The Nation's Fiscal Health: Road Map Needed to Address Projected Unsustainable Debt Levels

Fast Facts

The federal government faces an unsustainable fiscal future. If policies don't change, debt will continue to grow faster than the economy. Our review of the nation's fiscal health found:

- Large annual budget deficits drive debt growth, as the government borrows to finance spending that exceeds revenue

- Interest costs rise and make up a larger share of total spending as overall debt and interest rates increase over the long-term

- Risks include delays in raising or suspending the debt limit, and events, such as natural disasters

We previously suggested developing a plan to address fiscal sustainability and identified pieces of an effective plan.

Federal spending on interest costs will increase over time.

Highlights

What GAO Found

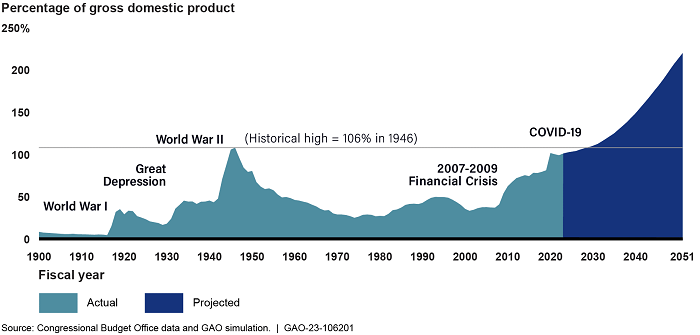

The federal government faces an unsustainable long-term fiscal future. At the end of fiscal year 2022, debt held by the public was about 97 percent of gross domestic product (GDP). Projections from the Office of Management and Budget and the Department of the Treasury, the Congressional Budget Office, and GAO all show that current fiscal policy is unsustainable over the long term. Debt held by the public is projected to grow at a faster pace than the size of the economy. Debt held by the public is projected to reach its historical high of 106 percent of GDP within 10 years and to continue to grow at an increasing pace. GAO projects that this ratio could reach more than twice the size of the economy by 2051, absent any changes in revenue and spending policies.

Debt Held by the Public Projected to Grow Faster Than GDP

The Federal Budget Deficit in Fiscal Year 2022 Was among the Largest in History

When the government spends more than it collects in revenue, Treasury borrows money to finance the resulting deficit. The federal budget deficit in fiscal year 2022 was $1.4 trillion, a 50 percent decline from fiscal year 2021, but still the fourth largest in U.S. history. This decline is attributable to higher tax revenue and lower pandemic-related federal spending. In fiscal year 2022, federal debt held by the public grew by about $2 trillion, reaching $24.2 trillion.

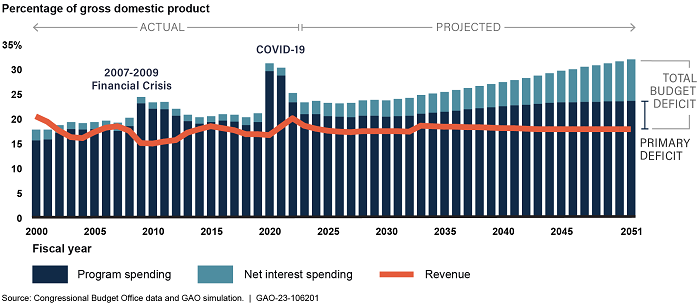

Increasingly Large Deficits Drive Unsustainable Debt Levels

The growing debt is a consequence of borrowing to finance increasingly large annual budget deficits. GAO projects that

- spending for Social Security, federal health care programs, and all other federal program spending increases more than revenue, resulting in the primary deficit; and

- net interest spending, which primarily represents the federal government’s cost to service its debt, steadily increases over the next 30 years, further widening the total budget deficits.

Primary Deficit and Total Budget Deficit, Actual, and Projected

Net interest spending will continue to increase because of both higher levels of overall debt, and projected increases in interest rates over the long-term. Higher than projected interest rates would further increase interest costs and debt. In addition to increased borrowing costs, rising debt could lead to slower economic growth.

Other potential fiscal risks stem from delays in raising or suspending the debt limit—the legal limit on the total amount of money that the federal government is authorized to borrow to meet its existing legal obligations. These delays could create disruptions to financial markets, and investors may require higher interest rates to hedge against increased risks, which, in turn, could increase borrowing costs. Failure to raise the debt limit in time to prevent a default would have much more dire economic and reputational consequences.

Action Is Needed to Change the Unsustainable Fiscal Path

GAO has previously suggested that Congress develop a plan to address the government’s fiscal outlook and promote fiscal sustainability. GAO’s work has identified several components of an effective fiscal plan:

- Incorporate well-designed fiscal rules and targets to help manage debt, for example by controlling factors such as spending and revenue to meet a debt-to-GDP target.

- Assess the drivers of the primary deficit, such as mandatory and discretionary spending as well as revenue—including tax expenditures, such as deductions and tax credits.

- Consider alternative approaches to the debt limit to avoid disrupting the Treasury market and increasing borrowing costs and to improve federal debt management. For example, the debt limit could be set as part of the budget resolution or Treasury could be given the authority to propose a change in the debt limit that would take effect absent congressional disapproval.

Why GAO Did This Study

GAO produces this annual fiscal health report to examine the current fiscal condition of the federal government and its future fiscal path, absent policy changes in revenue and program spending.

This report describes: (1) federal government’s fiscal condition and changes from fiscal years 2019 to 2022; (2) outcomes from our 75-year simulation of the federal government’s fiscal outlook; (3) implications of rising interest costs and rates; (4) additional risks to the federal government’s fiscal outlook; and (5) components of a sustainable long-term fiscal plan and actions that Congress and federal agencies could take now to yield financial benefits.

For more information, contact Jeff Arkin, (202) 512-6806 or arkinj@gao.gov, Robert F. Dacey at (202) 512-3406 or daceyr@gao.gov, or Dawn B. Simpson, (202) 512-3406 or simpsondb@gao.gov.