Reverse Auctions: Additional Guidance Could Help Increase Benefits and Reduce Fees

Fast Facts

To buy goods or services, the government sometimes uses "reverse auctions" where vendors bid against each other with lower prices to win a contract.

We found reverse auctions often led to a vendor bidding more than once with a lower price, and may have saved the government up to $100 million in 2016. They also were easy to use.

However, most contracting officers we interviewed did not fully understand the fees they paid to use reverse auctions. Agencies we reviewed indirectly paid $3 million in fees when a free alternative was likely available.

We made 21 recommendations, including that agencies inform contracting officials about fees.

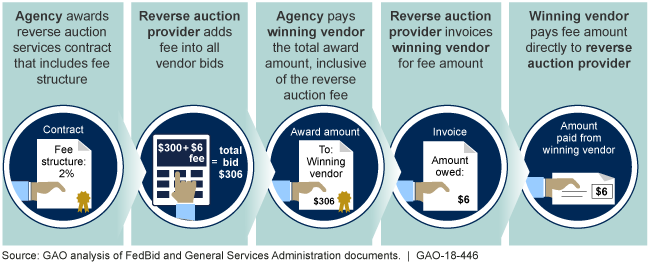

Example of Indirect Fee Payment Process for Reverse Auctions

This graphic shows how fees are added to bids and paid in reverse auctions.

Highlights

What GAO Found

Federal agencies' use of reverse auctions—a process where vendors bid against each other with lower prices to win government contracts—declined between fiscal years 2013 and 2017, from about 34,000 to 19,000 auctions valued at about $1.9 billion and $1.5 billion, respectively. In fiscal year 2016, the year GAO studied in detail, nearly three-quarters of auctions at the agencies GAO reviewed resulted in iterative bidding—when there are multiple bidders and at least one bidder submits more than one bid during the auction (see figure).

Extent of Reverse Auction Competition for Selected Agencies in Fiscal Year 2016

Contracting officers said reverse auctions reduce administrative burden, especially during peak contracting times. Reverse auctions data indicate that selected agencies may have saved more than $100 million in 2016.

The five agencies GAO reviewed indirectly paid about $13 million in fees to reverse auction providers through awardees in 2016. However, 28 of the 30 contracting officials GAO interviewed did not fully understand how fees were set. Further, in 2016, agencies GAO reviewed indirectly paid approximately $3 million in fees for reverse auctions for which a fee-free alternative was likely available. None of the guidance GAO reviewed provided sufficient information for contracting officers to assess the appropriateness of these fees (see table). Without better information, contracting officials may be offsetting potential savings by paying more in fees than necessary for the level of services required.

GAO Assessment of Reverse Auction Guidance at Selected Agencies

|

Agency |

Addresses contracting officials' role in understanding and assessing fees |

Details fee structure for reverse auction platforms used by the agency |

Requires or suggests consideration of fee-free options when appropriate |

|

Army |

● |

◒ |

◒ |

|

Navy |

○ |

◒ |

◒ |

|

Homeland Security |

● |

○ |

○ |

|

Interior |

● |

○ |

○ |

|

State |

○ |

○ |

○ |

Legend: ● = addressed in agency guidance; ◒ = partially addressed in agency guidance or addressed only for one or more agency components; ○ = not addressed in agency or component guidance

Source: GAO analysis of agency guidance. | GAO-18-446

Why GAO Did This Study

Reverse auctions are intended to result in enhanced competition, lower prices, and reduced acquisition costs. GAO has previously found that agencies did not maximize these benefits.

GAO was asked to review federal agencies' use of reverse auctions. This report examines (1) the use of reverse auctions and the extent to which selected agencies achieved benefits, such as competition; and (2) the extent to which selected agencies had insight into reverse auction fees.

GAO collected and analyzed data on federal agencies' use of reverse auctions from fiscal years 2013 to 2017. For five of the largest users of reverse auctions—the Departments of the Army, Homeland Security, Interior, Navy, and State—GAO reviewed documentation for 40 auctions that resulted in contract awards in fiscal year 2016 (the most recent data available when the review began), and that were selected to obtain a mix of dollar values and levels of competition, among other factors. GAO also interviewed contracting officials and analyzed agency guidance.

