COVID-19: Insights from Fraud Schemes and Federal Response Efforts

Fast Facts

As of June 2023, the Department of Justice has brought federal fraud-related charges against at least 2,191 individuals or entities in cases involving federal COVID-19 relief programs, consumer scams, and more.

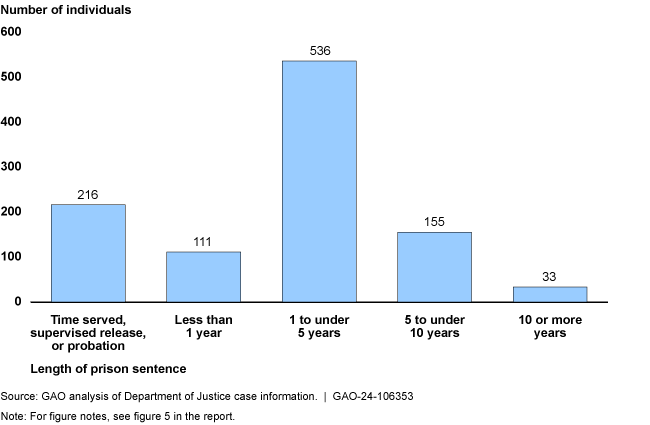

Of the cases we reviewed, at least 1,525 individuals or entities facing fraud-related charges were found guilty or liable. Courts have ordered prison terms up to 10 years or more and restitution up to $60 million or more.

Our analysis highlights the financial loss and impacts of these fraud schemes on taxpayers and federal program goals. Agencies can use this data for their fraud risk management efforts.

How much jail time did individuals found guilty of COVID-19 fraud-related charges receive?

Highlights

What GAO Found

The Department of Justice (DOJ) has brought federal fraud-related charges against at least 2,191 individuals or entities in cases involving federal COVID-19 relief programs, consumer scams, and other types of fraud as of June 30, 2023. Based on GAO's analysis of the cases announced in DOJ press releases, at least 1,525 individuals or entities facing fraud-related charges were found guilty or liable. Courts have ordered individuals to pay restitution ranging up to over $60 million and serve prison terms up to 10 years or more. GAO's analysis of fraud schemes highlights the resulting financial losses and impacts on taxpayers, agency reputation, federal program goals, and health and safety. Agencies can use information about schemes to improve their fraud risk management efforts.

Examples of Fraud Schemes Involving Federal COVID-19 Relief Programs or Consumer Scams

|

Key mechanism |

Fraud scheme description |

|---|---|

|

Conspiracy |

A group allegedly conspired to obtain more than $240 million from a federal child nutrition program in a complex fraud scheme. Individuals colluded to open shell companies acting as program sites to claim they were serving thousands of meals a day to underserved children during the pandemic. Instead, these funds were diverted for self-enrichment. Four individuals pleaded guilty but have not been sentenced. Over 40 others are awaiting trial. |

|

Misrepresentation |

Two company owners attempted to obtain a total of $5 million by applying for 14 Paycheck Protection Program loans and 12 COVID-19 Economic Injury Disaster Loans. They submitted fabricated tax and other documents inflating the companies' number of employees and payroll. The owners received almost $650,000 in funds they used for personal items, such as a luxury car. Both pleaded guilty, were ordered to pay more than $800,000 in restitution, and were sentenced to 2 to 3 years in prison. |

|

Mislabeling |

A company owner sold and mailed pesticide marketed as an air purifier to kill airborne viruses such as COVID-19. The product contained sodium chlorite, a substance declared unmailable under U.S. postal regulations because of its propensity to cause a fire or explosion. The owner was sentenced to 8 months in prison and ordered to pay a total penalty of $556,443 through restitution, fines, and forfeiture. |

|

Health care fraud |

A licensed medical practitioner pleaded guilty to selling homeopathic immunizations, falsely claiming they provided immunity to COVID-19. She received over $74,000 for fabricated COVID-19 vaccination and immunization records, knowing this would mislead school officials enforcing the state's vaccination laws. She was sentenced to almost 3 years in prison. |

Source: GAO Antifraud Resource and analysis of court documentation (information); Icons-Studio/stock.adobe.com (icons). | GAO-24-106353

Various interagency task forces and the Pandemic Response Accountability Committee (PRAC) were established to combat COVID-19 fraud. For example, the COVID-19 Fraud Enforcement Task Force conducted an enforcement sweep and reported taking law enforcement actions against fraudsters responsible for approximately $836 million in fraud. Similarly, the PRAC estimated its information and resource sharing with investigative agencies supported hundreds of criminal convictions and the recovery of more than $1 billion.

Why GAO Did This Study

Since March 2020, Congress provided over $4.6 trillion to help the nation respond to and recover from the COVID-19 pandemic. The public health crisis, economic instability, and increased flow of federal funds associated with the pandemic increased pressures on federal agency operations and presented opportunities for individuals to commit fraud. The COVID-19 pandemic saw an increase in the number of fraud-related charges, including schemes by individuals and large complex syndicates.

The CARES Act of 2020 includes a provision for GAO to report regularly on the federal response to the pandemic.

This report describes: (1) the status of federal COVID-19 fraud-related cases announced by DOJ, including examples of fraud schemes and (2) examples of federal efforts that have been taken to combat COVID-19 fraud.

GAO reviewed public statements from DOJ from March 2020 through June 2023 to identify federal fraud-related cases. Specifically, GAO identified cases involving COVID-19 relief program fraud; consumer scams; and other types of fraud. GAO then analyzed court documents for details on fraud schemes. GAO also reviewed federal agency documentation and rules, proposed legislation, and proposed antifraud efforts.

Recommendations

In March 2022, GAO identified 10 actions Congress could take to strengthen internal controls and financial and fraud risk management practices across the government. All 10 remain open.