Federal Oil and Gas Royalties: Opportunities Exist to Improve Interior's Compliance Program

Fast Facts

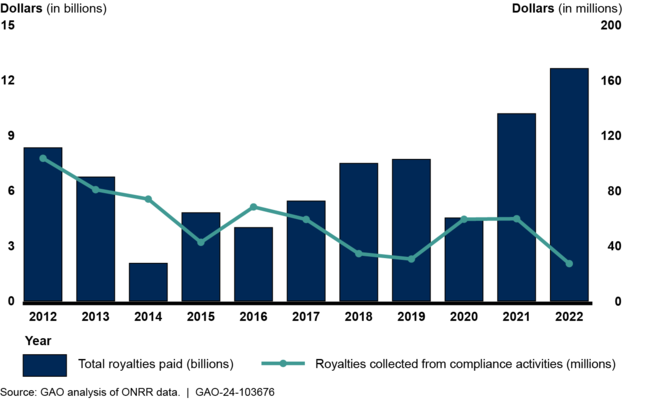

Royalties on the sale of oil and gas produced on federal lands are a significant source of federal revenue. From 2012-2022, companies paid the U.S. government $74 billion in royalties. The Interior Department's efforts to ensure that companies pay the royalties they owe produced $600 million in additional payments in this period.

Our recommendations are to help Interior improve on these results. For example, Interior could improve its data quality and collect additional data to better select compliance cases that are more likely to yield additional payments.

Interior's management of oil and gas has been on our High Risk List since 2011.

Highlights

What GAO Found

The Department of the Interior's Office of Natural Resources Revenue (ONRR) collected $74 billion in royalties on $600 billion total sales of oil and gas produced by companies on federal leases from 2012–2022. Royalties collected depended in large part on the price of oil and gas, which increased from 2012 through 2022. ONRR generated $600 million through compliance activities for 2012–2022.

Office of Natural Resources Revenue (ONRR) Royalty and Compliance Collections, 2012–2022

ONRR has made progress developing new risk models for selecting cases for compliance. However, incomplete data and resource challenges have impeded ONRR's ability to analyze its compliance data. ONRR is developing its own risk models for case selection, which should increase its capacity to analyze data, officials said. However, ONRR does not have certain data that could be used to inform the risk models, such as complete data on violations. By assessing the need for complete compliance data, ONRR could better inform its compliance strategy. Additionally, ONRR has not prioritized hiring staff with data analysis skills. By assessing human capital needs, ONRR could better determine what skills and staff it needs to strengthen compliance efforts.

ONRR last estimated a royalty gap of approximately $100 million for both 2010 and 2011. The royalty gap is the difference between the payments ONRR collects from companies and what it should collect. ONRR staff recommended improving the model to continue estimating the royalty gap. However, ONRR management did not continue this effort after 2011. GAO attempted to estimate a royalty gap for more recent years using a different model but was unable to do so due to limitations with ONRR's data. Rigorous and improved estimates of its royalty gap could help ONRR enhance its decision-making and strategic planning of compliance efforts on an ongoing basis.

Why GAO Did This Study

The federal government receives significant revenues from royalties paid on the sale of oil and gas extracted from leased federal lands and waters. Interior has faced challenges verifying the accuracy of royalty payments. In 2011, GAO added Interior's management of federal oil and gas resources to its High Risk List. Interior has since taken steps to operate more effectively.

GAO was asked to examine ONRR's federal oil and gas royalty compliance efforts. This report (1) describes ONRR's royalties and compliance activities for 2012 through 2022, the most current data available at the time of our review; (2) examines how staffing resources affected its ability to analyze compliance data; and (3) examines ONRR's latest estimates of an oil and gas royalty gap, and what opportunities ONRR has to improve its royalty gap model. GAO reviewed relevant laws, regulations, agency guidance, and Interior's annual performance documentation and budget justifications for the period. GAO also analyzed ONRR compliance data and interviewed ONRR officials.

Recommendations

GAO is making 14 recommendations, including that ONRR improve the completeness of its compliance data, assess its human capital needs related to its data and data systems, and periodically estimate a royalty gap of adequate rigor. Interior concurred with GAO's recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Office of Natural Resources Revenue | The Director of ONRR should assess the benefits of incorporating randomly selected compliance activities into its workplans, including the resources necessary to conduct the appropriate number of random compliance activities, to validate its risk models. (Recommendation 1) |

Interior concurred with our recommendation. In December 2024, Interior stated that the Director of ONRR will assess the benefits of incorporating randomly selected compliance activities into its workplans, including the resources necessary to complete the cases, and if the impact of those cases and their results will validate the risk models in use. As of December 2025, ONRR expects to complete this by April 30, 2026.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider adding related violation data to already closed cases in OMT to better assure ONRR has complete data on violations in its current compliance data system. (Recommendation 2) |

