Nonbank Mortgage Companies: Greater Ginnie Mae Involvement in Interagency Exercises Could Enhance Crisis Planning

Fast Facts

Many mortgage companies aren't banks, meaning they don't take deposits to fund loans and help them withstand financial stress. Failure of these "nonbank" companies could severely affect mortgage markets.

These companies service most of the loans in mortgage-backed securities guaranteed by Ginnie Mae, a government-owned corporation. Ginnie Mae participated in a 2023 interagency exercise that simulated the failure of a large nonbank mortgage company. But it didn't document lessons learned from the exercise or have processes for doing so.

Our recommendation could help Ginnie Mae better use interagency exercises to prepare for this scenario.

Highlights

What GAO Found

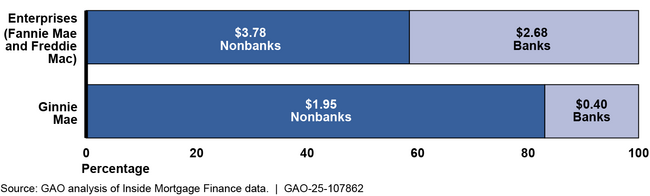

Nonbank mortgage companies—nondepository institutions specializing in mortgage lending—play a major role in the housing finance system. Nonbanks service most mortgages backing securities guaranteed by Ginnie Mae, a government-owned corporation, and by Fannie Mae and Freddie Mac, enterprises under Federal Housing Finance Agency (FHFA) conservatorships.

Share of Mortgages in Federally Backed Securities Serviced by Nonbanks (by Outstanding Dollar Volume in Trillions), as of Second Quarter 2024

Since 2020, FHFA and Ginnie Mae have coordinated on aspects of nonbank monitoring, including

- jointly updating program eligibility requirements (such as capital and liquidity standards) to strengthen nonbank financial capacity and promote consistency;

- enhancing nonbank reporting of financial data the agencies use for monitoring and risk analysis; and

- participating in the Financial Stability Oversight Council's (FSOC) task force on nonbank mortgage servicing. Both agencies contributed to a May 2024 FSOC report on the risks of nonbanks. They also have been supporting initiatives to develop risk-monitoring metrics and a plan for interagency coordination in a crisis.

However, Ginnie Mae played a limited role in the task force's October 2023 crisis planning exercise, which simulated the failure of a large nonbank working with Ginnie Mae and the enterprises. Ginnie Mae did not produce responses to discussion questions during the exercise, citing legal restrictions and risks of sharing nonpublic information about its counterparties. But not all the exercise questions required sharing such information. For example, participants were asked to consider the possible consequences of their actions on external parties, information they would need from other agencies, and how they would communicate with other agencies. Ginnie Mae also did not identify or document lessons learned from the interagency exercise and lacks processes for doing so. By developing processes to guide participation in these exercises and incorporating lessons learned into its strategy for managing nonbank failures, Ginnie Mae could enhance its interagency coordination during a nonbank crisis and bolster overall federal preparedness.

Why GAO Did This Study

Nonbanks service the majority of federally backed home mortgages. Nonbank failures could significantly disrupt mortgage markets and increase federal fiscal exposure.

Federal monitoring and oversight of nonbanks is spread among several agencies. These include Ginnie Mae and FHFA, which play key roles in supporting stable markets for mortgage-backed securities. Interagency coordination can help address the challenges of managing systemwide risks in a fragmented federal structure.

Since 2013, GAO has designated the federal role in housing finance as a high-risk area. This report examines the extent to which FHFA and Ginnie Mae coordinate to monitor nonbanks.

GAO reviewed FHFA and Ginnie Mae policies and procedures, as well as documentation on an FSOC exercise simulating a major nonbank failure. GAO also interviewed FHFA, Ginnie Mae, and FSOC officials.

Recommendations

GAO recommends that Ginnie Mae develop processes for participating in interagency exercises—taking into consideration the potential risks and benefits of sharing nonpublic information in a crisis—and for incorporating lessons learned from the exercises into its strategy for managing nonbank failures. Ginnie Mae neither agreed nor disagreed with GAO's recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Government National Mortgage Association (Ginnie Mae) | The President of Ginnie Mae should develop processes for participating in interagency exercises—taking into consideration the potential risks and benefits of sharing nonpublic information in a crisis—and for incorporating lessons learned from the exercises into Ginnie Mae's issuer default strategy. (Recommendation 1) |

In December 2025, Ginnie Mae said it had taken steps to strengthen its response to issuer defaults, including formalizing a crisis response plan and incorporating some aspects of interagency coordination into its internal 2025 default simulation exercise. However, Ginnie Mae had not developed processes specifically for participating in interagency exercises, which is the focus of our recommendation.

|