Compacts of Free Association: Trust Funds for Micronesia and the Marshall Islands Are Unlikely to Fully Replace Expiring U.S. Annual Grant Assistance

Fast Facts

The U.S. is providing $3.6 billion in economic assistance to the nations of Micronesia and the Marshall Islands from 2004 through 2023. This assistance has increasingly been provided as contributions to trust funds for each nation, and is intended to boost their self-sufficiency. After the assistance ends, the trust funds should generate revenue from investments.

We testified that the trust funds may not provide disbursements in some years or sustain their value after 2023.

To date, the U.S. Interior Department has not implemented the 6 recommendations we previously made to address the risks to the funds' ability to provide income after 2023.

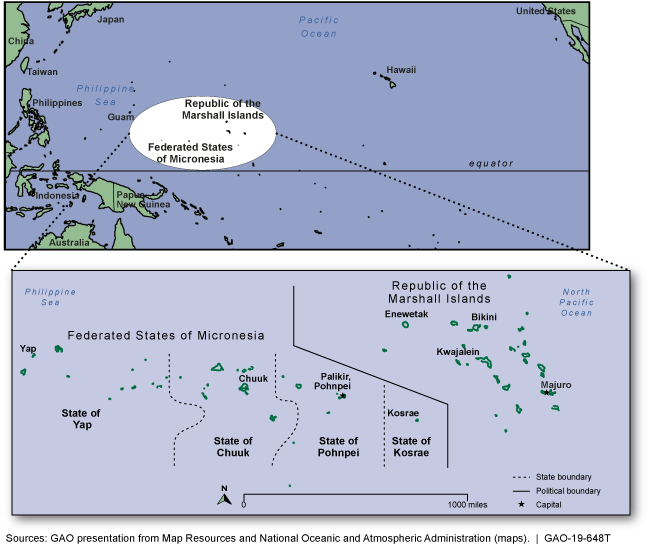

The Federated States of Micronesia and Republic of the Marshall Islands

Map showing location of the Federated States of Micronesia and Republic of the Marshall Islands.

Highlights

What GAO Found

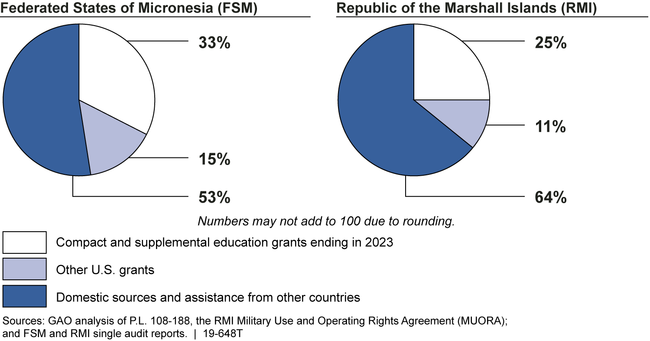

The Federated States of Micronesia (FSM) and the Republic of the Marshall Islands (RMI) rely on U.S. grants and programs, including several that are scheduled to end in 2023. In fiscal year 2016, U.S. compact sector grants and supplemental education grants, both scheduled to end in 2023, supported a third of the FSM's expenditures and a quarter of the RMI's. Agreements providing U.S. aviation, disaster relief, postal, weather, and other programs and services are scheduled to end in 2024, but some U.S. agencies may provide programs and services similar to those in the agreements under other authorities.

FSM and RMI Total Expenditures of Government Revenues, Fiscal Year 2016

GAO's 2018 report noted that the FSM and RMI compact trust funds face risks and may not provide disbursements in some future years. GAO projected a 41 percent likelihood that the FSM compact trust fund would be unable to provide any disbursement in 1 or more years in fiscal years 2024 through 2033, with the likelihood increasing to 92 percent in 2054 through 2063. GAO projected a 15 percent likelihood that the RMI compact trust fund would be unable to provide any disbursement in 1 or more years in fiscal years 2024 through 2033, with the likelihood increasing to 56 percent in 2054 through 2063. Potential strategies such as reduced trust fund disbursements would reduce or eliminate the risk of years with no disbursement. However, some of these strategies would require changing the trust fund agreements, and all of the strategies would require the countries to exchange a near-term reduction in resources for more-predictable and more-sustainable disbursements in the longer term.

Interior has not yet implemented the actions GAO recommended to prepare for the 2023 transition to trust fund income. The trust fund committees have not developed distribution policies, required by the agreements, which could assist the countries in planning for the transition to trust fund income. The committees have not developed the required fiscal procedures for oversight of disbursements or addressed differences between the timing of their annual determinations of the disbursement amounts and the FSM's and RMI's annual budget cycles.

Why GAO Did This Study

In 2003, the United States approved amended compacts of free association with the FSM and RMI, providing a total of $3.6 billion in economic assistance in fiscal years 2004 through 2023 and access to several U.S. programs and services. Compact grant funding, overseen by the Department of the Interior (Interior), generally decreases annually. However, the amount of the annual decrease in grants is added to the annual U.S. contributions to the compact trust funds, managed by joint U.S.-FSM and U.S.-RMI trust fund committees and chaired by Interior. Trust fund earnings are intended to provide a source of income after compact grants end in 2023.

This testimony summarizes GAO's May 2018 report on compact grants and trust funds ( GAO-18-415 ). In that report, GAO examined (1) the use and role of U.S. funds and programs in the FSM and RMI budgets, (2) projected compact trust fund disbursements, and (3) trust fund committee actions needed to address the 2023 transition to trust fund income. For this testimony, GAO also reviewed key variables for its trust fund model as of June 2019 to determine whether these variables had substantially changed. In addition, GAO reviewed the status of Interior's response to GAO's May 2018 recommendations.

Recommendations

In its May 2018 report, GAO made three recommendations to Interior regarding each country's trust fund to address trust fund disbursement risks. Interior concurred with GAO's recommendations and discussed actions in response at subsequent trust fund committee meetings, with implementation targeted for 2023.