Direct File: IRS Successfully Piloted Online Tax Filing but Opportunities Exist to Expand Access

Fast Facts

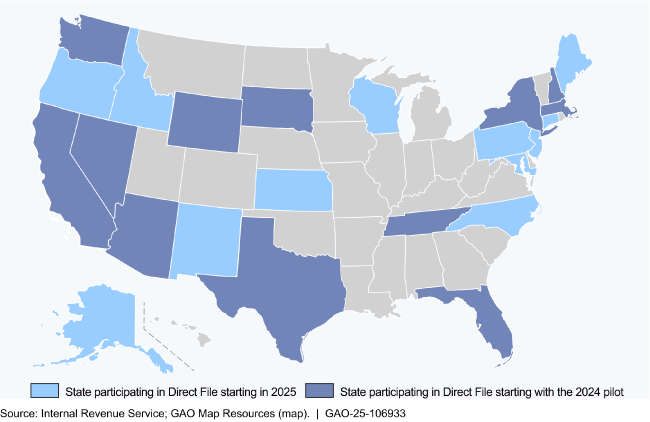

IRS is offering a new, free service to help taxpayers prepare and file tax returns electronically. It piloted Direct File in 2024 for taxpayers with simple tax returns in 12 states and will make it a permanent option starting in 2025. Taxpayers said it was easier to prepare and file returns.

IRS plans to offer Direct File in 12 more states in 2025 but is behind schedule with recruiting and training customer service agents to help taxpayers use it. There will also be equity concerns with Direct File because people won't have access to it if they live outside of the 24 states where it's available.

We recommended addressing these issues, and more.

Highlights

What GAO Found

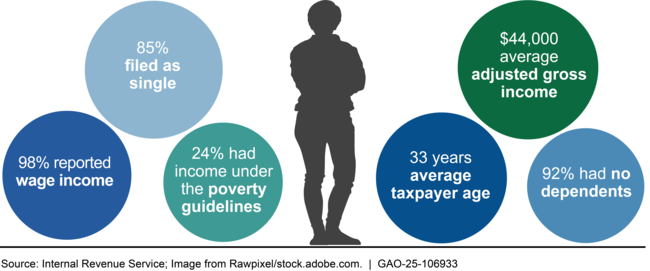

The Internal Revenue Service (IRS) successfully piloted Direct File from February to April 2024 for taxpayers with simple tax situations residing in one of 12 states. Direct File used interview-style questions to guide taxpayers through preparing a return on an IRS website at no cost to the taxpayer. IRS accepted 140,803 Direct File returns which helped many taxpayers with lower incomes fulfill their filing obligations. Taxpayers reported that Direct File was an easier tax preparation method than they had previously used, a factor that contributed to IRS's decision to make Direct File permanent.

Demographics of Direct File Taxpayers during the 2024 Filing Season

GAO found that IRS followed leading practices in piloting Direct File. These included identifying learning objectives and collecting relevant data such as customer service requests. IRS also identified lessons learned, such as how to develop website content more efficiently. IRS continues to determine staffing needs for a newly established Direct File Office.

IRS is planning to expand the scope of taxpayers who can use Direct File in 2025 by adding support for the premium tax credit for health insurance and other tax provisions and by allowing residents of an additional 12 states to use the federal Direct File system. However, GAO found that IRS is behind schedule in recruiting and training customer service representatives for the 2025 filing season due in part to insufficient coordination among IRS offices. Additionally, IRS limits participation in Direct File to taxpayers who live in certain states, which facilitates coordination between federal and state tax filing. However, GAO found that IRS could face challenges in reaching agreements with all states, which raises equity concerns for taxpayers unable to access Direct File due to where they live.

GAO found that selected foreign and territorial revenue agencies prepopulate tax returns with information already on file, such as wages reported by employers. IRS began offering limited prepopulation in April 2024 during the pilot. IRS officials told GAO that they are considering additional prepopulation of taxpayer data but are still in the early stages of planning. Identifying additional data for prepopulation in Direct File and developing a plan for testing its accuracy could enable IRS to reduce taxpayer burden.

