COVID-19: Significant Improvements Are Needed for Overseeing Relief Funds and Leading Responses to Public Health Emergencies

Fast Facts

In our 9th comprehensive report on the COVID-19 pandemic, we provide updates on topics like pandemic emergency rental assistance and tax relief for businesses. We made 5 recommendations, including ways the Treasury Department can more quickly recover rental assistance overpayments.

We are also adding the Department of Health and Human Services' (HHS) leadership of public health emergencies to our High Risk List. For over a decade, we have found issues with how HHS's leadership prepares for and responds to emergencies, including COVID-19, other infectious diseases, and extreme weather events, such as hurricanes.

Reported Daily Hospitalizations and 7-Day Averages of Patients with Confirmed COVID-19 in the U.S., Aug. 1, 2020–Jan. 6, 2022

Highlights

What GAO Found

New U.S. COVID-19 cases and virus variants continue to challenge the nation. New daily reported cases increased sharply from December 21, 2021 to January 3, 2022 due primarily to the emergence of the Omicron variant. Cases during this time generally exceeded 380,000, surpassing the daily case rate reported during the emergence of the Delta variant in summer 2021, according to Centers for Disease Control and Prevention (CDC) data. Hospitalizations of individuals with confirmed COVID-19 also increased almost twofold at the end of 2021—from an average of 50,000 daily in late November 2021 to 93,000 daily.

According to CDC data, as of January 3, 2022, about 62 percent of the total U.S. population had been fully vaccinated. In late 2021, FDA expanded COVID-19 vaccine eligibility in multiple ways, including authorizing vaccines for children 5 through 11 years old, and authorizing booster shots for vaccinated individuals 12 years and older. In addition, the federal government and private businesses began requiring COVID-19 vaccination for certain employees.

Reported COVID-19 Vaccinations by Age Group in U.S., as of Jan. 3, 2022

|

Percentage of population |

Percentage of fully vaccinated population |

|

|---|---|---|

|

Fully vaccinated |

Booster dose |

|

|

5 years of age and older |

66.1 |

Not applicable |

|

12 years of age and older |

71.2 |

Not available |

|

18 years of age and older |

72.9 |

37.2 |

|

65 years of age and older |

87.7 |

58.8 |

|

Total |

62.1 |

34.3 |

Source: Centers for Disease Control and Prevention (CDC). | GAO-22-105291

Note: CDC counts individuals as being fully vaccinated if they received two doses on different days of the two-dose vaccines or received one dose of the single-dose vaccine.

GAO’s COVID-19 reports have provided analyses of broad federal efforts to respond to the pandemic and support U.S. businesses and residents, resulting in 246 total recommendations for improving federal operations. Agencies have fully or partially addressed 38 percent as of December 31, 2021, fully addressing 16 percent (40 recommendations) and partially addressing another 22 percent (54 recommendations). Fully addressing GAO’s recommendations will enhance the quality and accountability of federal COVID-19 pandemic response and recovery efforts. GAO also raised four matters for congressional consideration, three of which remain open.

In this report, GAO makes five new recommendations in the areas of emergency rental assistance, nutrition assistance, and tax relief for businesses. GAO is also designating the Department of Health and Human Services’ (HHS) leadership and coordination of a range of public health emergencies as high risk. This designation is in keeping with long-standing efforts to identify federal programs needing transformation, and to help ensure sustained executive branch and congressional attention so the nation is prepared for future emergencies.

Emergency Rental Assistance

As of November 30, 2021, the Department of the Treasury had disbursed nearly $38 billion of the $46.55 billion it was appropriated for Emergency Rental Assistance (ERA) programs. These programs provide funds to grantees to administer programs to assist eligible renter households that are unable to pay rent, utilities, or other expenses due, directly or indirectly, to the COVID-19 pandemic. Treasury disburses ERA funds to grantees, such as states, local governments, and tribal governments, which make payments to landlords, households, and others eligible to receive the funds.

Treasury has not yet designed processes to identify and recover overpayments made by grantees, such as post-payment reviews or recovery audits. Such reviews could verify the eligibility for and accuracy of ERA payments. Without a process for conducting effective post-payment reviews or recovery audits for the ERA programs, Treasury’s ability to consistently identify and recover overpayments made by grantees may be delayed or impossible.

