Pandemic Unemployment Assistance: States' Controls to Address Fraud

Fast Facts

Earlier, we estimated that more than $100 billion was lost to fraud in unemployment insurance programs during the pandemic.

We also found higher rates of fraud in the Pandemic Unemployment Assistance program. This Q&A report examines state efforts to fight fraud in this program. States were challenged to rapidly start the program and establish anti-fraud measures.

Our survey found that states used multiple tools, such as cross-checking IDs with a variety of sources. States also said that they continued improving their tools as the pandemic progressed—such as by adding a check for duplicate banking or address information across claims.

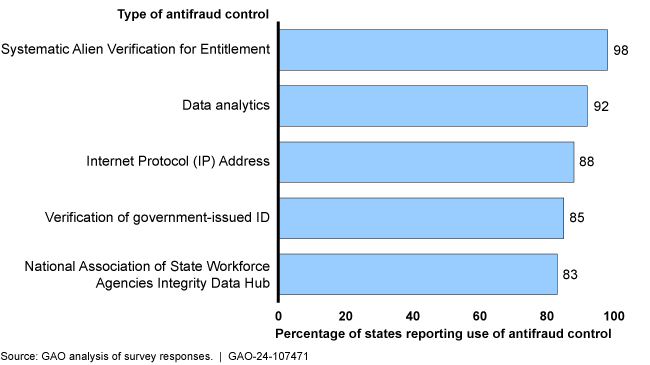

Percentage of Surveyed States Reporting Use of Particular Antifraud Controls in their Pandemic Unemployment Assistance Programs

Highlights

What GAO Found

The Pandemic Unemployment Assistance (PUA) programs temporarily expanded unemployment insurance (UI) benefits to populations, such as self-employed and certain gig economy workers, previously not covered by regular unemployment insurance. States had to rapidly implement these new programs following the passage of the CARES Act in March 2020. The CARES Act required states to allow applicants to self-certify their employment history and program eligibility; this requirement was amended by the Consolidated Appropriations Act of 2021.

States' use of controls to manage fraud risks varied and evolved during the pandemic. However, as states added new controls, some applied them to new claims and not continuing claims that had been previously approved, thereby leaving the states vulnerable to fraud. In September 2023, GAO estimated that UI programs during the pandemic—including the PUA program—were subject to an estimated $100 billion to $135 billion in fraud from April 2020 through May 2023.

GAO surveyed state officials to understand the controls they initially implemented in their PUA programs. The variety of controls used increased significantly in the first few months of PUA program implementation. Over time, states continued to increase the controls used as the pandemic further progressed. For example, states increased their utilization of the Integrity Data Hub—a multistate data system with data cross-matching and analysis capability—to identify potential fraud in PUA and other programs within the unemployment insurance system.

Table 1: Controls That States We Surveyed Reported Using Early in Their Pandemic Unemployment Assistance (PUA) Programs

| Control description | Percentage of responding states that reported using the control by that month or earlier | |||

|---|---|---|---|---|

| April 2020 | May 2020 | June 2020 | Peak montha | |

| Verification of government-issued ID | 35.4b | 54.2 | 58.3 | 85.4 |

| Third-party vendor-provided identity verification service | 18.8 | 25.0 | 29.2 | 79.2 |

| National Association of State Workforce Agencies Integrity Data Hub | 47.9 | 54.2 | 62.5 | 83.3 |

| Systematic Alien Verification for Entitlement | 72.9 | 89.6 | 93.8 | 97.9 |

| Interstate Connection Network | 54.2 | 58.3 | 62.5 | 70.8 |

| State Information Data Exchange System | 41.7 | 43.8 | 43.8 | 45.8 |

| Social Security Administration cross-match | 52.1 | 66.7 | 66.7 | 75.0 |

| State Directory of New Hires cross-match | 58.3 | 60.4 | 60.4 | 72.9 |

| Internet Protocol address | 47.9 | 60.4 | 68.8 | 87.5 |

| Data analytics | 43.8 | 54.2 | 58.3 | 91.7 |

| Other fraud prevention toolsc | 64.6 | 79.2 | 85.4 | 100 |

Source: GAO analysis of state survey responses. | GAO-24-107471

Note: In spring 2023, GAO surveyed the state workforce agencies in 50 states and the District of Columbia. Three states did not respond to the survey by the deadline. The results of the survey reflect responses from 47 states and the District of Columbia. For the purposes of this report, when GAO refers to states’ administration of the PUA program, it includes states, territories, and freely associated states.

aPeak month refers to the month in which the highest number of states surveyed responded that they used a control in their PUA program. The specific month may vary by control.

bThe percents displayed refer to the percentage of responding states and the District of Columbia that reported using the control at any point in the specified month for their PUA programs. GAO did not independently verify the information that states reported on when controls were used or whether controls were used on all PUA claims, or only a subset of claims.

cOther fraud prevention tools include, but are not limited to, additional controls. such as the Social Security Administration’s death cross-match, Vital Statistics cross-match, Department of Motor Vehicles cross-match, fictitious employer cross-matches, and other comparisons that detect shared applicant characteristics (e.g., phone numbers or banking information) on multiple claims.

While each state's PUA program varied to meet the needs of that state's population and any related state regulations, states used some common controls to manage fraud risk in their PUA programs. For example, almost all the states GAO surveyed reported using the Systematic Alien Verification for Entitlement program to confirm citizenship and immigration status prior to granting benefits to applicants. While less than 48 percent of states GAO surveyed reported using Internet Protocol (IP) address verification in their PUA programs in April 2020, over 85 percent reported using this control at some point while the PUA program was active.

The Department of Labor Office of Inspector General identified many cases of fraudulent UI activity where hundreds of false UI claims were filed from a single IP address.

As reported by the Pandemic Response Accountability Committee (PRAC) in April 2024, understanding how UI fraud occurred during the pandemic is important to better prepare for future emergencies. Also, in November 2023, GAO testified that agencies have the opportunity to learn from the experiences during the pandemic and ensure that they are strategically managing their fraud risks in the future. Consistent with the PRAC's reporting and GAO's testimony, states may take lessons from the PUA program when considering future temporary UI programs. One lesson is that failing to apply a new control to continuing claims may leave a state vulnerable to fraud and lessen the efficacy of the control at mitigating fraud risk in the program.

Why GAO Did This Study

Fraud poses a significant risk to the integrity of federal programs and erodes public trust in government. The UI system has faced long-standing challenges with effective service delivery and program integrity, which worsened during the COVID-19 pandemic because of historic levels of job loss. As a result of these long-standing challenges, in June 2022 GAO designated the UI system as a high-risk area.

Program integrity is a shared responsibility between the federal and state governments. The Department of Labor oversees UI, and states design and administer their own UI programs within federal parameters. The CARES Act, enacted in March 2020, created three new federally funded temporary UI programs—including PUA—that expanded benefit eligibility, enhanced benefits, and extended benefit duration.

The unprecedented demand for UI benefits and the need to quickly implement the new programs increased the risk of fraud. GAO's analysis in September 2023 found higher fraud rates for PUA payments than for other UI program payments. GAO was asked to follow up on its September 2023 work. This report provides information on the controls that states used to prevent and detect fraud in their PUA programs.

For more information, contact: Seto J. Bagdoyan, Director, at (202) 512-6722 or BagdoyanS@gao.gov and Jared B. Smith at (202) 512-2700 or SmithJB@gao.gov.