Financial Technology: Products Have Benefits and Risks to Underserved Consumers, and Regulatory Clarity Is Needed

Fast Facts

Financial technology—or "fintech"—provides consumers, who may not have access to accounts or credit via traditional banks, online access to financial services. For example, "earned wage access" products aim to help consumers get a portion of their paycheck before payday—money they've already earned, but not yet received.

The Consumer Financial Protection Bureau has clarified that some earned wage access products aren't considered "credit"—so providers of these products aren't required to disclose finance charges. However, it's still unclear exactly which of these products are considered credit. We recommended that the Bureau clarify this issue.

Highlights

What GAO Found

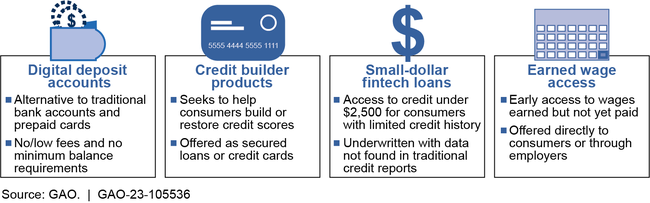

Fintech refers to the use of technology and innovation to provide financial products and services (see figure for selected products). Fintech products may offer benefits to underserved consumers, such as those without bank accounts or credit scores, but can also pose risks. For example, digital deposit accounts advertise low or no fees and no minimum balance requirements. However, consumers may be unaware that their funds are not being held by the fintech company itself and may be confused about how to recover their funds if the company goes out of business. Earned wage access purports to give consumers access to money that has been earned but not yet paid, potentially helping lower-income consumers meet financial obligations. But the costs of the product may not be transparent, and there may be risks of unexpected overdraft fees.

Overview of Selected Fintech Products

Some underserved consumers may face barriers in accessing fintech products—for example, they may lack internet access or prefer the individualized or in-person assistance of traditional banks. Data on the extent to which fintech products serve underserved consumers are limited. However, one company offering digital deposit accounts told GAO nearly half of its accountholders are underbanked (i.e., have bank accounts but use alternative financial services like payday loans, which can be costly) and 15 percent were previously unbanked. Data GAO received from four earned wage access companies indicate that these products were used mostly by consumers earning less than $50,000 annually.

Regulators have taken some steps to address risks that selected fintech products pose, but regulatory uncertainty exists for certain earned wage access products. State and federal regulators have sought to better understand fintech products through measures such as information-sharing agreements with companies. Federal financial regulators are modifying their examination processes to better monitor banks' partnerships with fintech companies. The regulators have also issued guidance related to selected fintech products. For example, the Consumer Financial Protection Bureau (CFPB) issued an advisory opinion in November 2020 clarifying that earned wage access products with specific characteristics are not considered to be an extension of credit under the Truth in Lending Act. However, despite this guidance, some have expressed continued uncertainty about how the law applies to products that do not fall under the advisory opinion. Further clarification could help companies that offer these products understand whether the act and its disclosure requirements are applicable.

Why GAO Did This Study

Millions of consumers face barriers to obtaining accounts and accessing credit through traditional banks and credit unions. In recent years, fintech has emerged as a potential way of helping some underserved consumers gain access to financial services. However, it is unclear how many underserved consumers use these products, what risks they may pose, and to what extent existing financial services laws address those risks.

The Dodd-Frank Wall Street Reform and Consumer Protection Act includes a provision for GAO to annually report on financial services regulation. This report examines (1) the benefits, risks, and limitations of selected fintech products for underserved consumers, and what is known about the extent to which underserved consumers have used them, and (2) federal and state regulators' steps to assess selected fintech products. GAO reviewed studies by federal agencies, academics, and industry groups; analyzed data from selected fintech companies; and interviewed federal and state financial regulators, consumer groups, industry associations, and academics.

Recommendations

GAO recommends that CFPB issue clarification on the application of the Truth in Lending Act's definition of “credit” for earned wage access products not covered by its November 2020 advisory opinion. CFPB agreed with this recommendation.

Recommendations for Executive Action

| Agency Affected | Recommendation | Status |

|---|---|---|

| Consumer Financial Protection Bureau | The Director of the Consumer Financial Protection Bureau should issue clarification on the application of the Truth in Lending Act's definition of "credit" for earned wage access products not covered by its November 2020 advisory opinion. (Recommendation 1) |

In July 2024, CFPB proposed an interpretive rule regarding earned wage access products and the applicability of the Truth in Lending Act. Comments are due on August 30, 2024. We will continue to monitor the rule as CFPB finalizes it.

|