The Single Audit Act establishes requirements for audits of states, local governments, and other nonfederal entities that receive funding from federal awards (e.g., grants) when their expenditures meet a certain dollar threshold. The Office of Management and Budget (OMB) is responsible for developing government-wide guidance for performing audits to comply with the act. OMB guidance includes issuing an annual Compliance Supplement—a tool to help auditors identify compliance requirements that could have a direct and material effect on major programs. Auditors who conduct single audits follow guidance in the Compliance Supplement and agency guidance specific to their programs.

In its 2021 Compliance Supplement, OMB listed the ERA programs as “higher risk” programs, but did not include guidance for auditing grantee compliance with ERA. Without this guidance, auditors might not consistently and effectively identify deficiencies in grantees’ compliance with the requirements of the programs, limiting Treasury’s ability to identify and mitigate risks, including risks to payment integrity.

GAO recommends that Treasury design and implement processes, such as post-payment reviews or recovery audits, to help ensure timely identification and recovery of overpayments made by grantees to households, landlords, or utility providers in the ERA programs. Treasury agreed with this recommendation and stated that it is working to establish post-payment reviews and recovery audit activities.

GAO also recommends that OMB, in consultation with Treasury, issue guidance now or in the near future on the ERA programs in OMB’s Compliance Supplement for single audits to help ensure that auditors consistently and timely identify deficiencies in grantees’ compliance with the programs’ requirements. OMB neither agreed nor disagreed with this recommendation.

Nutrition Assistance

The Food and Nutrition Service (FNS), within the Department of Agriculture, administers multiple federal nutrition assistance programs, including the Pandemic Electronic Benefits Transfer (Pandemic EBT) program—which provides food assistance for children attending schools closed due to COVID-19—and the Supplemental Nutrition Assistance Program, among others.

COVID-19 Funding and Expenditures for Selected Federal Nutrition Assistance Programs as of Nov. 30, 2021

|

Program |

Description |

Total COVID-19 funding ($) |

COVID-19 expenditures as of Nov. 30, 2021 ($) |

|---|---|---|---|

|

SNAP |

Provides low-income individuals and households with benefits to purchase allowed food items and achieve a more nutritious diet. |

16.8 billion |

15.6 billion |

|

Indefinite appropriation |

15.0 billion |

||

|

Pandemic EBT |

Provides households with children who would have received free or reduced-price school meals if not for school closures due to COVID-19, as well as eligible children in childcare, with benefits to purchase food. |

Indefinite appropriation |

42.4 billion |

|

WIC |

Provides eligible low-income women, infants, and children up to age 5 who are at nutrition risk with nutritious foods to supplement diets, information on healthy eating, and referrals to health care. |

1.4 billion |

710.5 million |

|

TEFAP |

Provides low-income individuals with groceries through food banks. |

1.25 billion |

1.1 billion |

Legend: Pandemic EBT = Pandemic Electronic Benefits Transfer; SNAP = Supplemental Nutrition Assistance Program; TEFAP = the Emergency Food Assistance Program; WIC = Special Supplemental Nutrition Program for Women, Infants, and Children.

Source: GAO analysis of relevant provisions of the Families First Coronavirus Response Act; the CARES Act; the Consolidated Appropriations Act, 2021; and the American Rescue Plan Act of 2021 as well as information from the Food and Nutrition Service (FNS), within the Department of Agriculture. | GAO-22-105291

FNS does not have a comprehensive strategy for how its nutrition assistance programs should respond during emergencies. As part of this, FNS’s pandemic plans are outdated, and FNS efforts to identify and incorporate lessons learned from COVID-19 into its nutrition programs are incomplete. Developing a strategy for how its programs should respond to emergencies would benefit FNS’s response to both the current pandemic and future emergencies. Such a strategy could help FNS ensure that individuals and households maintain food security in times of heightened need and that FNS does not miss opportunities to coordinate with vendors across the country.

FNS has also not provided sufficient assistance to state and local agencies to facilitate their efforts to obtain reliable and comprehensive eligibility data for the Pandemic EBT program. According to FNS officials, state agencies reported various challenges collecting such data, including relying on manual tracking of thousands of participants. Reliable and comprehensive data can help state Supplemental Nutrition Assistance Program agencies ensure they have issued Pandemic EBT benefits to all eligible students in the correct benefit amounts.

