Improper Payments: Information on Agencies' Fiscal Year 2023 Estimates

Fast Facts

Improper payments—those that should not have been made or were made in the incorrect amount—have consistently been a government-wide issue. Since fiscal year 2003, federal agencies reported about $2.7 trillion in total improper payments. In FY 2023 alone, federal agencies made $236 billion in improper payments, a decrease of about $11 billion from the prior fiscal year.

This Q&A report shows that this estimate doesn't include the Department of Health and Human Services' Temporary Assistance for Needy Families—a program that is susceptible to significant improper payments. We covered this issue in a prior report.

Agencies' FY 2023 Reported Estimated Improper Payments by Type

Highlights

What GAO Found

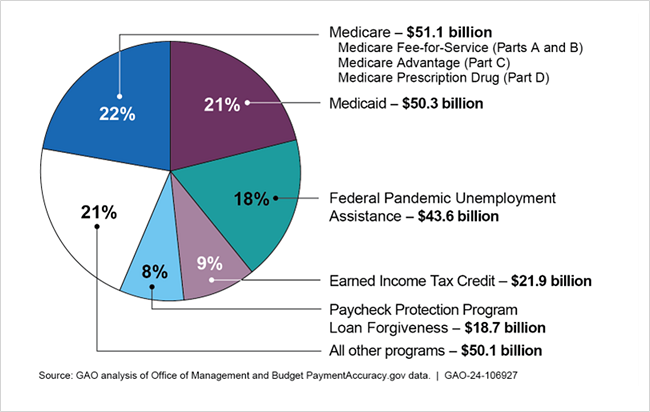

For fiscal year 2023, 14 agencies reported a total estimated $236 billion in improper payments across 71 programs. Agencies reported that about $175 billion (over 74 percent) of this total was the result of overpayments. About $186 billion (approximately 79 percent) was concentrated in five program areas. However, the $236 billion total does not include certain programs that agencies have determined are susceptible to significant improper payments, such as the Department of Health and Human Services' Temporary Assistance for Needy Families. The Department of Housing and Urban Development also did not report improper payment estimates for the Office of Public and Indian Housing's Tenant Based Rental Assistance program and the Office of Multifamily Housing's Project-Based Rental Assistance program. As a result, the government-wide estimate potentially does not represent the full extent of improper payments.

Programs Reporting the Largest Percentage of Government-Wide Improper Payments Estimates for Fiscal Year 2023

Agencies reported about $11 billion less in improper payments in fiscal year 2023 than they did the prior fiscal year. Those agencies that reported substantial decreases attributed the declines to factors such as terminating certain programs, implementing mitigation strategies, and suspending eligibility determinations for Medicaid during COVID-19.

The Payment Integrity Information Act of 2019 (PIIA) and Office of Management and Budget (OMB) M-21-19 include criteria that executive branch agencies must comply with in assessing risk and estimating and reporting improper payments. In fiscal year 2022, 14 of the 24 Chief Financial Officers Act agencies fully complied with PIIA criteria and related OMB requirements, according to their inspectors general (IG). This was an increase from fiscal year 2021, when 10 agencies were reported compliant. IGs identified various causes for agencies' noncompliance with these criteria, such as inadequate risk assessments and unreliable estimates.

Why GAO Did This Study

Improper payments—those that should not have been made or were made in the incorrect amount—have consistently been a government-wide issue. Since fiscal year 2003, cumulative improper payment estimates by executive branch agencies have totaled about $2.7 trillion. Reducing improper payments is critical to safeguarding federal funds.

GAO has reported on improper payments in its audit reports on the U.S. government's consolidated financial statements since fiscal year 1997. GAO has found that these payments represent a material deficiency or weakness in internal controls. Specifically, GAO has noted that the federal government is unable to determine the full extent of its improper payments or to reasonably assure that appropriate actions are taken to reduce them.

House Report 117-389, which accompanied the Legislative Branch Appropriations Act, 2023, includes a provision for GAO to provide quarterly reports on improper payments. This is GAO's fifth such report, and it provides an overview of federal agencies' reported improper payment estimates for fiscal year 2023. Additionally, this report discusses agencies' compliance with legal requirements for reporting and managing improper payments.

For more information, contact M. Hannah Padilla at (202) 512-5683 or padillah@gao.gov.