2014 Annual Report: Additional Opportunities to Reduce Fragmentation, Overlap, and Duplication and Achieve Other Financial Benefits

GAO-14-343SP

Published: Apr 08, 2014. Publicly Released: Apr 08, 2014.

Skip to Highlights

Highlights

Improving Efficiency and Effectiveness

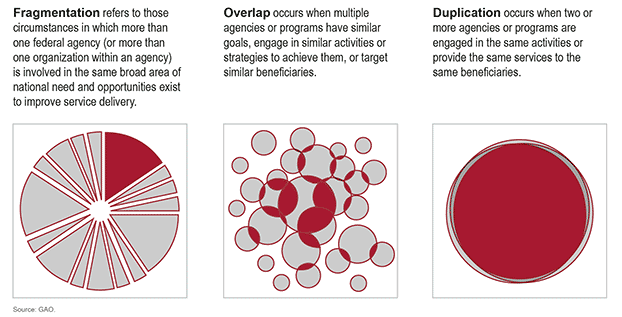

GAO's 2014 Annual Report identified 11 new areas of fragmentation, overlap, and duplication in federal programs and activities. GAO also identified 15 new opportunities for cost savings and revenue enhancement. Related work and GAO's Action Tracker—a tool that tracks progress on GAO's specific suggestions for improvement—are available here.

Recommendations

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider passing legislation to require the Social Security Administration (SSA) to offset Disability Insurance (DI) benefits for any Unemployment Insurance (UI) benefits received in the same period. | No legislation introduced in the 119th Congress as of February 2025. In April 2014, the Government Accountability Office (GAO) recommended that Congress consider implementing legislation that would mandate the Social Security Administration (SSA) to offset Disability Insurance (DI) benefits by any Unemployment Insurance (UI) benefits received during the same period. The Social Security Disability Insurance and Unemployment Benefits Double Dip Elimination Act was first introduced during the 114th Congress in 2015 as bills S.2005 and H.R.918, but the bills were not enacted then. These bills would have implemented the GAO recommendation at that time. During the 117th Congress, the Double Dip Elimination Act was introduced and referred to the House Committee on Ways and Means, but was not enacted during that congressional session. The bill, identified as H.R. 3971, was proposed in 2021. Two bills in the 118th Congress were introduced that could have addressed this matter: Section 4 of H.R. 6427 and section 4 of S. 3316 both prohibit payment of Social Security disability benefits based on receipt of unemployment compensation. These bills were not enacted during the 118th congressional session. According to the Office of Management and Budget, implementing such legislation could save $2.18 billion over ten years for the Social Security Disability Insurance program. | |

| Unless the Department of Energy (DOE) can demonstrate a demand for new Advanced Technology Vehicles Manufacturing (ATVM) loans and viable applications, Congress may wish to consider rescinding all or part of the remaining $4.3 billion in credit subsidy appropriations. | In December 2020, Congress passed and the President signed legislation rescinding part of the ATVM program's remaining credit subsidy appropriations, as GAO had suggested in April 2014. Specifically, the Consolidated Appropriations Act, 2021 rescinded about $1.9 billion of the ATVM program's remaining $4.3 billion in credit subsidy appropriations (Pub. L. No. 116-260, 134 Stat. 1182, 1367 (Dec. 27, 2020)). Congress now has the opportunity to use the funds for other priorities. |

Full Report

GAO Contacts

Orice Williams Brown

Managing Director, Office of Congressional Relations

Congressional Relations

Public Inquiries

Topics

Defense operationsDisability benefitsExecutive agenciesFederal agenciesFiscal policiesInformation technologyInternational relationsPaymentsProductivity in governmentProgram evaluationProgram managementTaxesDuplication of effortProgram goals or objectivesSavings estimates