GAO recommends that the Department of Agriculture ensure that FNS (1) develops a comprehensive strategy for the agency’s nutrition assistance programs to respond to emergencies that includes lessons learned during the COVID-19 pandemic and a mechanism to periodically review and update the strategy and (2) shares timely information with states and other stakeholders during development of the strategy to help inform their ongoing response to COVID-19.

GAO also recommends that the Department of Agriculture ensure that FNS further assists state and local agencies in their efforts to obtain reliable and comprehensive eligibility data for the Pandemic EBT program in order to determine eligibility and benefits amounts accurately. The Department of Agriculture agreed with both recommendations.

Tax Relief for Businesses

To provide liquidity to businesses during the COVID-19 pandemic, the CARES Act and other COVID-19 relief laws included tax measures to help businesses by reducing certain tax obligations, which, in some cases, led to cash refunds. These tax measures included expanded carrybacks for net operating losses—that is, when a taxpayer’s allowable deductions exceed the gross income for a tax year—and the acceleration of alternative minimum tax (AMT) credit refunds. According to officials from the Internal Revenue Service (IRS), the CARES Act changes contributed to the agency receiving 276 percent more filings for carryback refunds—which include applications for tentative refunds for net operating loss carrybacks and AMT credit refunds—in fiscal year 2021 than in fiscal year 2020.

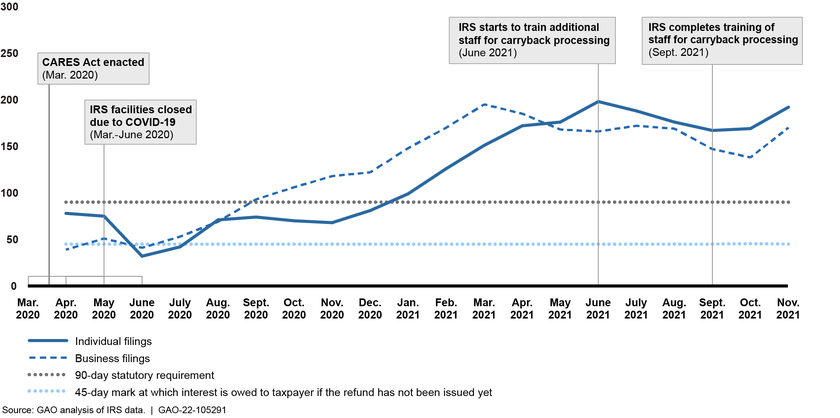

IRS has been unable to process this backlog consistent with its statutory time frames for processing applications for tentative refunds, which businesses submit through IRS Forms 1045 and 1139. The Internal Revenue Code and the CARES Act generally require IRS to issue certain refunds within a 90-day period. IRS data show that the agency started to miss the 90-day statutory requirement for applications in September 2020 and missed it throughout 2021. As of November 2021, the average time for IRS to process all carryback refunds was 165 days (see figure).

Average Monthly Processing Times for Carryback Applications and Claims Filed with the Internal Revenue Service (IRS), Apr. 2020–Nov. 2021

Note: These data include all carryback cases, including those filed as “claims” on other IRS forms and those filed as “applications” on Forms 1045 and 1139. Forms 1045 are represented in the individual line and Forms 1139 are represented in the business line. Forms 1139 may also contain refund claims for the alternative minimum tax refund. IRS officials said the reported times do not include the additional time—up to 2 weeks—it may take for IRS to finalize production and distribute the refund to the taxpayer. The figure does not represent all of the work that IRS did throughout the year, but focuses on actions specific to the processing times for carryback cases. The Consolidated Appropriations Act, 2021 and American Rescue Plan Act of 2021 were also enacted in December 2020 and March 2021 respectively, and contained provisions that also required IRS action.

While IRS took some remedial actions, it did not have effective preventative control activities or mitigation plans in place to detect or address growing processing times for tentative refunds submitted on IRS Forms 1139 and 1045, such as an average processing time threshold to trigger activities to avoid missing refund deadlines. As such, IRS did not take actions to reduce the carryback backlog until April 2021—7 months after the agency began missing its statutory requirement.