Recommendations

GAO is making a total of 21 recommendations to the five agencies in GAO's review, including that agencies inform contracting officials about fees to better compare available provider options. Defense, State, and Interior concurred with this recommendation. DHS did not, stating that contracting officials should obtain this knowledge during market research. GAO believes managing this information centrally could eliminate confusion and minimize duplicate efforts.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Army | The Secretary of the Army should: assess why reverse auctions that are conducted using existing contract vehicles have only one bidder at higher rates than reverse auctions conducted on the open market; determine what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles; and provide this information to contracting officials so that they can consider it when developing their acquisition strategies. (Recommendation 1) |

DOD agreed with this recommendation. Army officials stated that they assessed why reverse auctions using existing contract vehicles have only one bidder at higher rates and determined what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles. In February 2019, the Army provided a policy alert to the contracting workforce noting that the smaller pool of vendors under existing vehicles could reduce the effectiveness of reverse auctions, and encouraging contracting officers to use market research to ensure that the benefits of reverse auctions can be achieved.

|

| Department of the Army | The Secretary of the Army should: document and provide information to contracting officials that describes available reverse auction providers and platforms, and any associated fee structures; and provide guidance, as appropriate, to contracting officials to ensure that they compare the options that are available to them when considering whether to use reverse auctions. (Recommendation 2) |

DOD agreed with this recommendation. In February 2019, the Army provided a policy alert to the contracting workforce that described the reverse auction platforms commonly used by the Army and their fee structures.

|

| Department of the Army | The Secretary of the Army should clarify with FedBid how fees apply when contract option years are exercised. (Recommendation 3) |

DOD agreed with this recommendation. Army officials stated that the contracting officer for the FedBid contract clarified the application of fees for contract option years. In February 2019, the Army provided a policy alert to the contracting workforce that included this information.

|

| Department of the Navy | The Secretary of the Navy should: assess why reverse auctions that are conducted using existing contract vehicles have only one bidder at higher rates than reverse auctions conducted on the open market; determine what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles; and provide this information to contracting officials so that they can consider it when developing their acquisition strategies.(Recommendation 4) |

DOD agreed with this recommendation. In August 2019, Navy officials told us that they had reviewed data on reverse auctions to determine a root cause of single bidders, and the factors that indicate that conducting a reverse auction are appropriate. At that time, Navy officials told us they expected to leverage a proposed revision to the Federal Acquisition Regulation (FAR) about the use of reverse auctions. The FAR rule effective as of August 29, 2024 discusses the option of cancelling an auction if only one offer is received. In September 2024, Navy officials advised contracting officials about the FAR rule and highlighted GAO's finding of increased instances of having only one bidder when using existing contract vehicles and recommended that contracting officers consider that information in their evaluation of use of a reverse auction on an existing contract. The FAR rule and Navy guidance should help contracting officials when determining how, when, and under what circumstances to use - or not - a reverse auction.

|

| Department of the Navy | The Secretary of the Navy should review the agency's current guidance to assess whether it adequately addresses contracting officer responsibilities to consider the cost of any fees associated with reverse auction options they may be considering when developing their acquisition strategies, and revise its guidance as appropriate. (Recommendation 5) |

DOD agreed with this recommendation and stated that the department expected to complete actions to address it by the end of calendar year 2018. In November 2018, the Navy revised its existing reverse auctions guidance to specify that contracting officers should consider the cost of any fees when developing its acquisition strategies.

|

| Department of the Navy | The Secretary of the Navy should: document and provide information to contracting officials that describes available reverse auction providers and platforms, and any associated fee structures; and provide guidance, as appropriate, to contracting officials to ensure that they compare the options that are available to them when considering whether to use reverse auctions. (Recommendation 6) |