In November 2025, ONRR provided documentation that it had added violation data to closed compliance cases. ONRR stated that it submitted a system change request, identified the corresponding violation category and type for the cases, communicated the information to the IT contractor for implementation, and determined that the effort required to update violation information into the closed case was minimal. According to ONRR, the IT contractor completed the work to add the relevant violation data to the specified cases in April 2025 and ONRR confirmed that the violation category and violation type were successfully added to 105 closed cases. To ensure violation data is complete for all OMT cases, ONRR stated it also submitted a change request to track violation data for OMT light cases. Finally, ONRR submitted a system change request to require violation data for all OMT cases to mark "no violation" for the cases without any findings. The contractor completed these change requests in September 2024 and August 2025, respectively.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider examining how to better link compliance royalty collections with the associated violation. (Recommendation 3) |

In November 2025, ONRR provided documentation supporting that it had considered the recommendation. ONRR stated that it can link collections to a specific violation when a single violation is identified for a workstream. However, according to ONRR, most compliance cases identify multiple violations for a single workstream. When multiple violation types are identified for a single workstream, breakdown of royalty underpayments by violation type may not always be feasible. ONRR concluded that after evaluating the feasibility of tying collections to violation types, ONRR does not believe the benefits outweigh the costs of this additional information collection, especially given the increased administrative burden for both ONRR and industry.

|

| Office of Natural Resources Revenue | The Director of ONRR should assess the need to develop a consistent and complete dataset from ONRR's multiple compliance data systems to better analyze historical compliance performance and inform its compliance strategy. (Recommendation 4) |

In September 2025, ONRR provided documentation supporting that it had assessed the need to develop a consistent and complete compliance dataset. ONRR indicated that for the period subject to GAO's review, it had three datasets to track compliance results. ONRR stated that while there are common data fields across each of the datasets, the results information varied greatly with respect to the level of detail and employee use. ONRR concluded its assessment by stating that while not impossible to build a consistent and complete dataset of compliance results, ONRR must consider existing priorities and the resource commitments to build the data architecture for such a dataset. Currently, ONRR stated that it does not have the resource availability to commit to the lengthy process of developing a complete and consistent dataset. However, ONRR stated that should circumstances change, it will revisit this recommendation.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider how to better assure that it will have a consistent and complete compliance dataset should OMT be replaced, including an assessment of migrating key compliance data to its future compliance data system. (Recommendation 5) |

In November 2025, ONRR provided documentation describing future information technology plans and how that relates to a complete compliance dataset. ONRR stated that in March 2025, all modernization contracts were classified as nonmission essential, and ONRR closed out the modernization initiatives. According to ONRR, it does not intend to resume modernization or request the additional funding necessary to consider an alternative to OMT in fiscal year 2025. ONRR stated that it continues to agree with the recommendation that having a consistent and complete compliance dataset in any new compliance system is essential. ONRR concluded by stating that once ONRR can meaningfully consider and pursue an alternative to OMT, it will assess how to ensure key compliance data migrates to the new compliance system.

|

| Office of Natural Resources Revenue | The Director of ONRR should reiterate its existing policy for using PAD numbers—for example, through additional training—to ONRR staff about how payments resulting from compliance activities are to be recorded in accordance with existing policies (i.e., PAD number). (Recommendation 6) |

In July 2025, Interior provided documentation demonstrating that it took actions to reiterate its policy for using PAD numbers. On October 8, 2024, ONRR issued a policy memorandum, effective October 1, 2024, which stated requirements for recording collections related to its compliance activities. Additionally, effective January 1, 2025, ONRR required that industry report all royalty reporting adjustments from data mining activities using the same process as compliance reviews and audits, which includes using the correct PAD number. With this memorandum, all compliance activities--audits, compliance reviews, and data mining--follow the same collection policy, including the use of the OMT-generated PAD number to provide consistency across ONRR in recording collections. Additionally, on February 12, 2025, ONRR held an all-hands staff meeting and included a training presentation on accurate tracking of compliance collections. During the presentation, Program Managers emphasized the requirement for companies to use the OMT-generated PAD number for all compliance-related royalty adjustments. The Program Managers further instructed employees to reject company submissions that do not use the correct PAD numbers. Finally, in June 2025, ONRR presented three training modules at a Reporter Training for companies that emphasized the proper use of the OMT-generated PAD number and the correct Adjustment Reason Codes when submitting compliance related adjustments using the CMP-2014.

|

| Office of Natural Resources Revenue | The Director of ONRR should examine adding functionality in its current and future compliance data systems to comprehensively crosswalk the PAD number between its compliance and royalty data systems as a means of providing greater assurance that all compliance payments are correct. (Recommendation 7) |

In September 2025, ONRR provided documentation demonstrating that had taken actions to implement the recommendation. To address the recommendation, ONRR submitted a system change request to enhance OMT functionality to automatically load collection information to each OMT case based on the unique PAD number. This functionality was migrated to OMT production in June 2025. All compliance related royalty adjustments with a receipt date on or after July 1, 2025, automatically populates to OMT using the unique PAD number established for each case. Royalty adjustments with a receipt date prior to July 1, 2025, were manually entered into OMT.

