Thrift Savings Plan: Investment Board Needs to Greatly Improve Acquisition Management and Contractor Oversight

Fast Facts

Federal employees can invest in the Thrift Savings Plan, the nation's largest retirement plan.

In 2020, the agency that runs the plan contracted with a company to modernize its recordkeeping system, website, and mobile app. The new system launched in 2022, triggering a wave of complaints.

The agency and contractor have improved the system, but there's more to do. For example, some benefit payments involving court orders, like divorce settlements, were wrong and didn't meet federal standards. Also, the contractor doesn't have to share data on certain transactions—so the agency can't oversee them.

Our recommendations address this, and more.

Highlights

What GAO Found

The Federal Retirement Thrift Investment Board (FRTIB) did not fully implement key acquisition management practices to ensure the success of Thrift Savings Plan (TSP) products and services. Specifically, while the agency identified its needs and assessed alternatives to meet those needs, it did not

- develop policies and procedures to govern the way it acquires products and services until after the TSP services acquisition was underway;

- ensure that the new TSP recordkeeping system was consistent with federal requirements for loan repayment, court-ordered benefits, and accessibility;

- verify that the contractor had completed tests in accordance with plans;

- ensure that all milestones were met before progressing through the acquisition process; and

- confirm that personnel requirements for training, background investigations, and contract monitoring were met.

By not fully implementing these practices, FRTIB significantly increased the risk of a problematic rollout of the new system.

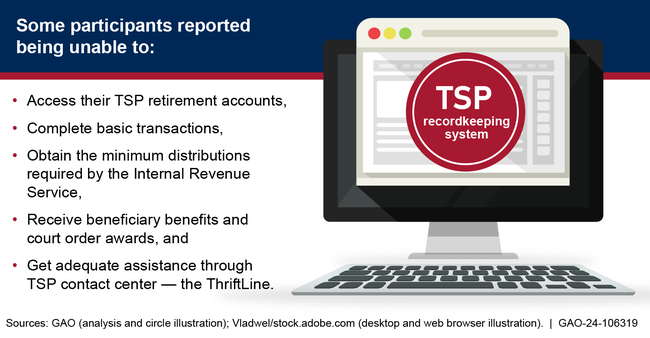

When the TSP recordkeeping system deployed in 2022, participants encountered a variety of problems (see figure). According to Accenture Federal Services (AFS), it received about 120,000 calls on the first day of operation. The average wait time went from 35 minutes on the first day to two hours by the third day. The agency and its contractor subsequently took action to address many of these issues, although in some cases, resolution took months.

Examples of the Issues Encountered by Thrift Savings Plan (TSP) Participants When Using the New System

To enable FRTIB's oversight of AFS, the contract includes a process with performance metrics. The agency can credit or penalize the contractor for its performance in meeting the metrics. In the first 2 years of service, it did both (see table).

Credits Earned and Penalties Incurred by the Contractor for the New Thrift Savings Plan System, June 2022 through December 2023

|

|

Year 1 |

Year 2 | ||

|---|---|---|---|---|

|

Service category |

Credits earned |

Penalties deducted |

Credits earned |

Penalties deducted |

|

Participant services |

— |

$4,017,137 |

— |

$1,326,553 |

|

|

— |

— |

$656,424 |

— |

|

Administrative services |

$272,965 |

— |

— |

— |

|

|

— |

— |

$407,637 |

— |

|

|

$270,378 |

— |

— |

— |

|

Regulatory, accounting, & compliance |

— |

— |

$223,549 |

— |

|

Security and information technology |

$543,343 |

— |

$553,297 |

— |

|

Total |

$1,086,686 |

$4,017,137 |

$1,840,907 |

$1,326,553 |

Legend: — = not applicable

Source: GAO (analysis), Federal Retirement Thrift Investment Board (data). | GAO-24-106319

Note: Credit and penalty totals for Year 2 are for June 2023 through December 2023, not the entirety of Year 2.

However, the agency was unable to adequately oversee the contractor's performance in key areas such as court order and death claim timeliness because it did not have the information needed to do so. The contract does not require AFS to provide this information. For nearly 2 years, FRTIB and its contractor have discussed contract modifications that would require such information to be provided. It is unknown when the two parties will reach agreement.

In addition, the agency was limited in its ability to penalize AFS for poor performance because the contract only allows a subset of performance metrics to be eligible for penalty each year. Many of these metrics do not focus on areas that would have the most financial impact on participants. This misalignment of incentives will likely continue to persist without action by the agency to issue penalties in areas that have the most impact on participant outcomes.

