The Nation's Fiscal Health: Action Needed to Address Projected Unsustainable Debt Levels

Fast Facts

This testimony discusses our work on the nation's unsustainable fiscal path, the fiscal risks of debt limit impasses, and what Congress could do to address these challenges.

For example:

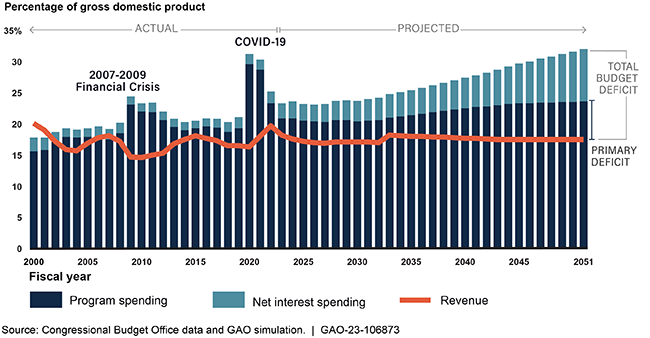

- Large annual budget deficits drive debt growth as spending exceeds revenue

- Interest costs make up a larger share of total spending as overall debt and interest rates increase over the long-term

- Delays in raising or suspending the debt limit disrupt financial markets and increase borrowing costs for the government

We previously suggested developing a plan to address fiscal sustainability and considering alternative approaches to avoid debt limit impasses.

Budget Deficits are Projected to Increase

Highlights

What GAO Found

The federal government faces an unsustainable long-term fiscal future. At the end of fiscal year 2022, debt held by the public was about 97 percent of gross domestic product (GDP). Debt held by the public is projected to grow at a faster pace than the size of the economy and reach its historical high of 106 percent of GDP within 10 years, then continue to grow at an increasing pace.

The fiscal outlook faces additional risks posed by delays in raising or suspending the debt limit—the legal limit on the total amount of money that the federal government is authorized to borrow to meet its existing legal obligations. These delays could disrupt financial markets, and investors may require higher interest rates to hedge against increased risks, which could increase borrowing costs. Failure to raise or suspend the debt limit in time to prevent a default would have devastating effects on U.S. and global economies and the public.

Since 2017, GAO has stated that a plan is needed to address the government's fiscal outlook and promote a sustainable fiscal policy. GAO's work has identified several components of an effective fiscal plan:

- Incorporate well-designed fiscal rules and targets to help manage debt, for example by controlling factors such as spending and revenue to meet a debt-to-GDP target.

- Assess the drivers of the primary deficit, such as mandatory and discretionary spending as well as revenue—including tax expenditures, such as deductions and tax credits.

- Consider alternative approaches to the debt limit. For example, the debt limit could be set as part of the budget resolution or Treasury could be given the authority to propose a change in the debt limit that would take effect absent congressional disapproval.

Why GAO Did This Study

GAO's long-term projections show that the balance of current revenue and program spending policies result in debt growing faster than the economy. This is unsustainable over the long term. In addition, delays in raising or suspending the debt limit pose additional risks to the long-term outlook.

This testimony discusses the nation's unsustainable fiscal path, the risks posed by debt limit impasses, and actions Congress can take to address these challenges. This statement is based on prior reports on the nation's fiscal health and federal debt management.

Recommendations

In prior reports GAO has made suggestions to Congress that could help address the nation's unsustainable fiscal path and debt limit impasses, including that Congress should:

- consider establishing a long-term fiscal plan that includes fiscal rules and targets, such as a debt-to-GDP target, and

- consider alternative approaches that better link decisions about the debt limit with decisions about spending and revenue at the time those decisions are made such as those described in this testimony.