Small Business Research Programs: Information Regarding Subaward Use and Data Quality

Fast Facts

Agencies that participate in the Small Business Innovation Research and Small Business Technology Transfer programs have helped small businesses bring new technologies to market—such as a low-cost, energy-efficient alternative to fluorescent lights.

Small businesses that receive these awards are allowed to use subcontractors and consultants (such as other companies, academic institutions, and nonprofits) to assist with these projects.

We estimated that about 70% of award recipients did so in FY 2019, mostly for help with things like product design, development, and testing.

Highlights

What GAO Found

Several factors determine which first-tier subawards must be reported by recipients of Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) awards under the Federal Funding Accountability and Transparency Act. These factors include the value of the subawards, applicable exemptions, and varying definitions of first-tier subawards. According to small business representatives that GAO interviewed, a lack of awareness and understanding by small businesses may also affect reporting rates. Based on GAO's review of USAspending.gov, few SBIR/STTR awards (about 10 percent) display subawards. Limitations on first-tier subaward reporting are a government-wide issue and not unique to SBIR/STTR awards (see GAO-24-106237).

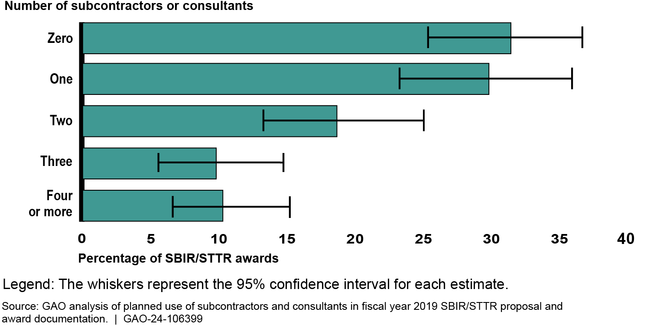

SBIR/STTR award recipients commonly partner with other entities, including subcontractors or consultants, to assist with a portion of the work for contracts, grants, and cooperative agreements. Based on a sample of fiscal year 2019 awards, GAO estimates that approximately 70 percent of SBIR/STTR Phase II awards—which are used to advance concepts after feasibility is assessed—included the use of subcontractors or consultants. In addition, GAO estimates that about 16 percent of the total award value across all Phase II awards went to subcontractors and about 2 percent went to consultants.

Estimated Percentage of Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Awards That Used Subcontractors or Consultants, Fiscal Year 2019

SBIR/STTR award recipients use private sector entities, academic institutions, and nonprofits for a variety of support. GAO estimates, for example, that 29 percent of awards included one or more subcontracts to private sector entities and 24 percent included one or more subcontracts to academic institutions. Award recipients use subcontractors and consultants for a wide variety of purposes, such as providing technical insights and expertise; assisting with design activities; developing systems, products, or software; and performing testing and evaluation of technological innovations.

Why GAO Did This Study

Small businesses are important drivers of economic growth, but they can face challenges in accessing capital to fund research and development (R&D). Congress established the SBIR/STTR programs to enable small businesses to undertake and obtain the benefits of R&D. Agencies issue SBIR/STTR awards as contracts, grants, and cooperative agreements. The award recipients may enter into agreements—subawards—with other entities to carry out part of the work or to provide needed materials, supplies, or services.

The SBIR and STTR Extension Act of 2022 includes provisions for GAO to evaluate subcontracting practices of SBIR/STTR award recipients. This report (1) examines factors that affect the reporting of SBIR/STTR first-tier subaward data on USAspending.gov; and (2) estimates the extent to which SBIR/STTR award recipients used subawards, the general purposes for these subawards, and which types of entities received them.

GAO reviewed a generalizable sample of 198 fiscal year 2019 SBIR/STTR awards and interviewed agency officials from the Small Business Administration and 11 agencies that participate in the SBIR/STTR programs. GAO also interviewed a non-generalizable sample of 10 SBIR/STTR award recipients to obtain their perspectives on subaward reporting requirements.

For more information, contact Candice N. Wright at (202) 512-6888 or WrightC@gao.gov.