Crop Insurance: In Areas with Higher Crop Production Risks, Costs Are Greater, and Premiums May Not Cover Expected Losses

Highlights

What GAO Found

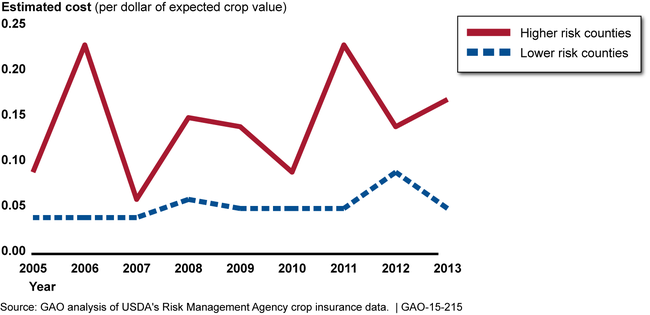

The federal government's crop insurance costs are substantially higher in areas with higher crop production risks (e.g., drought risk) than in other areas. In the higher risk areas, government costs per dollar of crop value for 2005 through 2013 were over two and a half times the costs in other areas. The figure below shows the costs during this period. However, the U.S. Department of Agriculture's (USDA) Risk Management Agency (RMA)—the agency that administers the crop insurance program—does not monitor and report on the government's crop insurance costs in the higher risk areas.

Estimated Federal Government Crop Insurance Costs per Dollar of Expected Crop Value for 2005 through 2013

Note: The crops used for these calculations are corn, cotton, grain sorghum, soybeans, and wheat.

RMA implemented changes to premium rates in 2014, decreasing some rates and increasing others, but GAO's analysis of RMA data shows that, for some crops, RMA's higher risk premium rates may not cover expected losses. RMA made changes to premium rates from 2013 to 2014, but its plans to phase in changes to premium rates over time could have implications for improving actuarial soundness. USDA is required by statute to limit annual increases in premium rates to 20 percent of what the farmer paid for the same coverage in the previous year. However, GAO found that, for higher risk premium rates that required an increase of at least 20 percent to cover expected losses, RMA did not raise these premium rates as high as the law allows to make the rates more actuarially sound. Without sufficient increases to premium rates, where applicable, RMA may not fully cover expected losses and make the rates more actuarially sound. Furthermore, in analyzing data on premium dollars for 2013, GAO found that had RMA's higher risk premium rates been more actuarially sound, the federal government could have potentially collected tens of millions of dollars in additional premiums.

Why GAO Did This Study

The federally subsidized crop insurance program, which helps farmers manage the risk inherent in farming, has become one of the most important programs in the farm safety net. Since 2000, the government's costs for the crop insurance program have increased substantially. The program's cost has come under scrutiny as the nation's budgetary pressures have been increasing.

GAO was asked to identify the costs to the federal government for insuring crops in areas with higher production risks. This report examines, for these areas, (1) the government's cost of the crop insurance program and (2) the extent to which RMA's premium rates, as implemented, cover expected losses. GAO analyzed RMA crop insurance program data from 1994 through 2013 (the most recent year with complete program data) and premium rate data for 2013 and 2014; reviewed relevant studies, RMA documents, and documents from stakeholders including farm industry groups; and interviewed RMA officials.

Recommendations

GAO recommends that RMA (1) monitor and report on crop insurance costs in areas that have higher crop production risks and (2), as appropriate, increase its adjustments of premium rates in these areas by as much as the full 20 percent annually that is allowed by law.

RMA disagreed with GAO's first recommendation and agreed with the second. GAO continues to believe that RMA can and should do more to monitor and report on crop insurance costs in higher risk areas, where government costs were found to be substantially higher.

For more information contact Steve D. Morris at (202) 512-3841 or morriss@gao.gov

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Risk Management Agency | To better inform Congress in the future about crop insurance program costs, reduce present costs, and ensure greater actuarial soundness, the Administrator of the U.S. Department of Agriculture's Risk Management Agency should monitor and report on crop insurance costs in areas that have higher crop production risks. |

As of June 2025, we are reviewing information on the actions that USDA has taken in response to this recommendation and will update its status when our review is complete.

|

| Risk Management Agency | To better inform Congress in the future about crop insurance program costs, reduce present costs, and ensure greater actuarial soundness, the Administrator of the U.S. Department of Agriculture's Risk Management Agency should, as appropriate, increase its adjustments of premium rates in areas with higher crop production risks by as much as the full 20 percent annually that is allowed by law. |

As of June 2025, we are reviewing information on the actions that USDA has taken in response to this recommendation and will update its status when our review is complete.

|