Tax Gap: Modest Reductions in the Gap Could Yield Large Fiscal Benefits

Fast Facts

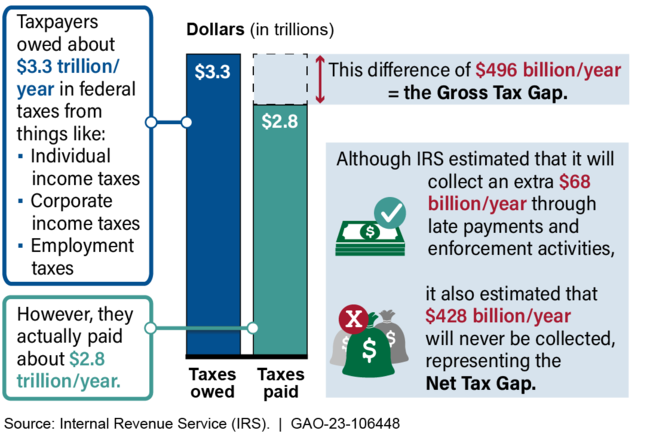

According to IRS estimates, taxpayers—people and businesses—collectively pay about 85% of the total taxes they owe. The difference between what taxpayers owe and what they pay on time is known as the tax gap, which IRS estimated to be $496 billion per year for tax years 2014-2016.

In this snapshot, we identify factors—such as the complexity of tax laws—that contribute to the gap. We also offer strategies to reduce it. For instance, IRS should implement a way to digitize tax returns so that its tax enforcement programs can better identify noncompliant taxpayers, such as those who underreport income.

Tax law enforcement is on our High-Risk List.

Highlights

The Big Picture

The Internal Revenue Service (IRS) estimated the tax gap—the difference between tax amounts that taxpayers should have paid and what they actually paid voluntarily and on time—to be $496 billion per year for tax years 2014-2016. The tax gap is a complex problem that requires a multipart solution. A small reduction in the gap could yield major fiscal benefits to the federal government.

IRS's Annual Average Tax Gap Estimate for Tax Years 2014-2016

IRS uses several approaches to estimate the different components of the tax gap, but these approaches have limitations. Estimates can have measurement and sampling error and can vary in the quality of information available. Further, the estimates do not fully reflect all areas of the tax system. For example, foreign or illegal activities, digital assets, and some corporate income tax are not fully included because data are either not reliable or not available.

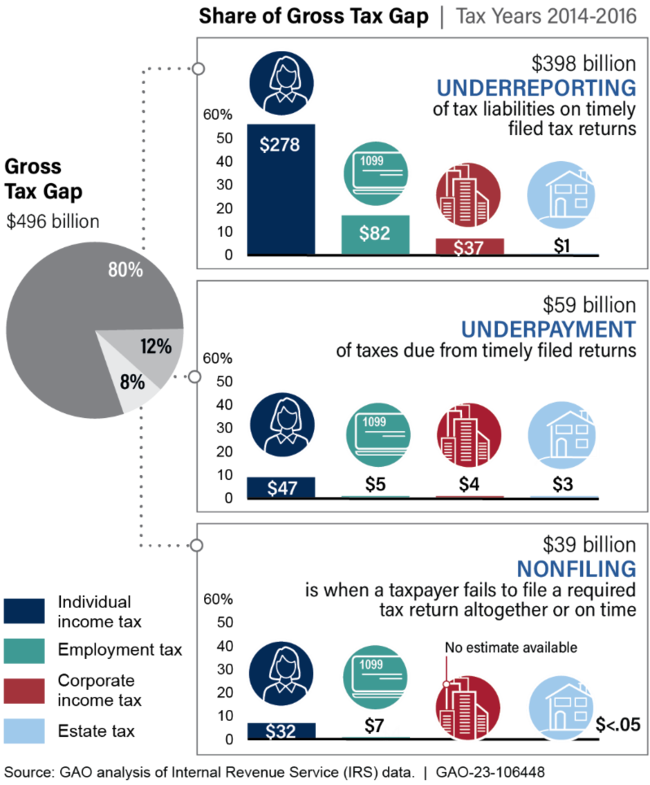

Despite those limitations, IRS’s estimate provides useful insights into the sources of the tax gap. For example, IRS found underreporting of tax liabilities makes up 80 percent of the gross tax gap. Individual underreporting alone represents more than half (56 percent) of the gross tax gap. The individual underreporting category includes estimates related to income from sole proprietorships, partnerships, S Corporations, estates, and trusts, among others.

Estimated Average Annual Gross Tax Gap by Type of Noncompliance and Tax (Tax Years 2014-2016)

What GAO’s Work Shows

Our work identified issues that contribute to the tax gap.

