Single Audits: Interior and Treasury Need to Improve Their Oversight of COVID-19 Relief Funds Provided to Tribal Entities

Fast Facts

The Departments of the Interior and the Treasury awarded $32.7 billion to tribal entities for COVID-19 relief.

Nonfederal entities that spend at least $750,000 in federal funds in a year are required to get a "single audit"—an independent review of their financial statements and federal awards. Some tribal entities met this condition for the first time.

Interior and Treasury should ensure tribal entities get the audit and correct any problems the audit finds in a timely manner. Treasury doesn't have a way to follow up when single audit reports aren't submitted. Neither agency monitors corrective actions.

Our recommendations address these issues.

Highlights

What GAO Found

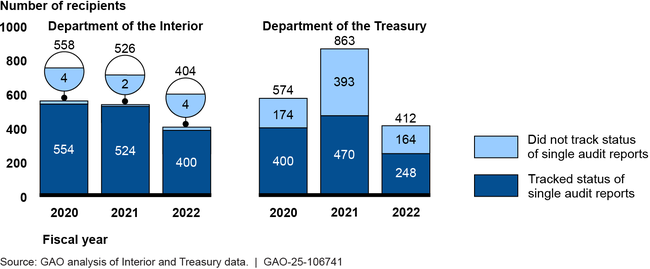

For the audit period of this report, the Single Audit Act requires nonfederal entities that spend $750,000 or more in federal awards in a year to undergo a single audit, which is an audit of an entity's financial statements and federal awards, or in select cases a program-specific audit. The Office of Management and Budget's (OMB) single audit guidance requires that federal awarding agencies ensure that award recipients submit single audit reports timely. As federal awarding agencies, the Department of the Interior and the Department of the Treasury track the submission of required single audit reports from tribal recipients (see figure). Interior appropriately designed procedures to identify and track tribal recipients that did not submit required single audit reports or were not required to do so, but Treasury has not. Treasury stated that it did not have existing single audit processes when its COVID-19 relief programs were established. By finalizing and implementing such procedures, Treasury could better ensure that its recipients are meeting its program requirements.

Single Audit Report Submissions Tracked by Interior and Treasury for Tribal Recipients Awarded COVID-19 Relief Funds, Fiscal Years 2020 through 2022, as of October 31, 2023

OMB's single audit guidance also requires awarding agencies to follow up on single audit findings to ensure that award recipients take timely and appropriate action to correct deficiencies identified by the audits. GAO found that both Interior and Treasury have policies and procedures to review findings and issue management decisions on the adequacy of tribal entities' plans to correct findings, but Treasury did not issue timely management decisions. In addition, neither agency has procedures for appropriately monitoring the implementation of tribal entities' corrective action plans. Until Interior and Treasury develop such procedures, these agencies may be missing opportunities to improve their oversight of federal awards and to help tribal entities address findings.

Interior and Treasury assisted tribal entities that received COVID-19 relief funds in complying with funding and single audit requirements. In general, tribal-serving organizations and a tribal official that GAO spoke with stated that Interior and Treasury have improved their assistance since the beginning of the COVID-19 pandemic. However, the tribal-serving organizations also noted that agency assistance did not fully consider the unique needs of tribal recipients and offered suggestions for enhancing such assistance.

Why GAO Did This Study

Treasury and Interior awarded $32.7 billion in COVID-19 relief funds to tribal entities, including two of the largest COVID-19 relief programs for tribal governments. Under the Single Audit Act, federal agencies are required to provide oversight for the funds that they award.

The CARES Act includes a provision for GAO to report on its ongoing monitoring efforts related to the COVID-19 pandemic. This report examines Interior's and Treasury's policies and procedures for (1) tracking the timely submission of required single audit reports from tribal entities to which the agencies awarded COVID-19 relief funds and (2) reviewing and following up on the findings of these audits. It also describes the assistance these agencies provided to tribal entities to help them navigate the single audit process.

GAO interviewed agency officials, three tribal-serving organizations, and a Tribe; analyzed agency data on tribal recipients of COVID-19 relief funds and tribal single audit submissions; and reviewed relevant federal statutes, regulations, and agency policies and procedures related to tracking and reviewing single audit reports.

Recommendations

GAO urges prompt implementation of an open recommendation that Treasury issue timely management decisions. GAO is making three new recommendations—two to Treasury and one to Interior—to further enhance the single audit oversight provided to tribal entities. Interior and Treasury agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of the Treasury | The Secretary of the Treasury should develop and implement procedures to identify tribal recipients that did not submit required single audit reports when due and follow up with those recipients. (Recommendation 1) |

In its comments on our draft report, Treasury agreed with this recommendation and cited actions it will take to address it. We will follow-up with Treasury on actions to address this recommendation.

|

| Department of the Interior | The Secretary of the Interior should develop and implement procedures for tracking the implementation of corrective action plans, including tracking repeat single audit findings, to ensure that tribal recipients take appropriate and timely action to correct single audit findings. (Recommendation 2) |

Interior agreed with this recommendation and, in May 2025, stated that it will develop a process for tracking and analyzing repeat single audit findings. Interior also plans to update its single audit oversight policy and procedures to (1) actively monitor repeat audit findings and the implementation of corrective action plans (CAP); (2) verify that corrective actions have been taken to resolve findings, including repeat findings; and (3) close out the single audit findings after CAPs are fully implemented. We will continue to follow-up with Interior regarding updates to its single audit oversight processes, policies, and procedures.

|

| Department of the Treasury | The Secretary of the Treasury should develop and implement procedures to use metrics to improve the effectiveness of Treasury's process for following up on audit findings, including developing baselines and targets, tracking the implementation of corrective action plans, and sharing the metrics with OCA's Chief Operating Officer. (Recommendation 3) |

In its comments on our draft report, Treasury agreed with this recommendation and cited actions it will take to address it. We will follow-up with Treasury on actions to address this recommendation.

|