Countering Illicit Finance and Trade: U.S. Efforts to Combat Trade-Based Money Laundering

Fast Facts

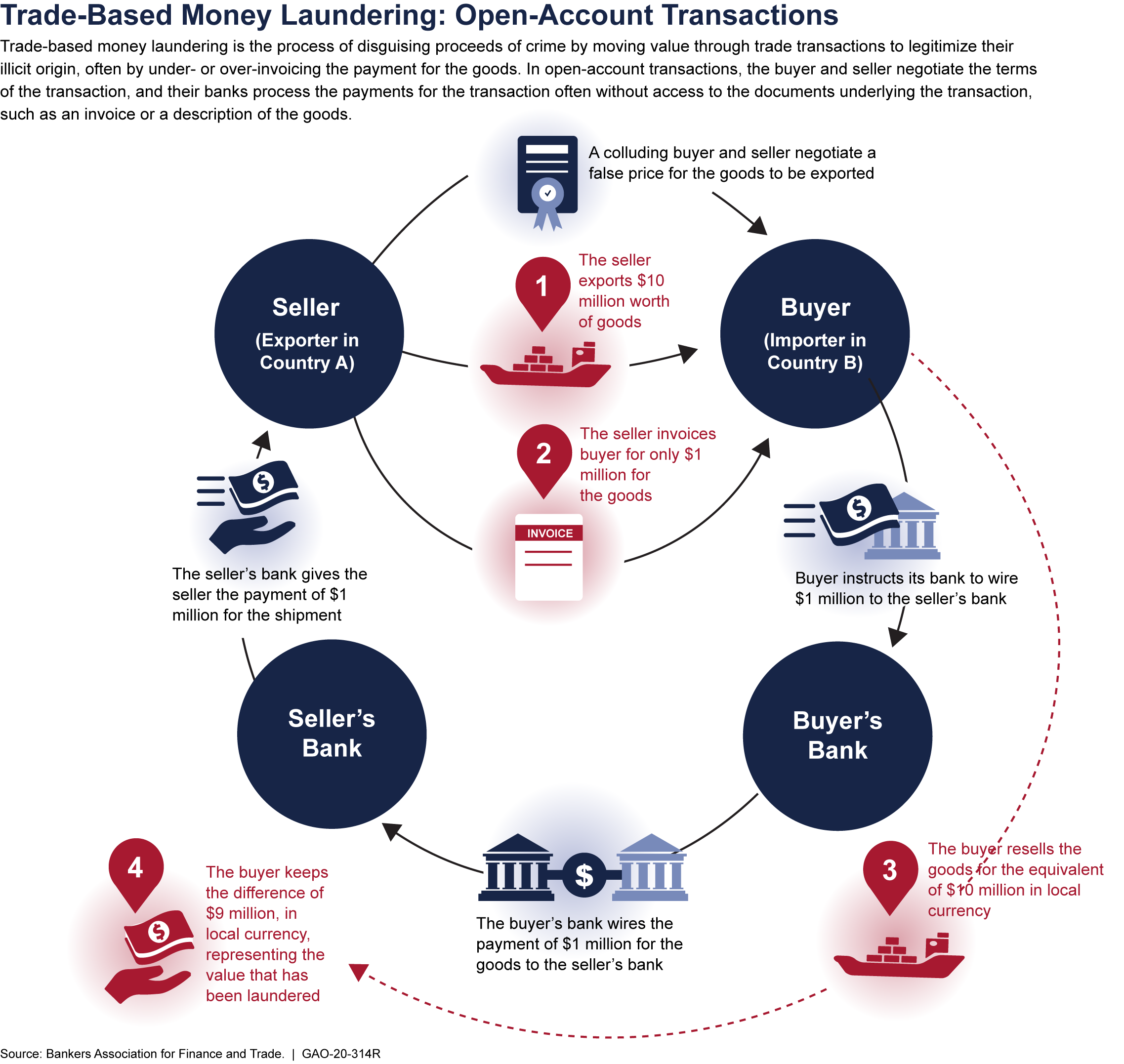

Some criminal groups use a process called trade-based money laundering to launder their illicit money. These schemes can include things like falsely describing goods and services in trade transactions.

