Federal Student Loans: Preliminary Observations on Borrower Repayment Practices after the Payment Pause

Fast Facts

Federal student loan payments resumed in October 2023 after more than 3 years of pause due to COVID-19. As of January 2024, the Education Department held $1.5 trillion in federal loans for nearly 43 million borrowers.

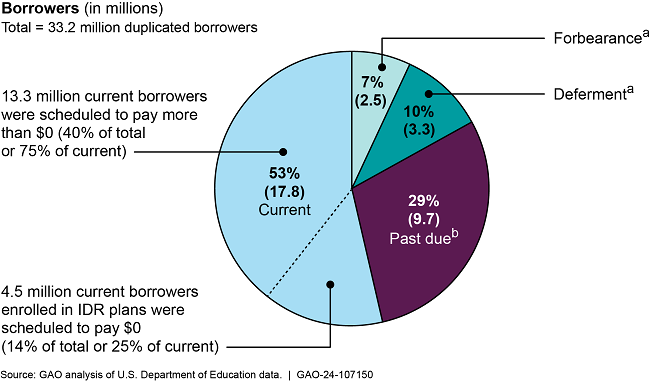

Of the borrowers whose loans had entered repayment and weren't in default:

About half—accounting for about $706 billion in loans—were current on their payments

Nearly 30%—accounting for about $290 billion in loans—were past due on their payments

The rest—accounting for about $254 billion in loans—were not expected to make payments because of deferment or forbearance

We continue to examine issues related to resuming payments.

Highlights

What GAO Found

Since federal student loan payments resumed in October 2023 after a 3½ year pause due to the COVID-19 pandemic, about half of borrowers in repayment (17.8 million) were current on their loan payments as of January 31, 2024. These borrowers accounted for approximately $706 billion in loans.

Number of Federal Student Loan Borrowers in Repayment by Status, as of January 31, 2024

aBoth deferment and forbearance allow eligible borrowers to temporarily postpone making payments. Deferment is available to borrowers who meet certain requirements, such as active-duty military service or returning to school. Forbearance is available to borrowers experiencing financial difficulties or who meet certain requirements, such as serving in AmeriCorps or the National Guard.

bPast-due borrowers were one or more days late.

Note: Borrowers may have loans in more than one status. As a result, the sum of borrowers in the different loan statuses (33.2 million) is slightly higher than the unduplicated number of borrowers (32.2 million). Numbers may not add to 100 due to rounding. IDR plans are income-driven repayment plans.

- Current borrowers. About 40 percent of borrowers (13.3 million) were current on their payments and had scheduled payments of more than $0. In addition, about 14 percent of borrowers (4.5 million) were current and scheduled to pay $0 on income-driven repayment (IDR) plans. IDR plans base monthly payments on a borrower's income and family size and offer forgiveness of any remaining balance at the end of the repayment period. Scheduled monthly payments on IDR plans can be as low as $0 and still count toward forgiveness at the end of the repayment period.

- Past-due borrowers. Nearly 30 percent of borrowers (9.7 million) were past due on their payments and accounted for $290 billion in outstanding loans. The Department of Education typically reports borrowers as delinquent to credit reporting agencies when they become 90 days past due on their loans, but the agency is forgoing this practice for the first 12 months of repayment resumption—October 2023 to September 2024. As of January 31, 2024, Education reported that nearly 6.7 million borrowers had been shielded from negative credit reporting since monthly payments resumed.

- Borrowers in deferment and forbearance. The remaining borrowers were not expected to make payments because their loans were in deferment (10 percent) or forbearance (7 percent), temporary options available to eligible borrowers based on factors such as enrollment in school or financial hardship. These borrowers had outstanding loans totaling about $254 billion.

Nearly a quarter of borrowers in repayment (7.3 million) were enrolled in Education's newest IDR plan, the Saving on a Valuable Education (SAVE) repayment plan, as of January 31, 2024. SAVE generally offers borrowers lower payments. Among the 6.2 million borrowers enrolled in SAVE who had scheduled monthly payments, nearly 60 percent (3.6 million) were scheduled to pay $0, as of January 31, 2024. On July 18, 2024, the U.S. Court of Appeals for the Eighth Circuit granted an emergency motion for a stay temporarily prohibiting Education from implementing the SAVE plan. On July 19, 2024, Education announced that borrowers enrolled in the SAVE plan would be placed in an interest-free forbearance while the litigation was ongoing.

Why GAO Did This Study

Federal student loans are an important resource to help individuals access higher education. As of January 2024, Education held $1.5 trillion in outstanding federal student loans for nearly 43 million borrowers, according to Education. Beginning in March 2020, in response to the COVID-19 pandemic, the CARES Act and related administrative actions paused several aspects of student loan repayment, including payments being due and interest accrual. After several extensions, this payment pause ended on August 30, 2023, per the Fiscal Responsibility Act of 2023. Interest began accruing again in September 2023, and monthly payments resumed in October 2023.

GAO was asked to examine borrower repayment practices after the student loan payment pause. This report describes the extent to which (1) borrowers were current on their student loan payments and (2) borrowers enrolled in the SAVE repayment plan.

To answer these questions, GAO reviewed summary data and documentation from Education on (1) borrowers' payment statuses from October 2023 through January 2024 and (2) borrower participation in IDR plans, including SAVE, as of the end of January 2024. GAO also solicited information from Education officials and reviewed relevant federal laws and regulations.

Education provided written comments with additional information about its efforts to support borrowers resuming repayment. GAO is not making recommendations.

For more information, contact Melissa Emrey-Arras at 617-788-0534 or emreyarrasm@gao.gov.