Financial Management Systems: VA Should Improve Its Risk Response Plans

Fast Facts

The Department of Veterans Affairs relies on a decades-old financial management system to help administer its veterans' benefit programs—including pensions, health care, and disability compensation. Since 1998, VA has been working on a replacement system.

This Q&A report covers the system's rollout. VA has followed most leading practices. But the system continues to be delayed and costs have increased. Plus, VA doesn't have specific, detailed actions planned to manage risks that arise from making the new system work with other systems.

Our recommendations address these issues and more.

Highlights

What GAO Found

The Department of Veterans Affairs (VA) is responsible for administering benefit programs for veterans, their families, and their survivors. These programs include those for pensions, education, disability compensation, home loans, life insurance, vocational rehabilitation, survivor support, medical care, and burial benefits. In 2016, VA established the Financial Management Business Transformation program (the program) to replace its aging financial and acquisition systems with one integrated system to meet financial management goals and comply with legislation and directives. VA's new integrated system is to allow VA to track and report how funds are used to deliver benefits, care, and services.

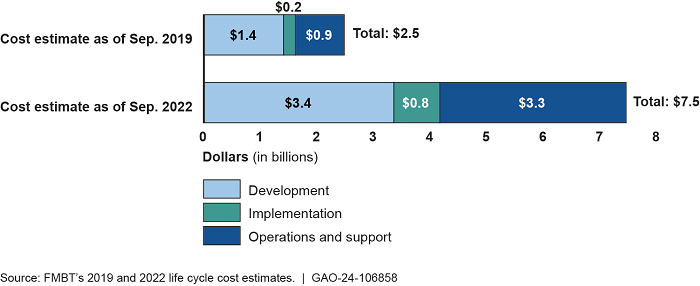

The program's October 2023 life cycle cost estimate shows total program costs are estimated at $7.7 billion, which is an increase of approximately $200 million over the 2022 estimate. Additionally, this is an increase of approximately $5 billion more than its 2019 estimate of $2.5 billion. Nearly half the cost increase from 2019 to 2022 is due to including 18 years of additional operations and support costs for the system's full projected useful life. GAO previously recommended that VA improve its cost estimating practices. Implementing that recommendation could help VA to develop a more reliable cost estimate.

Comparison of 2019 and 2022 Financial Management Business Transformation (FMBT) Program Life Cycle Cost Estimates

Note: The 2019 program cost estimate includes 3 years of actual costs and 11 years of estimated costs through 2029. The 2022 program cost estimate includes an additional 18 years to cover all operations and support costs for the system’s projected useful life through 2047.

According to VA's implementation schedule as of April 2024, the program's targeted completion date is 2030. However, this date is questionable since multiple deployments depend on other currently paused or delayed VA IT modernization efforts, such as Electronic Health Record Modernization and Supply Chain Modernization. GAO previously recommended that VA improve its scheduling practices. Implementing that recommendation could help VA develop a more reliable schedule.

GAO found that the program has followed leading practices to collaborate with stakeholders. For example, the program has established a clear governance structure that identifies leadership, includes relevant stakeholders across VA, clarifies roles and responsibilities, and helps to ensure accountability.

GAO also found that the program has followed leading practices to assess user satisfaction and address user concerns. After each deployment, the program conducted quarterly customer experience surveys to assess user satisfaction. The program also used multiple approaches to identify and resolve user concerns.

VA's risk management policies and procedures were consistent with leading practices. However, GAO found that the program could develop more comprehensive risk response plans to help mitigate risks related to systems integration with other IT modernization projects. GAO's analysis found that 11 of the 13 plans did not include specific, detailed actions. Plans that do not include detailed, specific actions increase the likelihood that the program will not timely identify and take appropriate action to mitigate its identified risks, thus exposing the program to potential delays and additional costs.

Why GAO Did This Study

VA's core Financial Management System is more than 30 years old. According to VA, it is extremely difficult to maintain, results in inefficient operations, requires complex manual work-arounds, and does not provide real-time integration between financial and acquisition information across VA. As such, the program is implementing a new system called the Integrated Financial and Acquisition Management System, an enterprise resource planning cloud solution. VA says implementing this system will increase the transparency, accuracy, timeliness, and reliability of financial and acquisition information, helping to improve fiscal accountability and services.

As of April 2024, the program has completed six incremental deployments. However, VA program leadership has not yet determined final implementation dates for multiple deployments at the Veterans Benefits Administration and Veterans Health Administration, which may further affect its timeline.

GAO was asked to review the program's implementation of the integrated system. This report addresses key project management practices on collaborating with stakeholders on changes such as cost and schedule estimates, assessing user satisfaction and concerns, and managing program risks.

Recommendations

GAO recommends that the VA Secretary direct the Deputy Assistant Secretary for the Financial Management Business Transformation program to work with the Office of Enterprise Integration to ensure that responsible risk owners develop integration risk response plans that contain detailed and specific mitigation actions. VA concurred with the recommendation and described actions it will take to address it.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Veterans Affairs | The VA Secretary should direct the FMBT Deputy Assistant Secretary to work with the Office of Enterprise Integration to ensure that responsible risk owners develop integration risk response plans that contain detailed and specific mitigation actions. (Recommendation 1) |

In December 2024, VA submitted standard operating procedures stating that risk owners must develop courses of action to respond to identified risks and report on their status during quarterly meetings with OEI. Additionally, VA submitted evidence that all open risk response plans found deficient in our original review had been updated to include specific, detailed mitigation actions. By taking these actions, VA enhanced its ability to timely identify and take appropriate actions to mitigate identified risks to the program.

|