DOD agreed with this recommendation. In July 2022, Navy officials told us that a proposed revision to the Federal Acquisition Regulation (FAR) would help address this recommendation. The FAR rule, effective as of August 29, 2024, is consistent with this recommendation, and includes a requirement for agencies to make the details of contracts or agreements for reverse auction services, including the provider's fee structure, available to contracting officers for consideration when determining whether to use a reverse auction service provider. As of September 2024, Navy officials distributed the final rule to contracting officials and advised contracting officials to consider any reverse auction provider's or platform's fee structures and compare options when considering whether to use reverse auctions. The FAR rule and Navy guidance should help contracting officials when determining how, when, and under what circumstances to use - or not - a reverse auction. Navy officials also advised contracting officials that they were not aware of an active contract with a reverse auction provider across the Department of the Navy, and asked that if any were in use, that information be provided to the Navy's procurement office, who would then distribute the relevant information to contracting officials.

|

| Department of the Navy | The Secretary of the Navy should clarify with FedBid how FedBid's fee cap will be calculated. (Recommendation 7) |

DOD agreed with this recommendation and stated that the department expected to complete actions to address it by the end of calendar year 2018. In July 2020, Navy officials clarified with FedBid -- now Unison -- how the fee cap is calculated under the Navy's contract with Unison.

|

| Department of Homeland Security | The Secretary of the Homeland Security should: assess why reverse auctions that are conducted using existing contract vehicles have only one bidder at higher rates than reverse auctions conducted on the open market; determine what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles; and provide this information to contracting officials so that they can consider it when developing their acquisition strategies.(Recommendation 8) |

DHS agreed with this recommendation. DHS officials stated that the factors that contribute to having only one bidder are the same whether using existing contract vehicles or on the open market, but that existing contract vehicles have a limited pool of vendors. In November 2018, DHS issued an acquisition alert that informed its contracting workforce that they should conduct market research to confirm that more than one source will likely participate in an auction, particularly when conducting auctions under existing contract vehicles, in order to optimize the benefits of reverse auctions.

|

| Department of Homeland Security | The Secretary of Homeland Security should: document and provide information to contracting officials that describes available reverse auction providers and platforms, and any associated fee structures; and provide guidance, as appropriate, to contracting officials to ensure that they compare the options that are available to them when considering whether to use reverse auctions. (Recommendation 9) |

DHS did not agree with this recommendation. However, in October 2019, DHS issued updated reverse auction ordering guidance that provided information about a new agreement with a third-party reverse auction provider and the associated fee structures. This guidance also included instructions for contracting officials to consider the fees when deciding whether to use reverse auctions and to only use the tool when they anticipate a competitive marketplace.

|

| Department of Homeland Security | The Secretary of Homeland Security should determine if it would be advantageous for the agency to enter into contracts with third-party reverse auction providers. (Recommendation 10) |

DHS agreed with this recommendation. In September 2019, DHS awarded a department-wide blanket purchase agreement with standardized terms and fees with a third-party reverse auction provider. DHS components can award orders for reverse auction services under this agreement.

|

| Department of Homeland Security | The Secretary of Homeland Security should obtain timely information on how much the agency is paying for reverse auction services. (Recommendation 11) |

DHS did not concur with this recommendation. However, in September 2019, DHS awarded a blanket purchase agreement with a third-party reverse auction provider that included requirements that the provider delivery monthly and annual reporting on use of its services, including fees paid.

|

| Department of the Interior | The Secretary of the Interior should: assess why reverse auctions that are conducted using existing contract vehicles have only one bidder at higher rates than reverse auctions conducted on the open market; determine what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles; and provide this information to contracting officials so that they can consider it when developing their acquisition strategies.(Recommendation 12) |

Interior agreed with this recommendation. Interior officials stated that they conducted analysis of reverse auctions that had one bidder using existing contract vehicles, compared to those conducted on the open market. In April 2019, Interior issued guidance to its contracting workforce reminding them that reverse auctions should only be used when market research shows that there is a reasonable expectation to receive more than on offer, and in particular, to monitor competition when using competition for purchases using existing contract vehicles.

|

| Department of the Interior | The Secretary of the Interior should: document and provide information to contracting officials that describes available reverse auction providers and platforms, and any associated fee structures; and provide guidance, as appropriate, to contracting officials to ensure that they compare the options that are available to them when considering whether to use reverse auctions. (Recommendation 13) |

Interior agreed with this recommendation, stating that the department will review and update guidance to provide contracting officials with current and relevant information on available reverse auction providers, platforms, and any associated fee structures. In August 2019, Interior's Senior Procurement Executive issued guidance describing the fee structure for the agency's primary reverse auction provider, including how the fee structure is applied when using certain existing contracting vehicles.

