Illicit Finance: Treasury Should Monitor Partnerships and Trusts for Future Risks

Fast Facts

Partnerships and trusts can be created without naming the people who own and control them. This lack of transparency can be attractive to criminals laundering money or hiding illegal activities.

The Corporate Transparency Act requires certain businesses to report ownership information to Treasury's Financial Crimes Enforcement Network (FinCEN). But some partnerships and trusts are not subject to this reporting requirement. As a result, illegal activities could go undetected.

We recommended FinCEN monitor data to analyze the risk of using partnerships and trusts to hide illegal activities.

Highlights

What GAO Found

States have jurisdiction over formation and reporting requirements for partnerships and trusts operating within their borders. Partnerships and trusts can be used for a range of business purposes, although trusts are more typically used for wealth management. States collect limited information from these entities. They require registration and ownership information only from certain types of partnerships and trusts, and the required information varies by state and entity type. For example, most states do not require general partnerships to register with the state, but generally require other types—such as limited partnerships—to register and provide some partner information.

Law enforcement officials told GAO that some investigations were halted by the inability to determine the beneficial owners of businesses using existing methods. A beneficial owner is an individual who owns 25 percent of an entity or exercises substantial control over its activities. In January 2025, federal law will require certain companies created by filing a document with the secretary of state to submit beneficial ownership information to the Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) registry. The registry is likely to benefit law enforcement investigations, according to Treasury and law enforcement officials. But law enforcement officials said they still may face barriers obtaining information on certain trusts and partnerships not covered under the reporting requirement.

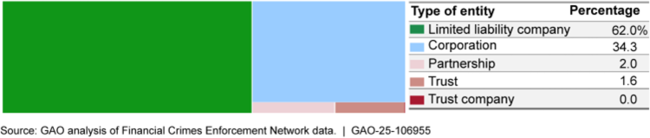

Partnerships and trusts represented a small percentage of entities named in suspicious activity reports (SAR) during 2019–2023, according to GAO's analysis of available data. SARs are reports that financial institutions must file with FinCEN if they identify potential criminal activity.

Types of Entities Named in Suspicious Activity Reports, 2019–2023

The Anti-Money Laundering Act of 2020 requires FinCEN to periodically report on threat patterns and trends from SARs. Treasury used SAR data in a 2022 report on financial activity of Russian oligarchs. However, it does not periodically analyze SARs for trends in illicit activity related to partnerships and trusts. Treasury stated in 2024 risk assessments that trusts can be misused for tax evasion and fraud, and little is known about them. Although few of these entities have been named in SARs, agency officials and experts told GAO that criminals could exploit registry gaps by creating entities not required to report ownership information. Illicit finance experts have noted this may have happened in the United Kingdom when it began requiring certain ownership information in 2016. By leveraging SAR data, Treasury would be better positioned to promptly identify any increase in illicit activity and target its efforts.

Why GAO Did This Study

Illicit actors can use companies and other legal entities to launder criminal proceeds. Entities such as partnerships and trusts offer a degree of anonymity because they can be created without naming the people who benefit from their activities.

The Corporate Transparency Act includes a provision for GAO to review beneficial ownership information requirements for partnerships and trusts. This report describes state requirements for registering partnerships and trusts and collecting beneficial ownership information. It also addresses views of federal law enforcement officials on the benefits of beneficial ownership information for law enforcement, and the illicit use of partnerships and trusts in the financial system and the risks they present.

GAO reviewed registration statutes and documents for the 50 states and the District of Columbia, reports from federal agencies and international organizations, and data from Treasury (FinCEN), the Federal Bureau of Investigation, Department of Homeland Security, and Internal Revenue Service. GAO also conducted a survey of state officials (45 responses), and interviewed federal agency officials, representatives of associations for secretaries of state, trust and business lawyers, and illicit finance experts.

Recommendations

GAO recommends that Treasury use SAR data to periodically analyze the risk of illicit activity related to partnerships and trusts. Treasury agreed with the recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should ensure that the Director of FinCEN periodically analyzes SAR data for the risk of illicit activity related to trusts and partnerships and incorporates this analysis in future money laundering and terrorist financing risk assessments. (Recommendation 1) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|