Until effective preventative control activities and mitigation plans are put in place, IRS remains at risk of continuing to exceed its 90-day statutory requirement to issue tentative refunds for net operating loss carrybacks and AMT credit refunds. Failure to meet processing deadlines not only causes some taxpayers to face delays in receiving their refunds, but also increases the cost to the federal government in terms of interest paid on such refunds. According to IRS data for fiscal year 2021, these interest payments amounted to approximately $61 million on all carrybacks, of which applications for tentative refund made up roughly 80 percent of all carryback interest payments for the fiscal year.

GAO recommends that IRS establish mitigation plans—including indicators, such as a threshold to initiate mitigation activities—to timely address future challenges to processing times for applications for tentative refunds on Forms 1045 and 1139 within the 90-day statutory requirement. IRS neither agreed nor disagreed with this recommendation, but said that it will take the recommendation into consideration as it continues to make improvements to taxpayer services.

HHS COVID-19 Funding

HHS received approximately $484 billion in COVID-19 relief appropriations from the six COVID-19 relief laws. These relief funds may be used for a range of purposes, such as assistance to health care or child care providers; testing, therapeutic, or vaccine-related activities; or procurement of critical supplies. Of the $484 billion appropriated, HHS reported that it had obligated about $387 billion and expended about $226 billion—about 80 percent and 47 percent, respectively, as of November 30, 2021.

GAO previously recommended that HHS provide projected time frames for its spending of the remainder of its COVID-19 relief funds in the spend plans HHS submits to Congress. HHS partially agreed with the recommendation, but stated that the department would not be able to provide specific time frames for all relief funds as it needed to remain flexible in responding to incoming requests. Providing projected time frames would not affect HHS’s ability to be flexible in its spend plans, as these plans are not binding to the agency and can be revised. GAO will continue to examine HHS’s oversight of COVID-19 relief funds.

High-Risk Designation: HHS’s Leadership and Coordination of Public Health Emergencies

For more than a decade, GAO has reported on HHS’s execution of its lead role in preparing for, and responding to, a range of public health emergencies and has found persistent deficiencies in its ability to perform this role. These deficiencies have hindered the nation’s response to the current COVID-19 pandemic and a variety of past threats, including other infectious diseases—such as the H1N1 influenza pandemic, Zika, and Ebola—and extreme weather events, such as hurricanes.

As devastating as the COVID-19 pandemic has been, more frequent extreme weather events, new viruses, and bad actors who threaten to cause intentional harm loom, making the deficiencies GAO has identified particularly concerning. Not being sufficiently prepared for a range of public health emergencies can also negatively affect the time and resources needed to achieve full recovery.

While HHS has taken some actions to address the 115 recommendations GAO has made related to its leadership and coordination of public health emergencies since fiscal year 2007, 72 remain open. For example, HHS has not addressed our September 2020 recommendation to work with the Federal Emergency Management Agency to develop plans to mitigate supply chain shortages for the remainder of the pandemic, thus contributing to the shortage of such supplies as of January 2022. Also, while HHS began to procure additional tests in the latter part of 2021 and into 2022, and the White House recently appointed a new testing coordinator, HHS had not issued a comprehensive and publicly available testing strategy, which we recommend it do in January 2021. Such a strategy is needed to ensure more timely proactive action in the future and the efficient use of billions of dollars in unobligated funds.

GAO’s prior work has identified persistent deficiencies in HHS’s preparedness and response efforts in several areas, including (1) establishing clear roles and responsibilities for the wide range of key federal, state, local, tribal, territorial, and nongovernmental partners; (2) collecting and analyzing complete and consistent data to inform decision-making—including any necessary midcourse changes—as well as future preparedness; (3) providing clear and consistent communication to key partners and the public; (4) establishing transparency and accountability to help ensure program integrity and build public trust; and (5) understanding key partners’ capabilities and limitations.

GAO is adding this area to the high-risk list to help ensure the executive branch and Congress pay sustained attention in order to make additional progress in implementing GAO’s open recommendations and strengthen HHS’s leadership and coordination role for future public health emergencies.

