GAOverview: FraudNet Activity Report for Fiscal Year 2023

Highlights

Why This Matters

FraudNet’s primary mission is to facilitate the reporting of allegations of fraud, waste, abuse, or mismanagement of federal funds. It also supports GAO audits and investigations. This is a summary of FraudNet’s activities for fiscal year 2023.

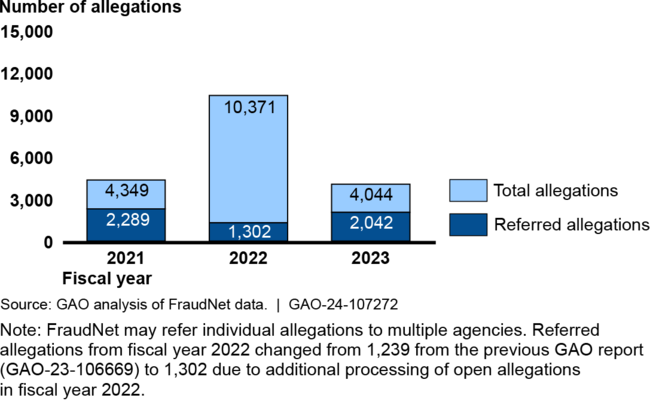

FraudNet Processed 4,044 Allegations in Fiscal Year 2023

The public, including government employees and contractors, submitted 4,044 allegations to FraudNet in fiscal year 2023. As shown in the figure below, the number of allegations processed in fiscal year 2023 was closer to fiscal year 2021 and substantially lower than fiscal year 2022. More than half of the allegations received in fiscal year 2022 were associated with social media campaigns that resulted in multiple complainants submitting form letters alleging the same fraud. This type of allegation was not prevalent in fiscal year 2023.

Allegations in fiscal year 2023 included topics such as government subsidy fraud, ethics/conflict of interest/misconduct, and employee fraud.

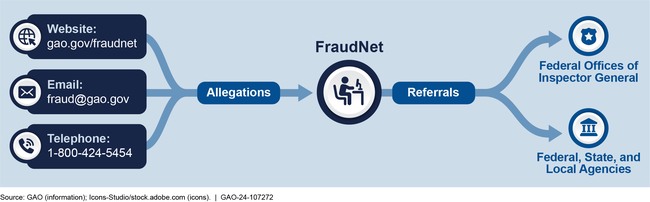

FraudNet’s Investigative Research Analysts review every allegation received. If it is determined a referral is appropriate, FraudNet makes referrals to federal Offices of Inspector General as well as to other federal, state, and local entities. Upon receipt of a referral, the receiving entity determines how it will address the allegation.

Of the total allegations received in fiscal year 2023, FraudNet referred 2,042 complaints to approximately 50 other entities, including the Department of Defense, Department of Justice, and Department of the Treasury. For 201 allegations, complainants indicated that they had sent the same allegation to entities other than GAO. In such instances, FraudNet does not generally refer the allegation to those other entities to avoid duplicating efforts.

FraudNet Analysts Provided Research Support to GAO Audits and Investigations

FraudNet analysts supported approximately 60 requests from GAO teams conducting audits and investigations in fiscal year 2023. These requests involved analysts researching individuals and businesses in investigative databases. For example, FraudNet collected state court records and publicly available information in support of work related to unemployment insurance. This support assisted GAO in updating fraud flags and generating consolidated fraud risk scores.

Report Fraud, Waste, Abuse, and Mismanagement

Anyone can contact FraudNet’s hotline to report suspected fraud, waste, abuse, or mismanagement of federal funds. The website is generally the preferred reporting method. However, GAO cannot accept classified information via the website – please call for further guidance for allegations involving classified information.

GAO does not independently investigate allegations at the request of the individual(s) who reported them. FraudNet documents all allegations received and makes them available to any ongoing or future GAO work. As appropriate, FraudNet refers allegations to the relevant external agency for consideration of further action.

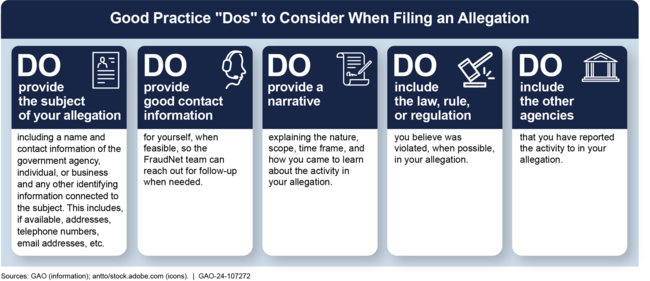

The graphic below provides good practices to follow when filing an allegation with FraudNet.

For more information, contact Howard Arp at (202) 512-6722 or ArpJ@gao.gov.