Tax Gap: IRS Should Take Steps to Ensure Continued Improvement in Estimates

Fast Facts

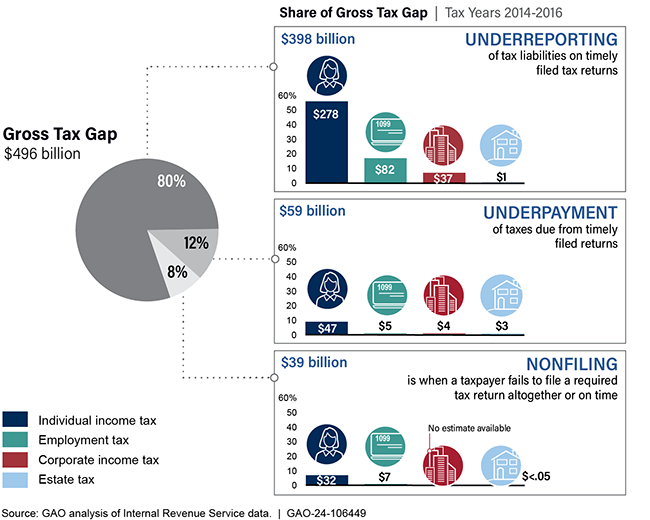

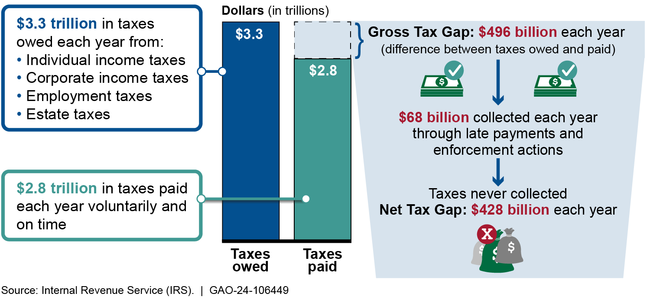

Taxpayers voluntarily paid 85% of taxes owed on time in 2014-2016. The other 15% of taxes owed—$496 billion—is called the tax gap. Most of this tax gap is a result of taxpayers underreporting the amount of taxes they owe.

To estimate part of the tax gap, the IRS audits a random sample of tax returns based on certain characteristics—such as whether the taxpayer is self-employed. The agency has recently piloted a new AI method to select taxpayers for audits. However, it hasn't documented key components and technical specifications of this AI.

We recommended that it do so to ensure that the IRS is being consistent and transparent with its AI use.

Estimated Average Annual Gross Tax Gap, Tax Years 2014-2016

Highlights

What GAO Found

Taxpayers voluntarily and timely paid about 85 percent of the taxes they should have paid for tax years 2014-2016, according to the Internal Revenue Service's (IRS) latest tax gap estimate. IRS most recently projected the tax gap will grow to $688 billion for tax year 2021. However, when measured relative to the overall economy, the tax gap has remained relatively stable.

The Internal Revenue Service's Annual Average Tax Gap Estimate for Tax Years 2014-2016

In developing the estimates, IRS applies a statistical technique to National Research Program (NRP) audit data to account for noncompliance that was not detected by examiners in audits. Applying this technique nearly doubles the individual underreporting tax gap estimate, increasing the estimate from $145 billion to $278 billion. IRS has not conducted analysis to understand the causes of this estimate of undetected noncompliance. By doing so, IRS would be better positioned to help improve the reliability of and confidence in the adjustment and potentially examiners' detection of noncompliance.

IRS is piloting a new process for sampling tax returns for NRP's audits. The new process uses artificial intelligence (AI) to improve the efficiency and selection of audit cases to help identify noncompliance. However, IRS has not completed its documentation of several elements of its AI sample selection models, such as key components and technical specifications. Completing documentation would help IRS retain organizational knowledge, ensure the models are implemented consistently, and make the process more transparent to future users.

IRS's Strategic Operating Plan (SOP) describes how IRS intends to spend the tens of billions of dollars it received under the Inflation Reduction Act. However, the SOP is not clearly linked to tax gap data. For example, the plan does not address sole proprietor noncompliance, which is one of the largest areas of tax noncompliance. Furthermore, IRS did not address a prior GAO recommendation to link NRP data to its compliance efforts. As IRS develops implementation plans for the SOP initiatives and projects, it has an opportunity to further integrate a significant source of evidence to refine its compliance strategies, thereby addressing the recommendation. Linking compliance strategies with data would help provide assurance that IRS is effectively allocating enforcement resources.

Why GAO Did This Study

The tax gap—the difference between the tax amounts voluntarily paid by individuals and businesses and the tax amounts that are owed—has been a persistent problem for decades.

The tax gap is an aggregate estimate of individual income, corporation income, employment, and estate taxes. IRS estimates are based on three types of noncompliance: (1) underreporting of tax liabilities on timely filed tax returns; (2) underpayment of taxes due from timely filed returns; and (3) nonfiling, when a taxpayer fails to file a required tax return altogether or on time.

GAO was asked to review IRS's most recent tax gap estimates for tax years 2014-2016. This report (1) describes IRS's estimates and changes from prior estimates; (2) assesses IRS's changes to the sample design of NRP; and (3) assesses how the estimates help IRS and other stakeholders gain insights into noncompliance. GAO reviewed IRS's tax gap data and reports and interviewed IRS officials.

Recommendations

GAO is making six recommendations to IRS, including that IRS conduct additional analyses to understand the root causes of undetected noncompliance and complete its documentation related to the pilot process for sampling returns.

IRS agreed with all six of GAO's recommendations and described steps it plans to take in response to each recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure officials in the Research, Applied Analytics and Statistics Division work with officials in the Small Business/Self-Employed and Large Business and International Divisions to develop and report on analyses that could provide stakeholders with more confidence in the methods used to estimate undetected noncompliance, and information on its root causes. (Recommendation 1) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should complete documentation on key components of the NRP AI models, such as which model options were considered and chosen for implementation, and how IRS determined risk levels and time frames for risk level updates. (Recommendation 2) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should complete documentation for the NRP AI models on the technical specifications needed to run the model, such as how the data are to be split or divided. (Recommendation 3) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure IRS has complete documentation on how to update the NRP sample selection process in response to changes in the operating environment, including the performance of its AI models and risk level analysis. (Recommendation 4) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should complete documentation on processes for assessing the results of AI model updates, including validating the models. (Recommendation 5) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should develop and document a plan for evaluating the redesigned sample selection process, including factors IRS will consider in determining whether or how to continue using it. (Recommendation 6) |

IRS agreed with this recommendation. When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information.

|