FRTIB, in coordination with its contractor, implemented key actions to improve the way it delivers services to the TSP participants. Specifically, the agency and its contractor

- integrated customer service into the agency's existing activities;

- used annual surveys to identify what its customers want;

- made services for the new TSP recordkeeping system available through multiple channels; and

- identified improvements and enhancements to the TSP recordkeeping system based on participant feedback and industry information sharing.

As a result, participant-reported satisfaction with the modernized system has improved significantly since its deployment.

Why GAO Did This Study

The TSP, administered by FRTIB, is the largest retirement plan in the U.S. with about $895 billion in retirement assets and approximately 7 million participants and beneficiaries.

In 2020, FRTIB contracted with AFS to predominantly own the underlying infrastructure and operate the services for the modernized TSP recordkeeping system. The contract length was a base of 3 years with options for up to 9 additional years. The total estimated cost to participants, if all options are exercised, is about $4.6 billion. Included in this cost are fees for transactions participants initiate through the system.

GAO was asked to review FRTIB's efforts in modernizing TSP services. This report examines (1) the extent to which the agency implemented key acquisition management practices to monitor progress before deployment of the new TSP recordkeeping system; (2) the key problems encountered by participants after the deployment of the new system and the actions taken to address them; (3) the extent to which the agency oversaw the actions of its contractor; and (4) the extent to which the agency implemented federal customer satisfaction requirements to improve customer service.

GAO evaluated FRTIB's acquisition procedures, contract solicitation and administration efforts, the TSP services contract, and contract personnel data against key acquisition management practices. GAO also summarized reported issues encountered by the TSP participants, and the actions taken to address them.

Additionally, GAO analyzed the TSP contract to summarize the agency's oversight approach and evaluated contractor performance documentation against that approach. Further, GAO analyzed participant satisfaction and interaction survey results, and contractor performance data against key actions for improving customer service, among other things.

Recommendations

GAO is making seven recommendations to FRTIB's Executive Director, including to:

- develop a process to ensure that requirements developed for the TSP recordkeeping system are consistent with applicable federal requirements;

- develop a process to review testing documentation to ensure planned testing is complete for any system enhancements or upgrades;

- develop a process to review milestone-related documentation to ensure that it fully addresses the milestone requirement;

- expedite negotiations with its contractor to modify, where feasible, the TSP services contract to ensure that all pertinent data necessary for performance oversight is provided by the contractor; and

- reevaluate and adjust the allowable credits and penalties to focus on areas with the largest financial impact to participants.

FRTIB agreed with GAO's recommendations and stated that it plans to implement them either through re-competition of the recordkeeping contract or through ongoing negotiations with AFS.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Federal Retirement Thrift Investment Board | The FRTIB Executive Director should develop a process to ensure that any future requirements developed for the new TSP recordkeeping system are consistent with the board's objectives, including applicable federal requirements, defined for the system. (Recommendation 1) |

As of September 2025, FRTIB documented processes for ensuring that the TSP recordkeeping system requirements are consistent with FRTIB's objectives and applicable federal requirements. Specifically, the agency developed a June 2025 standard operating procedure (SOP) that defines roles and responsibilities for aligning the TSP recordkeeping system with the agency's objectives and legal requirements. For example, according to the SOP, the FRTIB TSP Recordkeeping System Program Manager is responsible for ensuring alignment with organizational goals and the agency's objectives; Office of General Counsel (OGC) is responsible for ensuring the system is compliant with legal requirements; and the system contractor is responsible for ensuring implementation tasks are aligned with FRTIB policies. Additionally, in March 2025, the agency finalized a memo that requires all modifications to the TSP recordkeeping system contract to undergo a legal review by the FRTIB OGC. As a result, the agency is better able to ensure that changes to the TSP recordkeeping system are consistent with the board's objectives and federal requirements.

|

| Federal Retirement Thrift Investment Board | The FRTIB Executive Director should develop a process that requires FRTIB to review testing documentation to ensure planned testing is complete, the evidence for testing outcomes is clear, and that the solution meets the desired outcome for participants for any new system enhancements or upgrades. (Recommendation 2) |

