403(b) Retirement Plans: Department of Labor Should Update Educational Materials to Better Inform Plan Sponsors and Participants

Fast Facts

Millions of teachers and employees at non-profits rely on 403(b) plans for their retirement savings. These individual account-based plans let participants make investment decisions and bear risk.

Federal agencies, like the Department of Labor, oversee these plans. DOL also provides educational materials to plan sponsors and participants.

However, we found that DOL's website contains little educational material specific to 403(b) plans—such as information to help participants understand the fees associated with these plans. We recommended that DOL update information on these plans to help participants.

Highlights

What GAO Found

Millions of teachers and employees of tax-exempt organizations invest in 403(b) retirement plans. The Department of Labor (DOL), Securities and Exchange Commission (SEC), and Internal Revenue Service (IRS) take steps to oversee some 403(b) plans or their investment options, or both. Specifically, DOL oversees 403(b) plans subject to the Employee Retirement Income Security Act of 1974, as amended (ERISA), and uses a range of strategies to identify plans to investigate for compliance with the law. For example, DOL has investigated instances of self-dealing—when a plan fiduciary uses plan assets for the fiduciary's own interest or own account. The SEC's oversight focuses on compliance with securities laws and regulations, while the IRS's oversight focuses on compliance with the Internal Revenue Code. DOL, SEC, and IRS also conduct outreach and provide educational materials to 403(b) plan sponsors and participants. However, DOL's website does not contain targeted educational materials that could help participants understand 403(b) plan fees. Updated DOL information on 403(b) plans could help participants make more informed decisions.

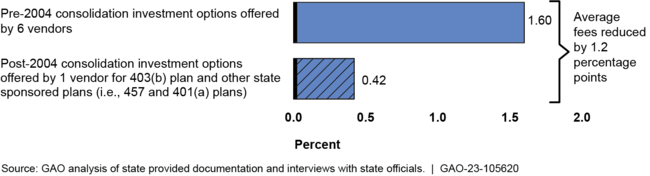

GAO reviewed how five selected states worked to improve outcomes—including in some cases reducing fees participants pay—in 403(b) plans that are not subject to ERISA requirements. Officials in three of the states said they had consolidated the number of service providers offering investment options, which strengthened oversight by reducing the number of service providers they had to oversee. Officials in Connecticut told GAO consolidating service providers also resulted in lower annual fees for participants (see figure). Officials in four of the selected states said they enhanced transparency by providing participants with additional information on plans' investment options and fees or by making it available elsewhere.

Connecticut: Average Investment Fees Pre- and Post-2004 Consolidation

Stakeholders and experts identified actions they said could improve 403(b) participant outcomes. For example, they suggested establishing fiduciary duties for non-ERISA plans in some states that are not subject to such protections can help protect participants' interests. Also, they said requiring distribution of standardized information on investment options' returns and fees for participants in non-ERISA plans would promote transparency. Multiple experts also suggested that allowing 403(b) plans to use certain other investment vehicles could reduce fees.

Why GAO Did This Study

Like 401(k) plans, 403(b) plans are account-based defined contribution plans sponsored by employers. Many 403(b) plans are subject to ERISA requirements and are intended to protect the interests of plan participants. However, some 403(b) plans are not covered by ERISA.

GAO was asked to review (1) the extent of federal agencies' 403(b) plan oversight, (2) actions by selected states that could improve 403(b) participant outcomes, and (3) options stakeholders and experts have identified that could improve outcomes for 403(b) participants.

GAO analyzed DOL, SEC, and IRS data and documentation; reviewed documentation from five selected states identified as taking actions to improve participant outcomes; interviewed federal and state agency officials and experts; and conducted and analyzed results from surveys of plan sponsors and service providers about options to improve participant outcomes. The analysis of state actions and survey results offer a range of perspectives on improving participant outcomes but are not generalizable.

Recommendations

GAO recommends that DOL update educational materials to contain information relevant to 403(b) plans, including information that could help participants understand plan fees. In commenting on the report, DOL neither agreed nor disagreed with our recommendation. DOL stated that it would review its relevant publications to see if they should more specifically reference 403(b) plans.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Department of Labor | The Secretary of Labor should update educational materials provided on the agency's 403(b) website to ensure these materials include information relevant to 403(b) plans for plan sponsors and participants. For example, these updates could include adding information with direct references to 403(b) plans to help participants understand their 403(b) plan fees. (Recommendation 1) |

DOL neither agreed nor disagreed with this recommendation. The agency noted it has a webpage dedicated to 403(b) plan issues and that the information in its 401(k) publications could be helpful to ERISA-covered 403(b) plan sponsors, participants and other interested parties evaluating fees and expenses in those plans. DOL stated that the agency's rule applicable to participant-directed individual account plans, which requires disclosure of certain plan and investment-related information including a comparative chart or similar format designed to facilitate a comparison of each investment option available under the plan, applies to ERISA-covered 403(b) plans as well as 401(k) plans. The agency added that, in accordance with our recommendation, it would review the relevant publications with an eye to seeing whether the agency should be more specific about referencing 403(b) plans. In August 2025, DOL reported that, due to competing priorities and statutorily required directives from SECURE 2.0, DOL is not currently pursuing action on this recommendation. We will continue to monitor agency efforts.

|