- Limited third party information reporting. The extent to which individual taxpayers accurately report their income is closely aligned with whether third parties (e.g., employers) report income to them and to IRS. Increased information reporting could help improve compliance, especially related to sole proprietors who continue to represent the largest share of the individual underreporting tax gap.

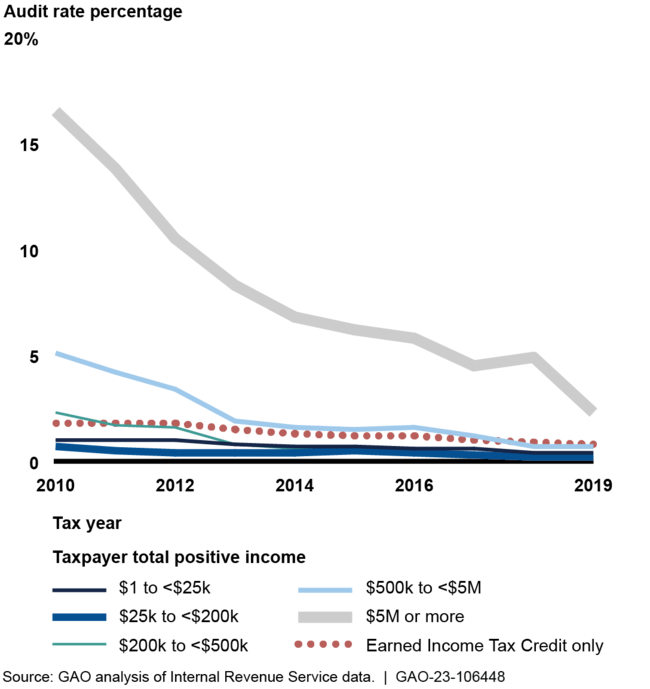

- Declines in audit rates. Audit rates of individual income tax returns decreased for all income levels for tax years 2010 to 2019. IRS officials attributed this decline primarily to reduced staffing because of decreased funding.

IRS's Audits Decreased across All Income Levels

- Taxpayer service. Good customer service can help make it easier for taxpayers to comply with their tax responsibilities. However, taxpayers often have trouble reaching IRS by phone and can wait for months for mail to be answered. Taxpayers with limited-English proficiency face challenges getting tax information in their languages. Taxpayers could benefit from additional options to file returns for free. IRS does not have clear performance goals for improvements in the taxpayer experience.

- Tax code complexity. The federal tax system’s complexity may help to target tax policy goals. However, this complexity also imposes record keeping, planning, computing, and filing requirements on taxpayers and can lead to errors and under or overpaid taxes. Other changes in the economy, such as the growing platform or gig workforce, could pose problems as taxpayers try to understand how to calculate their taxes.

- Abusive tax shelters. Tax shelters, such as offshore insurance products, can be designed to hide U.S. taxpayers’ assets or to falsely claim federal income tax benefits. Promoters can also market abusive tax schemes which are designed to circumvent tax laws or evade taxes. IRS could improve its ability to identify and deter promoters and stop abusive tax schemes.

Challenges and Opportunities

The tax gap has multiple causes and spans different types of taxes and taxpayers. So, multiple strategies are needed to reduce it. IRS’s budget and staffing levels have fallen over the past decade. IRS has also faced increasing responsibilities, such as implementing stimulus payments to taxpayers during the COVID-19 pandemic. Congress provided IRS with nearly $80 billion to modernize taxpayer service and enforce tax laws. IRS will need to plan for and manage these resources effectively to bring about needed improvements.

We have recommended that IRS should

- re-establish specific quantitative goals to reduce the tax gap and document a plan for using data to update compliance strategies;

- research, evaluate, and develop recommendations to expand third-party information reporting;

- implement a cost-effective method to digitize taxpayer-provided paper return information, making it more available for IRS’s tax enforcement programs; and

- amend the “Dirty Dozen” list to tell taxpayers how to refer information to IRS on preparers and promoters involved in abusive tax schemes.

We have also recommended Congress consider

- granting IRS the explicit authority to establish professional requirements for paid preparers to help increase the accuracy of tax returns;

- expanding third-party information reporting for certain payments that rental real estate owners make to service providers, such as contractors making repairs;

- providing IRS with expanded authority—with appropriate safeguards—to correct errors and discrepancies between what the taxpayer reported and other government information; and

- requiring that returns prepared electronically but filed on paper include a scannable code.

For more information, contact James R. McTigue, Jr. at (202) 512-6806 or MctigueJ@gao.gov.