As of September 2025, FRTIB documented processes for ensuring that the agency reviews testing documentation for any new system enhancements or upgrades to the TSP recordkeeping system. Specifically, the agency developed a June 2025 standard operating procedure (SOP) that defines roles and responsibilities for monitoring testing performed on the TSP recordkeeping system. According to the SOP, the FRTIB Office of Participant Experience is responsible for confirming that testing documentation has been reviewed, was conducted in accordance with test plans, and thoroughly covers all functionalities for new system enhancements and upgrades. Additionally, that office is to confirm that testing plans have been reviewed, and that testing feedback includes whether testing is complete, clearly demonstrates evidence for testing outcomes, and notes whether the solution meets the desired outcome for participants. Further, the Contracting Officer's Representative is responsible for receiving confirmation that testing is complete and maintaining testing documentation. As a result, FRTIB is better able to ensure that planned testing for enhancements and upgrades to the TSP recordkeeping system is complete, the evidence for testing outcomes is clear, and that the solution meets the desired outcome for participants.

|

| Federal Retirement Thrift Investment Board | The FRTIB Executive Director should develop a process that requires FRTIB to review milestone-related documentation to ensure that it fully addresses the milestone requirement. (Recommendation 3) |

In January 2025, FRTIB informed us that it was developing standard operating procedures to describe documentation that will be required for each milestone to be approved. The agency stated that the procedures will be for all new initiatives and projects. As of September 2025, FRTIB had not provided these procedures nor an estimated date for completing them. We will continue to follow up on FRTIB's progress in completing this action.

|

| Federal Retirement Thrift Investment Board | The Executive Director of FRTIB should expedite negotiations with its contractor to modify, where feasible, the TSP services contract to ensure that all pertinent data necessary for performance oversight is provided by the contractor. (Recommendation 4) |

In January 2025, FRTIB informed us that it is now receiving all pertinent data to conduct performance oversight of the Accenture Federal Services contract for TSP services. However, our review of supporting information provided by FRTIB in September 2025 indicated that FRTIB may still not be receiving information required to fully oversee contractor performance. For example, when overseeing timeliness and accuracy of legal and death claims, it is not clear that FRTIB is receiving information about when the claims were received or the documentation used to process death claims or court orders. We have requested additional information from the agency and will update the status of this recommendation once received.

|

| Federal Retirement Thrift Investment Board | The FRTIB Executive Director should negotiate with its contractor to modify, where feasible, the TSP services contract to include a requirement that FRTIB is notified of any new staff assigned to the contract, including the name and title of the staff, to help ensure appropriate background investigations are conducted. (Recommendation 5) |

In September 2025, FRTIB provided information that demonstrates that it has established policies and procedures for ensuring that contractor staff obtain a background investigation prior to obtaining system access. However, it is unclear, from the documentation provided, whether FRTIB is provided the job titles and positions of contractors that are newly hired to be able to ensure that the background investigation that is being requested for the individuals is the correct one. We have requested additional information from the agency and will update the status of the recommendation once received.

|

| Federal Retirement Thrift Investment Board | The Executive Director of FRTIB should establish a documented procedure to ensure any future third parties providing services for the TSP are able to provide transactional data needed for oversight prior to performing these services. (Recommendation 6) |

In January 2025, FRTIB informed us that it was updating its Contracting Standard Operating Procedures to include contractor requirements for future oversight activities, to include access to third-party data. According to the agency, the necessary oversight data will be incorporated into a future quality assurance surveillance plan modification to ensure ongoing oversight of the current TSP services vendor. As of November 2025, FRTIB has not provided an update on the status of the recommendation nor an estimated date for completing these actions. We will continue to follow up on FRTIB's progress in completing these actions.

|

| Federal Retirement Thrift Investment Board | The Executive Director of FRTIB should reevaluate and adjust the Performance Related Compensation Adjustment framework to focus on areas with the largest financial impact to participants, including issue resolution and timeliness and accuracy of transactions processing. (Recommendation 7) |

In January 2025, the FRTIB informed us that it reevaluates the penalty eligible service level requirements in the Performance Related Compensation Adjustment framework on an annual basis and will continue to do so to determine the need for any changes. In September 2025, FRTIB provided an updated Performance Related Compensation Adjustment framework that reflected very few changes since the time of our review. FRTIB added penalties for participant processing accuracy, but other areas with financial impact to participants, such as processing time and transaction processing time are neither penalized nor credited. We have requested additional information from FRTIB on the framework's review process and will update the status of the recommendation once received.

|