Why GAO Did This Study

IRS is offering a new online service called Direct File to assist individual taxpayers in preparing and filing a tax return. IRS intends for Direct File to make it easier to claim tax benefits and improve digital services consistent with legal authorities to provide taxpayer services. The Inflation Reduction Act of 2022 (IRA) directed IRS to study and report on a potential government-run online filing system. IRA also included a provision for GAO to oversee the use of IRA funds. GAO's objectives were to (1) describe IRS's Direct File pilot; (2) evaluate how IRS applied leading practices for pilot design to inform next steps; (3) evaluate IRS's efforts to expand the scope of Direct File; and (4) compare the online filing services provided by selected foreign and territorial taxing jurisdictions to IRS's. GAO reviewed IRS documents, interviewed IRS officials, and compiled case studies of online filing systems in six countries and Puerto Rico.

Recommendations

GAO is making four recommendations to IRS, including improving coordination among relevant offices to ensure the recruitment of customer support employees, opening Direct File to all eligible taxpayers in the future, and identifying additional data that could be prepopulated in Direct File and testing its accuracy. IRS agreed with three of our recommendations. IRS neither agreed nor disagreed with our recommendation to continue coordinating with state revenue agencies to expand access to Direct File and, as necessary, take steps to ensure the availability of the federal Direct File program to eligible taxpayers in all states.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure relevant officials collaborate on recruiting and training customer service representatives for Direct File and document an annual process for recruiting and training employees. (Recommendation 1) |

IRS agreed with the recommendation. In July 2025, Public Law 119-21 section 70607 provided $15 million for the Department of the Treasury to report to Congress on the cost of establishing and enhancing public-private partnerships to provide free tax filing to replace direct e-file programs run by the IRS. Following this new law, IRS stated in August 2025 that agency efforts to address this recommendation and others related to the Direct File program were contingent upon the program's continuation. In August 2025, we requested information from IRS regarding how officials may have addressed this recommendation during the 2025 tax filing season. As of September 16, 2025, we have not received the requested information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should continue to coordinate with state revenue agencies to expand taxpayer access to Direct File and, as necessary, take steps to ensure the availability of the federal Direct File program to eligible taxpayers in all states. (Recommendation 2) |

IRS agreed with the recommendation. In July 2025, Public Law 119-21 section 70607 provided $15 million for the Department of the Treasury to report to Congress on the cost of establishing and enhancing public-private partnerships to provide free tax filing to replace direct e-file programs run by the IRS. Following this new law, IRS stated in August 2025 that agency efforts to address this recommendation and others related to the Direct File program were contingent upon the program's continuation. In August 2025, we requested information from IRS regarding how officials may have addressed this recommendation during the 2025 tax filing season. As of September 16, 2025, we have not received the requested information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure IRS's planned research on potential Direct File users includes research questions that will allow the agency to collect data that can be used to prioritize the development of new capabilities for Direct File. (Recommendation 3) |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should identify additional data that could be prepopulated in Direct File returns and develop a plan for testing the accuracy of prepopulating the data and its effect on the taxpayer experience. (Recommendation 4) |

IRS agreed with the recommendation. A May 2025 IRS report stated that the agency expanded the data which Direct File taxpayers could choose to import into their returns during the 2025 tax filing season: The wage and tax statement (the Form W-2), interest income, biographical information such as date of birth, whether IRS records showed the primary taxpayer received a health insurance marketplace statement, and the identity protection PIN for taxpayers enrolled in IRS's identity protection program. IRS's report stated that more than 90 percent of taxpayers who were offered the option to import wage, tax, and interest information chose to do so and that taxpayers could make corrections if necessary. IRS's report also addresses other aspects of our recommendation by describing limitations with importing data such as taxpayers not being able to import all data from the Form W-2 due to legacy systems at the IRS and the Social Security Administration, e.g., state and local tax information not being imported into Direct File. IRS also identified opportunities to authenticate taxpayers filing jointly which would allow the spouse to consent to importing the information necessary to complete a joint return. While IRS's report identified opportunities for future improvements related to importing data, circumstances have evolved since we made our recommendation. In July 2025, Public Law 119-21 section 70607 provided $15 million for the Department of the Treasury to report to Congress on the cost of establishing and enhancing public-private partnerships to provide free tax filing to replace direct e-file programs run by the IRS. Following this new law, IRS stated in August 2025 that agency efforts to address this recommendation and others related to the Direct File program were contingent upon the program's continuation.

|