Why GAO Did This Study

At the beginning of January 2022, the U.S. had about 56 million reported cases of COVID-19 and over 830,000 reported deaths, according to CDC. The country also experiences lingering economic repercussions related to the pandemic, including rising inflation and ongoing supply chain disruptions.

Six relief laws, including the CARES Act, have been enacted to address the public health and economic threats posed by COVID-19. As of November 30, 2021 (the most recent date for which data were available), the federal government had obligated a total of $4 trillion and expended $3.5 trillion, 88 and 77 percent, respectively, of the total COVID-19 relief funds provided by these six laws.

The CARES Act includes a provision for GAO to report on its ongoing monitoring and oversight efforts related to the COVID-19 pandemic. This report, GAO’s ninth, examines the federal government’s continued efforts to respond to, and recover from, the COVID-19 pandemic.

GAO reviewed federal data and documents. GAO also interviewed federal and state officials and other stakeholders.

Recommendations

GAO is making five new recommendations for agencies that are detailed in this Highlights and in the report.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury |

Priority Rec.

The Secretary of the Treasury should design and implement processes, such as post-payment reviews or recovery audits, to help ensure timely identification and recovery of overpayments made by grantees to households, landlords, or utility providers in the Emergency Rental Assistance programs. See the Emergency Rental Assistance enclosure. (Recommendation 1) |

Treasury agreed with our recommendation. In fiscal year 2024, Treasury provided supporting documentation of the corrective actions taken, which included: (1) implementing a data-centric risk- based approach to recipient monitoring that relies on a combination of automated and manual reviews of recipient data to identify and address potential noncompliance, focusing on allowable costs; (2) developing a risk monitoring tool that uses risk-based analytics to identify the highest-risk recipients; and (3) establishing a process for remediation and audit resolution that allows for recovery of unallowable costs, including potential overpayments. Based on this documentation, we believe Treasury has partially addressed the recommendation. In March 2025, Treasury provided us a copy of Treasury's Desk Review Procedures document (dated January 15, 2025), which (1) pertains to oversight and monitoring of recipient's ability to manage their grants and ensure recipient's compliance in administering related funds and (2) covers the housing programs for Emergency Rental Assistance (ERA) and the Homeowner Assistance Fund. Additionally, Treasury noted that it only plans to perform desk reviews for a sub-selection of grantees and, per 2 CFR § 200.332(e), Treasury added that it does not directly monitor grantees' subrecipients. Based on our review of the documentation Treasury had provided in its prior year's status update and the document it provided in March 2025, we believe Treasury has designed monitoring procedures related to determining whether nonfederal entities appropriately disbursed ERA program funds to households. However, Treasury did not provide documentation of monitoring procedures related to eligibility of households and Treasury's recovery efforts on funds provided to or on behalf of ineligible households. To address this recommendation, Treasury needs to design and implement processes, such as post-payment reviews or recovery audits to identify and recover ERA overpayments made by grantees (e.g., nonfederal entities). This process would include monitoring procedures that detect ERA funds disbursed by nonfederal entities to households who were not eligible to receive those funds and steps to recover those funds. We will continue to monitor agency's actions to address this recommendation. As of February 2026, Treasury had not taken any additional action on this recommendation.

|

| Office of Management and Budget | The Director of the Office of Management and Budget, in consultation with the Secretary of the Treasury, should issue guidance now or in the near future on the Emergency Rental Assistance programs in the Office of Management and Budget's Compliance Supplement for single audits to help ensure that auditors consistently and timely identify deficiencies in grantees' compliance with the programs' requirements. See the Emergency Rental Assistance enclosure. (Recommendation 2) |

The Office of Management and Budget (OMB) neither agreed nor disagreed with this recommendation. However, on May 11, 2022, OMB issued its 2022 Compliance Supplement - 2 CFR Part 200 Appendix XI, which now includes a new section for the Department of the Treasury's Emergency Rental Assistance (ERA) program. This section identifies the key compliance requirements for the ERA program that are subject to audit and includes a description of program-specific requirements and suggested audit procedures. We believe OMB's 2022 Compliance Supplement addresses our recommendation.

