Securities Regulation: SEC's Oversight of the Financial Industry Regulatory Authority

Fast Facts

FINRA is a securities industry organization that regulates over 3,400 U.S. securities firms. The Securities and Exchange Commission also regulates the industry. Reviewing FINRA's work is critical to SEC's mission of protecting investors and maintaining fair, efficient markets.

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires us to review the SEC's oversight of FINRA in 10 specified areas, including conflicts of interest management and transparency of governance. We found SEC inspections covered all 10. Eight were examined in FYs 2021-2023 and the remainder before and after that period.

Highlights

What GAO Found

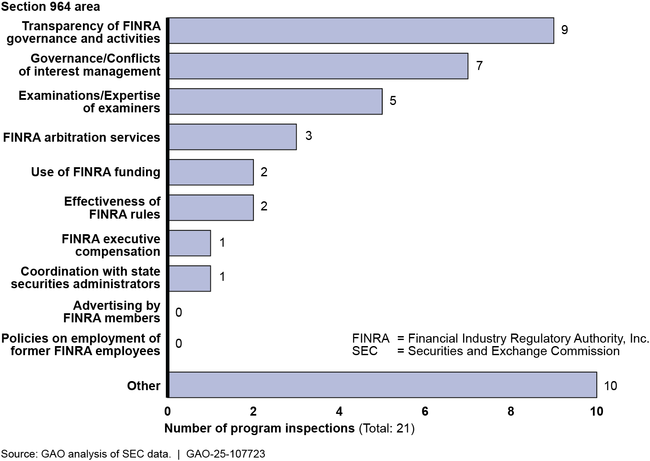

In fiscal years 2021–2023, the Securities and Exchange Commission (SEC) initiated 21 program inspections of the Financial Industry Regulatory Authority, Inc. (FINRA). These inspections covered eight of the 10 issue areas specified in Section 964 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, including conflicts of interest management and transparency of governance. SEC covered the remaining two areas (former FINRA employees and advertising by FINRA members) in an inspection before 2021, and in a separate review in 2023, respectively. To identify changing risks and priorities for its inspections and examinations, SEC conducts annual planning that incorporates stakeholder input and assesses potential risks. SEC also identifies emerging risks through ongoing monitoring of FINRA, which includes its tips, complaints, and referrals process.

Section 964 Areas Covered in SEC Program Inspections of FINRA Initiated in Fiscal Years 2021–2023

In 2022, SEC established new outcome-based performance measures and goals in response to a prior GAO recommendation. SEC reported meeting its performance goals. For example, SEC met its target for findings for which FINRA agreed to take corrective action.

This is a public version of a sensitive report GAO issued in July 2024. GAO omitted from this report information that SEC deemed sensitive.

Why GAO Did This Study

FINRA, a self-regulatory organization, regulates more than 3,300 securities firms doing business with the public in the U.S. SEC oversees FINRA's operations and programs.

Section 964 of the Dodd-Frank Wall Street Reform and Consumer Protection Act includes a provision for GAO to triennially report on specified aspects of SEC's oversight of FINRA. GAO issued prior reports in May 2012 (GAO-12-625), April 2015 (GAO-15-376), July 2018 (GAO-18-522), and a sensitive report in July 2021 (GAO-21-576SU) that was followed by a public version in December 2021 (GAO-22-105367).

This report examines the (1) extent to which SEC's oversight in fiscal years 2021–2023 included the areas specified in Section 964 and ways in which it incorporated changing risks, and (2) SEC's steps to assess recent changes to its FINRA oversight.

GAO examined case files for SEC reviews of FINRA for fiscal years 2021–2023; reviewed SEC policies, procedures, and analyses; and interviewed SEC and FINRA staff.

For more information, contact Michael E. Clements at (202) 512-8678 or ClementsM@gao.gov.