Rental Housing: Information on Institutional Investment in Single-Family Homes

Fast Facts

Millions of homeowners defaulted on their mortgages during the 2007-2009 financial crisis. Institutional investors—companies that own a lot of single-family rental homes—bought many of these foreclosed homes in bulk and converted them into rental housing, especially in states across the southern U.S.

Researchers found that institutional investors may have contributed to increasing home prices and rents following the financial crisis. However, it's unclear how these investors affected homeownership opportunities or tenants because many related factors affect homeownership—e.g., market conditions, demographic factors, and lending conditions.

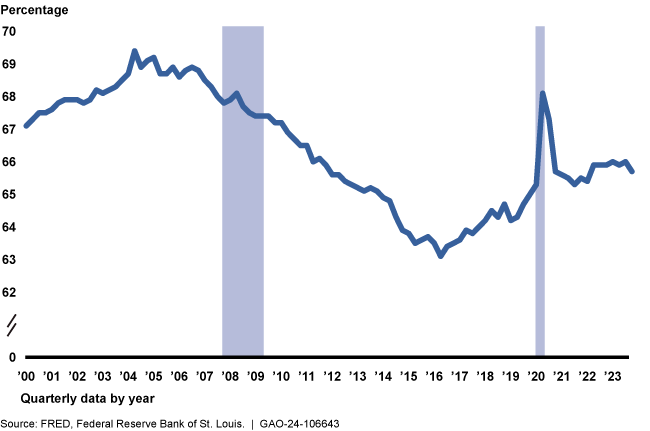

U.S. Homeownership Rate, 2000-2023

Highlights

What GAO Found

Large “institutional” investors emerged in the wake of the 2007–2009 financial crisis, bulk-purchasing foreclosed homes at auction and converting them into rental housing. Aided by access to capital through various sources, institutional investors had a funding advantage over smaller investors at a time when mortgage lenders were generally reducing lending. Additionally, technological advancements allowed companies to acquire and manage large portfolios of single-family homes more easily.

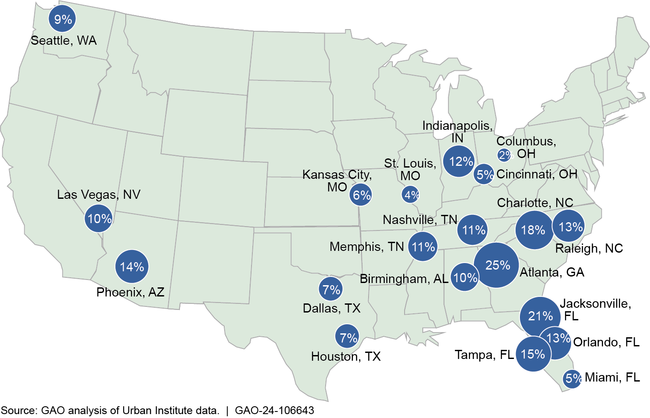

Institutional investors initially relied on bulk purchases but then shifted to making smaller-scale purchases, merging with other investors, or building homes for rent. These activities have contributed to their growth over time. Studies GAO reviewed found that no investor owned 1,000 or more single-family rental homes as of late 2011. However, by 2015, institutional investors collectively owned an estimated 170,000-300,000 homes. As of June 2022, institutional investors of varying sizes made up a large portion of the single-family rental market in many cities, particularly in Sunbelt states.

Estimated Share of the Single-Family Rental Market Held by Investors with over 1,000 Homes in Selected Areas, as of 2022

Note: For more details, see fig.6 in GAO-24-106643.

Studies GAO reviewed found that institutional investors may have contributed to increasing home prices and rents and helped stabilize neighborhoods following the financial crisis. However, information on these investors' effects on homeownership opportunities and tenants (e.g., eviction rates) was unclear because data are limited and there is no consistent definition of institutional investor.

Why GAO Did This Study

Millions of homeowners defaulted on their mortgages during the 2007–2009 financial crisis. Institutional investors (i.e., companies that own a large number of single-family rental homes) grew large portfolios of single-family homes and converted them to rental properties to help meet growing demand for rental housing. However, more recently, low housing supply and elevated housing prices and rents have raised questions about the effect of institutional investors on the housing market and renters.

The Joint Explanatory Statement accompanying the Consolidated Appropriations Act, 2023, includes a provision for GAO to report on the prevalence and types of institutional investors and their effect on single-family rental housing.

This report provides information on (1) institutional investors in single-family rental housing and (2) reported effects of institutional investment on housing markets and residents. GAO reviewed 74 studies that examined institutional investment in single-family housing, including scholarly articles and research reports from governmental and nongovernmental organizations. GAO also interviewed agency officials and representatives of consumer advocacy, industry, and research organizations selected for their knowledge in this area.

For more information, contact Jill Naamane at (202) 512-8678 or naamanej@gao.gov.