|

| Office of Natural Resources Revenue | The Director of ONRR should create a report with aggregate data on the federal oil and gas royalties subject to audits and compliance reviews, respectively. (Recommendation 8) |

In September 2025, ONRR provided documentation showing it had taken steps to create a report with aggregate data on federal oil and gas royalties subject to audits and compliance reviews. According to ONRR, it developed a report that aggregates data for the percentage of royalties subject to audits and compliance reviews (compliance activities). The data reflected in the report provided to GAO includes work completed in fiscal years 2023, 2024, and 2025. According to ONRR, it compared the royalties covered by compliance activities to the royalties reported for the calendar year in which the sale occurred. This allows ONRR to track the royalty coverage over time and understand the percent of royalties covered in each respective calendar year.

|

| Office of Natural Resources Revenue | The Director of ONRR should ensure that its Technical Metadata Dictionary is accurate, including descriptions of variables and the associated values and categories. (Recommendation 9) |

Interior concurred with our recommendation. In December 2024, Interior stated that the Director of ONRR will identify and address gaps in the compliance system Technical Metadata Dictionary to include associated values and variable descriptions. ONRR will evaluate current processes and controls to improve the accuracy of, and timely updates to, the Technical Metadata Dictionary. As of December 2025, ONRR expects to complete this by March 31, 2026.

|

| Office of Natural Resources Revenue | The Director of ONRR should ensure that its compliance data system schematic is accurate and updated to reflect any changes. (Recommendation 10) |

In November 2025, ONRR provided documentation supporting that it had updated the schematics of its compliance systems. According to ONRR, in late calendar year 2024, ONRR's Information and Data Services (IDS) team developed updated schematics for the Compliance Information Management (CIM) and Operations Management Tool (OMT) systems. In March 2025, IDS finalized the updated schematics after reviewing all submitted comments and incorporated them into the final version of the schematics. ONRR provided these updated schematics to GAO. ONRR stated that these actions ensure that its compliance data system schematics are accurate, complete, and aligned with the current system architecture and data relationships. In addition to these updates, ONRR stated that it plans to review, and release updated schematics with each major release or enhancement to its compliance systems or recertify them annually.

|

| Office of Natural Resources Revenue | The Director of ONRR should determine the number of staff it needs to better assure it has the necessary staff with skills to both understand ONRR's compliance data systems and analyze its data. (Recommendation 11) |

In December 2025, ONRR provided documentation describing the steps it took to determine the number of necessary staff. According to ONRR, its Analytics & Compliance Planning team developed a comprehensive Model Development Resource Plan to estimate the full-time equivalent (FTE) demand for each model in the current development pipeline. This plan, according to ONR, includes detailed breakdowns of task complexity, estimated hours, and overhead assumptions for each modeling phase, from data preparation through continuous improvement. The plan also incorporates a standardized framework for evaluating model complexity and overhead, ensuring consistency and transparency in future resource planning. In addition, to align resource planning with strategic direction, ONRR stated that ONRR leadership convened to review ONRR's Risk Model Development Proposal and discuss work plan needs. This leadership discussion helped define the compliance program's path forward and confirmed the importance of investing in internal modeling capacity to support risk-based oversight. This resource estimation directly supports the implementation of ONRR's Risk Model Development Proposal, which outlines a phased-approach to building and deploying statistical models for compliance prioritization, anomaly detection, and predictive risk assessment.

|

| Office of Natural Resources Revenue | The Director of ONRR should consider using the OPM IPA program to bring in additional skills needed to enhance its own compliance data analysis, which could improve compliance efforts. (Recommendation 12) |

Interior concurred with our recommendation. In December 2024, Interior stated that the Director of ONRR will consider the Office of Personnel Management (OPM) Intergovernmental Personnel Act (IPA) program for future additional staffing considerations to enhance its compliance data analysis. Continued budgetary reductions negatively impact ONRR's current ability to fund additional resources through OPM's IPA. As of December 2025, ONRR expects to complete this by December 12, 2025.

|

| Office of Natural Resources Revenue |

Priority Rec.

The Director of ONRR, in coordination with Interior's Statistical Official, should assess the costs and benefits of developing a plan and implementation timeline to create a royalty gap model of adequate rigor, including the collection of additional data, as needed, to inform decision-making and strategic planning of compliance efforts. (Recommendation 13) |

Interior concurred with our recommendation. In December 2024, Interior stated that the Director of ONRR will conduct a study to assess the costs and benefits of conducting a royalty gap analysis of adequate rigor, including the collection. As of December 2025, ONRR expects to complete this by March 31, 2026.

|

| Office of Natural Resources Revenue |

Priority Rec.

The Director of ONRR, in coordination with Interior's Statistical Official, should periodically estimate a royalty gap to inform decision-making and strategic planning of compliance efforts. (Recommendation 14) |

Interior partially concurred with our recommendation. In December 2024, Interior stated that based on the outcome of the cost benefit study from recommendation 13, the Director of ONRR may institute a process to periodically estimate a royalty gap to inform decision making and strategic planning efforts. As of December 2025, ONRR expects to complete this by August 31, 2026.

|