Banks are required to report suspicious financial transactions to the Treasury Department. However, we found that banks often do not have access to the documentation for most of the trade transactions for which they process payments, making it difficult to identify suspicious activity. Because of the large volume of trade, customs agencies also have difficulty identifying fraudulent trade documents that are often mixed in with legitimate trade.

money

Highlights

Why GAO Did This Study

Trade-based money laundering is one of the primary means that criminal organizations use to launder the proceeds of illicit activity and integrate them into the formal economy. According to the Department of the Treasury, TBML is one of the most challenging forms of money laundering to investigate because of the complexities of trade transactions and the large volume of international trade. U.S. law enforcement agencies believe there has been an increase in TBML activity attributable, in part, to U.S. financial institutions' improved compliance with Bank Secrecy Act and anti-money laundering regulations, such as cash reporting requirements.

GAO was asked to examine U.S. agencies' efforts to combat TBML and related schemes. This report describes, among other objectives, (1) TBML-related vulnerabilities in the U.S. financial and trade systems, and the types of criminal organizations that seek to exploit those vulnerabilities; and (2) U.S. agencies' use of available data to detect and combat TBML and related schemes.

To address these objectives, GAO reviewed reports and other documentation from the Departments of Commerce, Homeland Security, Justice, and the Treasury, and the federal banking regulators (Federal Deposit Insurance Corporation, Board of Governors of the Federal Reserve System, National Credit Union Administration, and Office of the Comptroller of the Currency). GAO interviewed officials from the Departments of Homeland Security, Justice, and the Treasury (including the Internal Revenue Service), as well as the U.S. Postal Service and the federal banking regulators.

What GAO Found

The U.S. financial and trade systems have vulnerabilities that criminal organizations seek to exploit. Financial institutions have responsibilities based on Bank Secrecy Act and anti-money laundering requirements to, among other things, report suspicious financial transactions to the Department of the Treasury's Financial Crimes Enforcement Network (FinCEN). However, financial institutions have limited visibility into the underlying documentation of the majority of trade transactions for which they process the payments, which makes it more difficult for them to identify suspicious activity. For example, one of the primary vulnerabilities of the U.S. financial and trade systems is open-account trade, in which the trade transaction is not financed by a bank. In open-account trade, the financial transaction between the buyer and seller—which underpins the trade transaction—is usually processed through a bank's automatic payment systems, without human intervention, by the bank sending the payment on behalf of its customer. As such, the bank has limited visibility into the underlying activity generating the payment.

Additionally, the large volume and complexities of international trade transactions, as well as the limited resources and varying priorities of customs agencies to identify and investigate illicit trade, make the U.S. financial and trade systems attractive for illicit activity, including trade-based money laundering (TBML) and related schemes. U.S. law enforcement officials that GAO interviewed said that the types of organizations using TBML schemes are primarily transnational criminal organizations involved in narcotics trafficking, customs fraud, and financial fraud schemes, as well as professional money launderers and terrorist organizations. Narcotics trafficking organizations use a particular kind of TBML—black market peso exchange schemes— to transfer the value of U.S. dollars earned from narcotics sales in the United States into other countries' currencies. In black market peso exchange schemes, the contents, prices, and quantities of goods exported and imported can be correctly reported to customs agencies, with no use of fraudulent trade documents, complicating the identification of anomalies in patterns of behavior based on those categories. U.S. agencies use trade, financial, and law enforcement data in their efforts to detect and investigate TBML and related schemes.

U.S. law enforcement agencies, such as Immigration and Customs Enforcement's Homeland Security Investigations, use import and export data, suspicious financial activity reported by financial institutions, and law enforcement investigative data to identify patterns and anomalies in financial and trade transactions. Law enforcement agencies and FinCEN also use these data to develop leads for and support ongoing investigations of TBML and related schemes. For example, in 2010 FinCEN issued an advisory to financial institutions based on its analysis of suspicious activity reports filed by financial institutions. FinCEN highlighted the increasing use of TBML schemes by criminal organizations—particularly narcotics trafficking organizations in the Western Hemisphere—and potential indicators of TBML that financial institutions should consider as they evaluate potential suspicious activity. Additionally, suspicious financial activity review teams have been established in 94 federal districts around the country, and they bring together investigators and prosecutors from different agencies to regularly review Bank Secrecy Act reports, such as suspicious activity reports, related to their geographic area of responsibility.

For more information, contact Michael Clements at 202-512-8678 or ClementsM@gao.gov or Rebecca Shea at (202) 512-6722 or SheaR@gao.gov.