|

| Food and Nutrition Service | The Secretary of Agriculture should ensure that the Administrator of the Food and Nutrition Service (1) develops a comprehensive strategy for the agency's nutrition assistance programs to respond to emergencies that includes lessons learned during the COVID-19 pandemic and a mechanism to periodically review and update the strategy, and (2) shares timely information with states and other stakeholders during development of the strategy to help inform their ongoing response to COVID-19. See the Nutrition Assistance enclosure. (Recommendation 3) |

The Food and Nutrition Service (FNS) agreed with our recommendation and has implemented it. In January 2024, FNS finalized a comprehensive plan for its nutrition assistance programs to respond to emergencies, entitled The Food and Nutrition Service Pandemic Plan for Protection of the Workforce and Continuity of Mission Essential Functions. To develop the plan, FNS established a team comprised of staff from across the agency. In February 2023, this team held a series of listening sessions with more than 270 staff from across FNS to gather feedback to aid in the development of this strategy. The team then analyzed the feedback to develop a list of key takeaways and lessons learned, which it used to develop its comprehensive plan. The plan establishes general guidance and direction to ensure FNS maintains its essential functions across programs during a pandemic or other emergency, including by outlining roles and responsibilities and the order of succession. The plan also documents flexibilities currently available for its programs to help FNS, states, territories, and tribal organizations respond quickly to a future pandemic or emergency. In addition, the plan includes approximately 20 recommended process improvements based on lessons learned from the COVID-19 pandemic. The plan highlights the need for periodic review and revision; FNS's Office of Emergency Management will review the plan annually and update it as needed. The plan provides examples of ways FNS communicated with states and other stakeholders during development of the plan, and also documents how FNS will coordinate closely with partners, stakeholders, and state agencies to support overall program delivery requirements during a future pandemic or emergency.

|

| Food and Nutrition Service | The Secretary of Agriculture should ensure that the Administrator of the Food and Nutrition Service further assists state and local agencies in their efforts to obtain reliable and comprehensive eligibility data for the Pandemic Electronic Benefits Transfer program in order to determine eligibility and benefits amounts accurately. See the Nutrition Assistance enclosure. (Recommendation 4) |

The Food and Nutrition Service (FNS) agreed with our recommendation and has implemented it. FNS completed a series of listening sessions with state agencies in summer 2022 to learn more about the challenges in the benefit issuance process for the Pandemic Electronic Benefits Transfer (EBT) program, what data were and were not available and why, and the ways FNS could assist with data reliability and the transfer of data across agencies within states. In February 2023, FNS summarized the primary themes and concerns identified through the listening sessions, including proposing a solution to address them. Specifically, FNS identified that the most common challenges were problems with data sharing and validity, criteria for program eligibility, and legal barriers to data sharing. To help address these issues, the agency retained the services of a contractor to build and administer an online application that households can use to enter the income information necessary for determining program eligibility. Though Pandemic EBT was temporary and ended at the end of the COVID-19 public health emergency, FNS is using the online application for the new Summer EBT program that began in summer 2024. FNS launched the online application, which states, territories, and Indian Tribal Organizations can use, at their option, in July 2024. The application allows applicants to report income or eligibility, facilitates confirmation of that information, and has design elements focused on applicant usability, accessibility, and program integrity. By analyzing the challenges in the Pandemic EBT program and developing a solution to address them for the new Summer EBT program, FNS has improved its assistance to state and local agencies in making accurate eligibility and benefits determinations.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should establish mitigation plans—including indicators, such as a threshold to initiate mitigation activities—to timely address any future challenges to processing applications for tentative refund on Forms 1045 and 1139 within the 90-day statutory requirement. See the Tax Relief for Businesses enclosure. (Recommendation 5) |

In a July 2022 letter, IRS disagreed with this recommendation, stating that IRS employees have several inventory management tools to assist with timely processing of applications for tentative refunds. As of March 2025, IRS said its stance has not changed on this recommendation. According to IRS, it continues to use several inventory management tools to assist with timely processing of applications for tentative refunds. IRS has not provided evidence that it has implemented a threshold or other additional mitigation strategies to proactively address future irregular backlogs. Developing a threshold at which planned preventative mitigation activities would start could help IRS better manage unexpected backlogs and reduce the volume of refunds issued after the 90-day deadline in the future.

|