Federal Debt Management: Treasury Should Strengthen Policies for Market Outreach and Analysis to Maintain Broad-Based Demand for Securities

Fast Facts

The Congressional Budget Office projects that federal deficits will average $1.2 trillion per year through 2029—adding to the existing $16 trillion in public debt.

The Treasury Department will need to borrow from investors to finance the government. To ensure low borrowing costs, Treasury must maintain strong demand for Treasury securities (e.g., bonds) from diverse investors, such as foreign and domestic banks, money market funds, and retirement funds.

We examined factors that affect demand and how Treasury analyzes the market to inform its debt issuance strategy. We recommended improving Treasury’s policies on market research and analysis.

The Department of the Treasury building

Highlights

What GAO Found

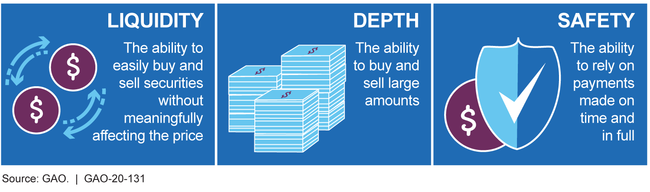

The large institutional investors GAO surveyed across multiple sectors identified liquidity, depth, and safety as the most important characteristics of Treasury securities. This combination supports reliable demand from different types of investors through changing market conditions. Many investors accept low yields because of these characteristics, keeping the Department of the Treasury's (Treasury) borrowing costs low.

Key Characteristics of the Treasury Market That Support Broad-Based Demand

Market participants GAO interviewed and surveyed identified risks that could degrade these key characteristics and reduce future demand:

- Debt limit impasses could force Treasury to delay payments on maturing securities and interest, until sufficient funds are available, compromising the safety of Treasury securities.

- Unsustainable levels of federal debt could cause investors to demand a risk premium and seek out alternatives to Treasury securities.

- A reduced role for the U.S. dollar as the dominant reserve currency could diminish the advantages of holding Treasury securities for foreign investors, particularly foreign government investors who hold large amounts of dollar-denominated assets to assist in managing their exchange rates.

- Changes in the Treasury secondary market where securities are traded— including high-frequency trading and a reduced role for broker-dealers who buy and sell for customers—could increase volatility and reduce liquidity.

Treasury regularly makes important issuance decisions—such as what types of securities to issue and in what quantities—to maintain broad-based demand and support its goal of borrowing at the lowest cost over time. Treasury officials said three key inputs support these decisions: market outreach; auction and market metrics (e.g., trading volumes); and analytical models.

However, Treasury has not finalized its policy for systematically conducting bilateral market outreach to ensure a thorough understanding of market demand. Treasury also does not have a policy governing important aspects of its analytical modeling, including following and documenting quality assurance steps to ensure that analytical methods are appropriate and available to future model developers and users. Codifying policies governing key information sources would help ensure that Treasury's decisions are based on the best possible information.

Why GAO Did This Study

The Congressional Budget Office projects that federal deficits will reach $1 trillion in 2020 and average $1.2 trillion per year through 2029, further adding to the more than $16 trillion in current debt held by the public. As a result, Treasury will need to issue a substantial amount of debt to finance government operations and refinance maturing debt. To support its goal to borrow at the lowest cost over time, Treasury must maintain strong demand from a diverse group of investors for Treasury securities.

GAO prepared this report as part of continuing efforts to assist Congress in identifying and addressing debt management challenges. This report (1) identifies factors that affect demand for Treasury securities and (2) examines how Treasury monitors and analyzes information about the Treasury market to inform its debt issuance strategy.

GAO analyzed data on investor holdings of Treasury securities; surveyed a non-generalizable sample of 109 large domestic institutional investors across 10 sectors (67 responded); reviewed Treasury analysis and market research; and interviewed market participants across sectors, experts on foreign investors, and Treasury officials.

Recommendations

GAO recommends that Treasury (1) finalize its policy for conducting bilateral market outreach and (2) establish a policy for the documentation and quality assurance of analytical models.

Treasury agreed with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of the Secretary for Treasury | The Secretary of the Treasury should finalize the Office of Debt Management's policy for conducting bilateral market outreach and ensure it includes guidance on selecting market participants and documenting and sharing relevant information throughout the office while safeguarding the confidentiality of discussions. (Recommendation 1) |

In June 2020, the Department of Treasury Office of Debt Management (ODM) finalized its market outreach policy consistent with our recommendation. For example, the policy included guidance for ODM staff on 1) using quantitative and qualitative measures to identify and select market participants for outreach; 2) documenting the outreach; 3) sharing key takeaways from outreach within the office as appropriate; and 4) safeguarding confidentiality.

|

| Office of the Secretary for Treasury | The Secretary of the Treasury should establish a policy for the documentation and quality assurance of the Office of Debt Management's analytical models. At a minimum, this policy should require (1) appropriate and sufficient documentation of analytical models, and (2) documented quality assurance of analytical models commensurate with the level of complexity, risk, and materiality to decision-making. (Recommendation 2) |

In June 2020, the Department of the Treasury Office of Debt Management (ODM) established a policy governing the documentation and quality assurance of analytical models sourced, created, and used by ODM. The policy identifies three types of analytical models considering complexity, use, and importance to decision making. Consistent with our recommendation, the policy provides guidance on the appropriate levels of documentation and quality assurance for each type of model. For example, the policy states that for the highest level models used by ODM, there should be an accompanying document describing its structure, assumptions, and key inputs and outputs in a way adequate for a subject matter expert to understand the model. Similarly, the policy specifies some quality assurance steps required for each type of model, such as testing and updating the assumptions in the model in the face of changing market conditions.

|