|

| Department of the Interior | The Secretary of the Interior should determine if it would be advantageous for the agency to enter into contracts with third-party reverse auction providers. (Recommendation 14) |

Interior did not concur with this recommendation, stating that it would be more efficient to provide guidance to contracting officials so that they can make the best business decision. Interior officials told GAO that they have considered whether or not to enter into contracts with reverse auction providers and determined that it is not to the department's advantage to do so.

|

| Department of the Interior | The Secretary of the Interior should obtain timely information on how much the agency is paying for reverse auction services. (Recommendation 15) |

Interior agreed with this recommendation. Beginning in November 2018, Interior implemented an annual process to obtain information on the dollar amount of fees paid to reverse auction providers, and collected information for fiscal year 2018.

|

| Department of State | The Secretary of State should review the agency's current guidance to assess whether it leads contracting officials to use reverse auctions in situations where there is not a highly competitive marketplace, and revise its guidance as appropriate. (Recommendation 16) |

State agreed with this recommendation, stating that the Office of Acquisition Management would conduct a review of current guidance and revise it as appropriate. In December 2019, the Office of Acquisition Management issued new guidance for using its enterprise-wide reverse auction tool, and, in March 2020, updated the guidance to specify that reverse auctions should only be used when market research shows that there is a reasonable expectation to receive adequate competition.

|

| Department of State | The Secretary of State should: assess why reverse auctions that are conducted using existing contract vehicles have only one bidder at higher rates than reverse auctions conducted on the open market; determine what factors indicate that conducting reverse auctions is appropriate when using existing contract vehicles; and provide this information to contracting officials so that they can consider it when developing their acquisition strategies. (Recommendation 17) |

State agreed with this recommendation. In December 2019, State's Office of Acquisition Management issued new guidance for using its enterprise-wide reverse auction tool, and, in March 2020, updated the guidance to describe factors to consider when considering whether to use a reverse auction, including whether using an existing contract vehicle would unduly limit competition compared to open market. The revised guidance also specifies that the reverse auction tool cannot be used if market research indicates that the pool of vendors on an existing contract vehicle is too small to realize the effectiveness or benefits of the reverse auction.

|

| Department of State | The Secretary of State should review the agency's current guidance to assess whether it adequately addresses contracting officer responsibilities to consider the cost of any fees associated with reverse auction options they may be considering when developing their acquisition strategies, and revise its guidance as appropriate. (Recommendation 18) |

State agreed with this recommendation. In December 2019, State's Office of Acquisition Management issued new guidance for use of its enterprise-wide reverse auction tool, which included specific information about how the reverse auction provider's fees would be applied.

|

| Department of State | The Secretary of State should: document and provide information to contracting officials that describes available reverse auction providers and platforms, and any associated fee structures; and provide guidance, as appropriate, to contracting officials to ensure that they compare the options that are available to them when considering whether to use reverse auctions. (Recommendation 19) |

State agreed with this recommendation. In August 2018, State's enterprise-wide reverse auction provider provided State contracting officials with additional information about fee structures via email and this information was subsequently integrated into new user training. In December 2019, State's Office of Acquisition Management issued new guidance for using its enterprise-wide reverse auction tool which included specific information about how the reverse auction provider's fees would be applied.

|

| Department of State | The Secretary of State should clarify with FedBid how FedBid's fee cap will be calculated and how fees apply when contract option years are exercised. (Recommendation 20) |

State agreed with this recommendation, stating that the Office of Acquisition Management would engage FedBid to better understand the fee cap and how the fees apply in future option periods. In August 2018, a clarified description of how FedBid's fee cap was calculated and how fees applied when contract option years are exercised was disseminated to all State users of FedBid. This description has been included in subsequent training for State users.

|

| Department of State | The Secretary of State should obtain timely information on how much the agency is paying for reverse auction services. (Recommendation 21) |

State agreed with this recommendation. State officials stated that they now receive monthly reporting on fees paid to its enterprise reverse auction provider, and provided us with examples of the information they have received.

|