Military Financial Education: DOD Should Improve Oversight to Ensure Trainings Effectively Support Service Members

Fast Facts

While serving their country, military service members make decisions that affect their financial security. Some choices—like whether to pay down debt—can affect them now. Others—like saving for retirement—can affect them in the future. The Department of Defense and the military services provide training and resources to help service members understand these and other financial topics.

DOD and the military services don't know how many service members complete some of the required training due to issues with tracking systems.

We recommend that DOD work with the military services to improve tracking and completion of this training.

Highlights

What GAO Found

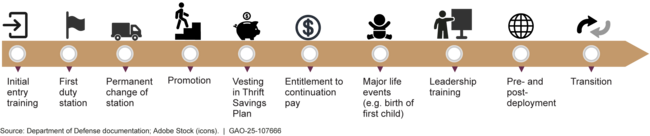

The Department of Defense (DOD) and the military services provide trainings and resources to support service members’ financial education. These required trainings cover specific learning objectives at key milestones—or training points—in a service member’s career (see figure). For example, the trainings cover information about the military’s Blended Retirement System (BRS), which was implemented for all new military personnel in 2018.

Figure: Military Financial Readiness Training Points

DOD and the military services also provide other resources to support the financial education of service members. For example, the military services provide financial counseling upon request to help service members and their spouses develop skills and strategies to meet financial goals. Service members and their families can also access financial information through DOD and service-specific websites and mobile apps.

DOD officials do not know the extent to which service members complete some of the required financial readiness common military training points because the military services face challenges accurately tracking training completion. According to DOD and military service officials, these challenges stem from the number of training points, the irregular frequency of some of the training points, and limitations with administrative systems. For example, some training points only occur at certain life or career events, and their timing is dependent on a service member’s individual circumstances. The irregular frequency of some of these training points can make them difficult to track, according to DOD officials.

DOD and the military services have taken steps to better track service members’ completion of financial readiness training, including standardizing data collection across the military services. However, these efforts have not fully addressed the underlying challenges in accurately tracking training completion.

In addition, some services members do not complete financial readiness common military training, according to officials from the military services. Some of the military services have taken steps to increase training compliance, such as by educating superiors on the importance of training. But DOD has not taken steps to identify and address the causes of non-completion across the military services. DOD officials told us that tracking issues hamper their ability to identify the extent of training non-completion and said tracking issues need to be addressed to know whether service members are taking the trainings. However, both inaccurate tracking and non-completion are known issues that can be concurrently addressed.

By taking steps to improve tracking of training completion and address non-completion, DOD could help ensure that service members have access to the information they need to help them be financially secure.

Additionally, DOD currently has a multi-year research study underway to identify standardized performance measures to evaluate its overall financial education efforts. DOD officials said that research-informed indicators can help DOD provide justification to collect data from service members to be aggregated, tracked, and analyzed over time to help measure training effectiveness. However, DOD has not established timelines for selecting or implementing measures based on this work. Doing so could help DOD ensure the quality of its financial education efforts.

Why GAO Did This Study

As of January 1, 2018, all new military personnel are automatically enrolled in BRS, which was created by the National Defense Authorization Act for Fiscal Year 2016. Under BRS, service members receive employer contributions to a personal Thrift Savings Plan account. They may also receive an annuity after retiring from military service. DOD also implemented a new financial readiness training program. House Report 118-529 contains a provision for GAO to review how DOD and the military services have implemented financial readiness training, as it relates to BRS.

GAO reviewed documents and websites from DOD and the military services related to financial readiness education and BRS. GAO also interviewed DOD officials and officials from the Air Force, Army, Marine Corps, and Navy. GAO compared the information it gathered to DOD policies, best practices for financial literacy and education developed by the U.S. Financial Literacy and Education Commission, guidelines for assessing strategic training efforts, and standards for internal control.

Recommendations

GAO is recommending that DOD (1) take additional steps to increase the accuracy of tracking service member completion of the financial readiness training, (2) take steps to identify and address causes of training non-completion, and (3) establish timelines for determining which standardized performance measures, if any, are needed for its financial education efforts and for implementing any selected measures. DOD concurred with these recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Defense | The Secretary of Defense should take additional steps to ensure the military services modify administrative systems to increase the accuracy of tracking service member completion of the financial readiness common military training. (Recommendation 1) |

DOD agreed with this recommendation. As of June 2025, DOD reported that it has asked the military services to include additional information about their tracking systems and training completion data in their annual financial readiness training plans. DOD will use this information to determine the status of tracking systems and develop an action plan. DOD anticipates full implementation of changes will be a multi-year effort. We will monitor DOD's efforts and will consider closing this recommendation once DOD has demonstrated that the military services have modified their administrative systems and increased the accuracy of tracking training completion.

|

| Department of Defense | The Secretary of Defense should ensure the military services identify and address causes of financial readiness common military training non-completion. (Recommendation 2) |

DOD agreed with this recommendation. In June 2025, DOD reported that it has requested that the military services provide additional information about causes of training non-completion in their annual financial readiness training plans. DOD will use this information to create an action plan. We will consider closing this recommendation once DOD has demonstrated that the military services have identified and addressed causes of training non-completion.

|

| Department of Defense | The Secretary of Defense should establish a timeline for determining which standardized performance measures, if any, are needed to measure the effectiveness of DOD's financial education efforts. If any performance measures are selected, DOD should also establish a timeline to implement those measures. (Recommendation 3) |

DOD agreed with this recommendation. In June 2025, DOD reported that it plans to establish performance measures and the timeline for doing so will be developed based on feedback from the military services due in August 2025. We will consider closing this recommendation once DOD has demonstrated that it has established a timeline for implementing any new performance measures.

|