Department of Education: Student Loan Relief in Cases of College Misconduct

Fast Facts

When the Department of Education finds a college engaged in certain kinds of misconduct, such as misrepresenting graduates' job prospects, students may qualify for loan relief.

Students can apply through a process known as "borrower defense." If Education finds misconduct, it can forgive outstanding loan balances and refund payments already made. If colleges engaged in misconduct over time and across locations, Education can approve relief for a group of borrowers, including those who did not apply.

As of April 30, 2024, Education forgave a cumulative total of $17.2 billion in federal student loans for 974,820 borrowers under borrower defense.

Highlights

What GAO Found

The Department of Education can approve relief for student loan borrowers through a process called borrower defense to repayment (borrower defense) if colleges engaged in certain types of misconduct. As of April 30, 2024, Education had discharged (i.e., forgiven) a cumulative total of $17.2 billion in federal student loans for 974,820 borrowers under borrower defense, according to agency data. Under the 1995 and 2016 borrower defense regulations, the agency determines if a borrower qualifies for loan relief using two pathways. Under the first pathway, Education evaluates individual borrower defense applications by following a multistep process to determine if a borrower's claim of a college's misconduct is credible. Under the second pathway, Education provides relief for a group of borrowers. Education uses this “group discharge” process when it determines that a college engaged in widespread and pervasive misconduct. In such cases, Education may provide relief to all borrowers who attended a specific college, campus, or program during a specific time, even if they did not submit applications. The $17.2 billion represents discharges through both the individual and group application pathways. The 974,820 borrowers include those who filed applications as well as those who did not.

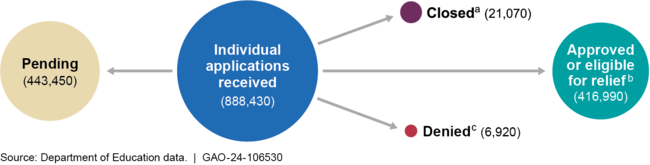

Education had received a cumulative total of 888,430 borrower defense applications filed by individual borrowers as of April 30, 2024, according to agency data (see figure). All borrowers with approved applications received full relief (i.e., the discharge of outstanding loan(s) to attend the college and a refund of payments made to Education), according to agency data and officials.

Borrower Defense Application Outcomes as of April 30, 2024

aEducation may close an application when, for example, the borrower cannot be reached to provide missing information or the borrower's loans were already discharged through other means.

bApproved includes 199,020 applications approved through individual adjudication or a group discharge. Eligible for relief includes 217,970 applications found eligible under the terms of a 2022 legal settlement (known as the Sweet settlement).

cDenied does not include approximately 137,000 denials that the agency rescinded and will reprocess according to the terms of the Sweet settlement.

As of April 30, 2024, Education approved group discharges for seven colleges. According to agency officials, all borrowers in the seven groups received full relief. According to GAO's analysis of agency documents and information from officials, the most common type of misconduct Education found (for six of the seven colleges) was the college misrepresenting its graduates' employment prospects, including job placement rates or expected earnings. Education determined that six of the seven colleges engaged in more than one type of misrepresentation. To assess the allegations, Education used information from various sources, including state attorneys general.

Why GAO Did This Study

Borrowers may qualify for relief of their federal student loans if their colleges engaged in certain types of misconduct, such as misrepresenting information about the employment prospects of their graduates. The Higher Education Act of 1965, as amended, authorized borrower defense, and federal regulations established the process for borrower defense. Borrower defense is designed to protect student loan borrowers. However, the federal government generally bears the cost of discharged and refunded federal student loans. Given the potential cost to the federal government, GAO was asked to review how Education processes borrower defense applications and the outcomes.

This report describes the process used to determine student loan relief under borrower defense and the total dollar amount of loans discharged; the number of borrower defense applications Education received and the outcome of those applications; and Education's approval of loan relief for groups of borrowers, among other things.

GAO analyzed Education's cumulative borrower defense data as of April 30, 2024, the most recent data available. GAO also reviewed relevant federal laws and regulations, a relevant class-action lawsuit settlement (known as the Sweet settlement), Education policies and procedures, and other agency documents. GAO also interviewed agency officials.

For more information, contact Melissa Emrey-Arras at (617) 788-0534 or emreyarrasm@gao.gov.