure.

GAO analyzed data provided by a nongeneralizable sample of litigation funders for 2017–2021 (selected based on the category of funding they provide and other factors); reviewed relevant laws, court rules, and reports by academic researchers, government agencies, and others; interviewed federal agencies, litigation funders, and U.S. and international trade associations; and convened a roundtable with 12 experts (selected to represent a mix of views and professional fields, among other factors).

For more information, contact Michael E. Clements at (202) 512-8678 or clementsm@gao.gov.