State and Local Governments: Fiscal Conditions During the COVID-19 Pandemic in Selected States

Fast Facts

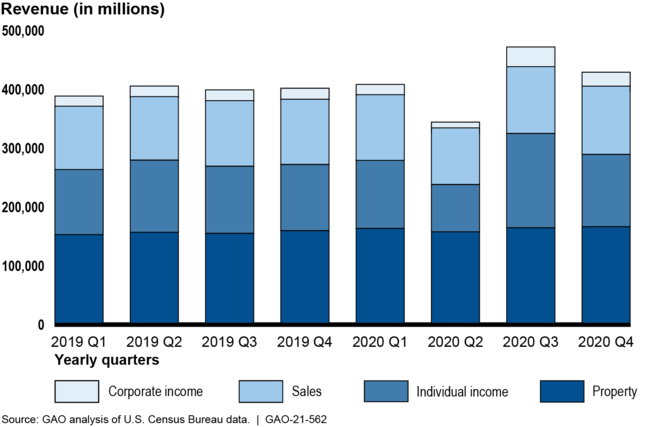

The COVID-19 pandemic took a toll on the U.S. economy, as well as the economies of state and local governments. Tax revenues in the 2nd quarter of 2020 dropped by $61 billion compared to the same period in 2019. Revenues rebounded in the 3rd and 4th quarters.

Looking at 8 states (representing about 20% of the U.S. population), we found that most increased public health and safety spending. Also,

- 6 of the states used hiring freezes to cut spending

- Half of the states used reserve funds to help balance budgets

- Most used federal assistance, like Coronavirus Relief Funds, to help manage increased demand for services like unemployment benefits

Highlights

What GAO Found

State and local government revenues from individual, corporate, and sales taxes declined about $61 billion in the second quarter of 2020 compared to the second quarter in 2019 and rebounded in the third and fourth quarters of 2020. State and local government expenditures remained largely flat throughout 2020 as state and local governments increased expenditures in some areas but limited spending in other areas.

State and Local Government Revenues, First Quarter 2019 through Fourth Quarter 2020

Among the eight states GAO selected, those highly reliant on tax revenues from the energy and tourism and leisure sectors were particularly vulnerable to the economic effects of the pandemic. Other states saw varying levels of revenue declines based on factors such as the duration of business shutdowns. Some selected states revised their revenue forecasts downward as the pandemic progressed and some states' revenue declines were not as severe as initially projected by the revised revenue forecasts.

Most selected states increased public health and safety expenditures and cut spending in other areas. Six states took actions aimed at reducing spending, including hiring freezes or furloughs. Half of the selected states used reserve funds to help balance their budgets. Officials from most states reported that their proposed budgets did not include tax or fee increases.

Five of the eight selected states used the federal assistance they received, including Coronavirus Relief Funds (CRF), to help bolster their states' capacity to implement federal programs. In particular, states used CRF to help manage the increased demand for services due to COVID-19, such as administering unemployment insurance benefits.

Why GAO Did This Study

The COVID-19 pandemic and related policies had a rapid and severe effect on the U.S. economy, including state and local governments. To limit social contact and slow the spread of the pandemic, nearly all states implemented policies that limited certain economic activities. Relief laws, including the CARES Act, provided appropriations to state and local governments to address the public health and economic threats posed by the pandemic.

The CARES Act includes a provision for GAO to report on COVID-19 pandemic oversight efforts. This report examines (1) changes in revenues and expenditures for the state and local government sector since the onset of the pandemic, (2) changes in revenues and expenditures for selected states, (3) actions selected states took to address changes in revenues and expenditures, and (4) factors that affected the selected states' capacity to implement federal programs.

To conduct this work, GAO analyzed state and local government revenue and expenditure data from the U.S. Census Bureau and the Bureau of Economic Analysis's National Income and Product Accounts. GAO analyzed state budget and other relevant documents and interviewed budget officials in eight states that represented a range of factors, including number of COVID-19 cases, revenue sources, and geographic region. GAO also interviewed organizations that represent state and local governments and experts that provide financial and credit risk information to state and local governments.

For more information, contact Michelle Sager at (202) 512-6806 or SagerM@gao.gov.