Improper Payments: Agency Reporting of Payment Integrity Information

Fast Facts

Since FY 2003, federal agencies have made $2.8 trillion in improper payments—i.e., payments that shouldn't have been made or were made in incorrect amounts. The Payment Integrity Information Act of 2019 requires agencies to manage and report their improper payments.

This Q&A looks at how Inspectors General and the Office of Management and Budget meet their responsibilities under the act.

When an IG finds an agency noncompliant, the agency must report its compliance plans to Congress.

OMB directed agencies to publish these plans on PaymentAccuracy.gov but some congressional staff don't know about the website. We recommended that OMB address this.

Highlights

What GAO Found

Improper payments are those that should not have been made or that were made in an incorrect amount. The Payment Integrity Information Act of 2019 (PIIA) includes requirements that agencies must follow to estimate and report on improper payments. These include publishing improper payments estimates, corrective action plans, and reduction targets for certain programs and activities with their annual financial statements. PIIA also requires each agency’s inspector general (IG) to issue an annual report on the agency’s compliance with applicable criteria.

The Office of Management and Budget (OMB) plays a key role in developing guidance for agencies to estimate and report on improper payments. OMB guidance includes information for agency IGs on how to determine agency compliance with PIIA criteria. It also includes information on the corrective actions PIIA requires of agencies if they are found noncompliant. When IGs find agencies to be noncompliant with PIIA criteria in a fiscal year, the law requires agencies to report on their plans to come into compliance to the appropriate authorizing and appropriations committees of Congress. OMB has directed agencies to report their plans for coming into compliance on PaymentAccuracy.gov to meet this requirement.

When an agency has been noncompliant for 2 or more consecutive fiscal years for the same program, the agency must propose to OMB additional program integrity proposals that would help the agency come into compliance. OMB guidance directs such agencies to include the program integrity proposals in their next annual budget submissions.

In IG reports issued in 2023, 10 of the Chief Financial Officers (CFO) Act agencies were found noncompliant with PIIA for fiscal year 2022 and reported their plans to come into compliance on PaymentAccuracy.gov. In addition, according to data reported on PaymentAccuracy.gov, nine CFO Act agencies were noncompliant with PIIA criteria for one or more of the same programs or activities for 2 consecutive years (fiscal years 2021 and 2022). OMB staff stated they would provide guidance on the process for submitting required program integrity proposals during development of the fiscal year 2026 President’s Budget.

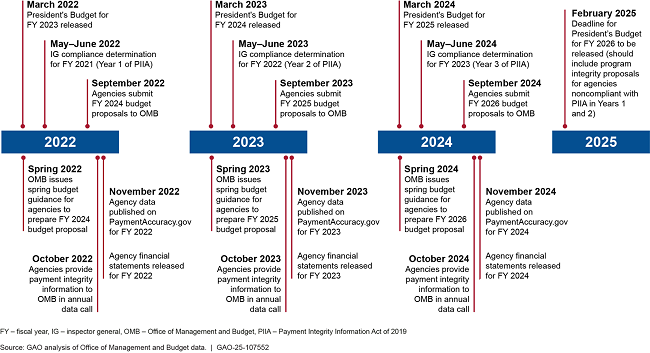

Timeline of Key Milestones in the Improper Payments Reporting Process

OMB staff said they communicated with congressional staff when PIIA was being drafted, including discussions about using PaymentAccuracy.gov to report improper payment information from agencies to ensure that the website included information that would meet congressional needs. They stated that they have not received congressional feedback on the usefulness of PaymentAccuracy.gov for reporting payment integrity information since they made updates to the information and its display on the website from 2020 through 2023. OMB did not offer any current plans to actively seek additional feedback from Congress regarding the updates.

Selected congressional committee staff GAO met with provided their perspectives about PaymentAcccuracy.gov and its role in providing information on improper payments for their oversight work. Some said they were unfamiliar with PaymentAccuracy.gov and relied on other sources of payment integrity information, while others said they used it in their oversight work and expressed appreciation for the website and its utility. Some noted technical challenges to accessing or analyzing information. Taking steps to clarify where key payment integrity information, such as noncompliant agencies’ plans for coming into compliance, is reported could increase transparency of payment integrity information and facilitate congressional oversight.

Why GAO Did This Study

Improper payments are a long-standing and significant problem in the federal government. Since fiscal year 2003, executive branch agencies have reported cumulative improper payment estimates of about $2.8 trillion, including $161.5 billion for fiscal year 2024. PIIA requires agencies to manage improper payments by identifying risks, taking corrective actions, and estimating and reporting on improper payments in programs they administer. Agencies’ understanding of the requirements and related key concepts of and proper oversight of compliance with PIIA criteria is important to more effective detection and prevention of improper payments.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, includes a provision for GAO to provide quarterly reports on improper payments. This is GAO’s eighth such report. It examines OMB’s and IGs’ roles in implementing PIIA and how agencies report payment integrity information, including instances of noncompliance and related plans to come into compliance that PIIA requires and OMB guidance reflects.

GAO reviewed federal statutes, standards, and guidance and GAO reports related to improper payments. GAO also reviewed agency financial reports and IG PIIA compliance reviews for the 24 CFO Act agencies for fiscal years 2021, 2022, and 2023 and reviewed PaymentAccuracy.gov to confirm the process for accessing reported payment integrity information. Additionally, GAO interviewed OMB staff and selected congressional staff.

Recommendations

GAO is recommending that OMB clarify that noncompliant agencies should state explicitly in annual financial statements that agency plans to come into compliance are available on PaymentAccuracy.gov, or otherwise directly communicate such plans to the appropriate congressional committees. OMB agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Management and Budget | We recommend that the Director of the Office of Management and Budget clarify that agencies found noncompliant with PIIA criteria should state explicitly in their annual financial statements that agency plans to come into compliance are available on PaymentAccuracy.gov, or otherwise directly communicate such plans to the appropriate congressional committees. (Recommendation 1) |

The Office of Management and Budget (OMB) agreed with our recommendation. In response to our recommendation, we verified that OMB included instructions in its revised OMB Circular No. A-136, Financial Reporting Requirements, dated July 14, 2025, directing agencies to disclose compliance plans related to the Payment Integrity Information Act of 2019 (PIIA). Specifically, this revised circular states that agencies found to be noncompliant with the PIIA criteria should state in their Agency Financial Reports or Performance and Accountability Reports that agency plans to come into compliance are available on PaymentAccuracy.gov. Based on our review of the documentation, we determined that, in revising its circular, OMB has addressed our recommendation.

|