Abusive Tax Schemes: Additional Steps Could Further IRS Efforts to Detect and Deter Promoters

Fast Facts

Abusive tax schemes contribute to the nation's tax gap—the difference between taxes owed and paid. These schemes can involve complex, multi-layer transactions that attempt to conceal the true nature and ownership of taxable income or assets.

One of IRS's tools to combat such schemes—and the people that promote them—is its Dirty Dozen list. This annual publication lists schemes that taxpayers may encounter. However, we found that this list does not include instructions on how the public can report potential abusive tax schemes to the IRS.

We recommended that IRS amend the Dirty Dozen publication to include this information.

Highlights

What GAO Found

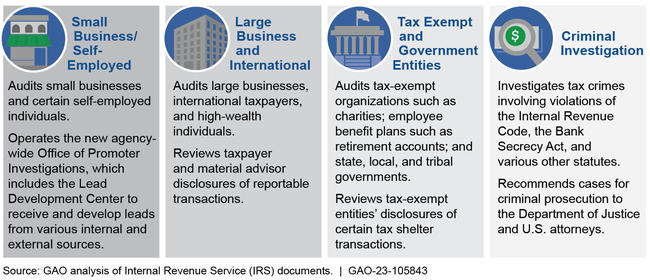

The Internal Revenue Service (IRS) has taken steps to identify and stop promoters who arrange and market abusive tax schemes. Such schemes involve various kinds of arrangements designed to circumvent tax laws or evade taxes. IRS's investigations into promoters vary in complexity and may span across different organizational units within IRS, as shown in the figure below. In fiscal years 2021 and 2022, IRS conducted hundreds of investigations that resulted in tens of millions of dollars in penalties assessed.

Principal IRS Organizational Units Involved in Abusive Tax Scheme Promoter Investigations

Currently, IRS is aware of over 40 types of abusive tax schemes involving promoters. One method IRS uses to identify these promoters is information referrals from the public. GAO found that the public can refer information to IRS on a number of forms, few of which can be submitted online. GAO previously recommended that IRS take steps to improve its referral programs by developing a consolidated, online referral submission tool.

Additionally, one of IRS's key public communication tools for abusive tax schemes, its annual Dirty Dozen list, does not include information on how to report promoters of suspected abusive tax schemes. Adding instructions to the Dirty Dozen list about how to submit information on promoters may allow IRS to better leverage information from the public and increase its ability to identify and stop promoters of abusive tax schemes.

IRS created the Office of Promoter Investigations in 2021 to coordinate IRS's response to promoters of abusive tax schemes. The office works to design, develop, and deliver the major activities that help detect and deter abusive tax schemes and their promoters. Although the office has developed strategic goals to fulfil its mission, it has not yet finalized and communicated outcome-oriented performance goals and measures within IRS. Finalizing outcome-oriented performance goals and measures will allow the Office of Promoter Investigations to better evaluate its efficacy and ensure it is meeting its mission.

Why GAO Did This Study

Abusive tax schemes threaten our tax system's integrity and contribute to the tax gap—the difference between taxes owed and paid. Often, abusive tax schemes are marketed by promoters and include complex, multi-layer transactions to attempt to conceal the true nature and ownership of the taxable income or assets. To address abusive tax schemes and their promoters, IRS created the Office of Promoter Investigations in 2021.

GAO was asked to review IRS actions to address abusive tax schemes and those who promote and enable them. This report (1) describes how IRS conducts promoter investigations and presents summary data on these investigations; (2) evaluates how IRS educates taxpayers about referring information on promoters to IRS; and (3) evaluates to what extent IRS's reorganization plan for promoter investigations was consistent with key practices and the extent to which IRS is prepared to evaluate the performance of its new office.

Recommendations

GAO recommends that IRS (1) amend the Dirty Dozen list publication to tell taxpayers how to refer information on promoters to IRS; and (2) finalize outcome-oriented goals and performance measures for the Office of Promoter Investigations. IRS agreed with the recommendations.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Director of the Office of Communications, in collaboration with other IRS organizational units as appropriate, amends the Dirty Dozen list publication to include telling taxpayers how to refer information to IRS on preparers and promoters involved in abusive tax schemes. (Recommendation 1) |

In January 2023, IRS amended its most recent Dirty Dozen list which had been published in June 2022 to include instructions to taxpayers informing them how to refer information to IRS on preparers and promoters in abusive tax schemes. In March 2023, IRS began publishing its 2023 version of the Dirty Dozen list. In all 12 of the Dirty Dozen publications issued from March to April 2023, IRS included instructions to to taxpayers informing them how to refer information to IRS on preparers and promoters in abusive tax schemes.

|

| Internal Revenue Service | The Commissioner of Internal Revenue should ensure that the Director of the Office of Promoter Investigations finalizes outcome-oriented goals and performance measures to evaluate the effectiveness of OPI. (Recommendation 2) |

In October 2024, IRS Office of Promoter Investigations (OPI) created outcome-oriented goals and measures and published a condensed version of them on the OPI webpage. In April 2025, IRS also published a condensed version of OPI's performance goals in the Internal Revenue Manual section 1.1.16.4.

|